The strength of the US dollar contributed to the selling of the yellow metal during yesterday's trading. Accordingly, gold prices fell to their lowest level in about two weeks at $1660 an ounce from the 1697 resistance on the same day, and settled around the $1683 level in the beginning of trading today, Wednesday. The US dollar rose as investors fled to it as a safe haven after the WHO chief warned about the outbreak of the Coronavirus, saying that "the worst is still ahead of us" and that "the virus is still not understood by many people."

Falling oil prices to historic levels, bleak first-quarter earnings reports and US President Donald Trump's comments that he will sign an executive order to temporarily suspend immigration to the United States have also affected investor appetite for risky assets.

The US dollar index, DXY, which measures the performance of the greenback versus a basket of six major currencies, rose to 100.48 in yesterday’s trading. Gold futures for June ended with a drop of $23.40, or about 1.4%, at $1,687 an ounce, the lowest close since April 8. Silver futures for May ended lower at $14.8 an ounce, while copper futures for May fell to $2.2295 a pound.

On US economic news, a report from the National Association of Realtors showed that sales of existing homes fell sharply in March. NAR said existing home sales fell 8.5% to an annual rate of 5.27 million homes in March after rising 6.3% to an average of 5.76 million in February. Economists had expected existing home sales to drop 8.1% to 5.30 million from the 5.77 million that was announced the previous month.

Despite the steep monthly drop, existing home sales in March increased by 0.8% compared to the same month last year, reflecting the ninth consecutive month of annualized growth.

Investors will watch the reaction from the desire of global economies to return to activity after months of strict closures by governments to contain the rapid spread of the Coronavirus, which has infected more than 2.25 million and killed more than 174,000 people worldwide. The United States of America recorded the largest number of infections at 810,561,000 people, and also the number of deaths at 43,200,000. Global health officials fear the hasty opening of economies could lead to a violent wave of epidemic infections.

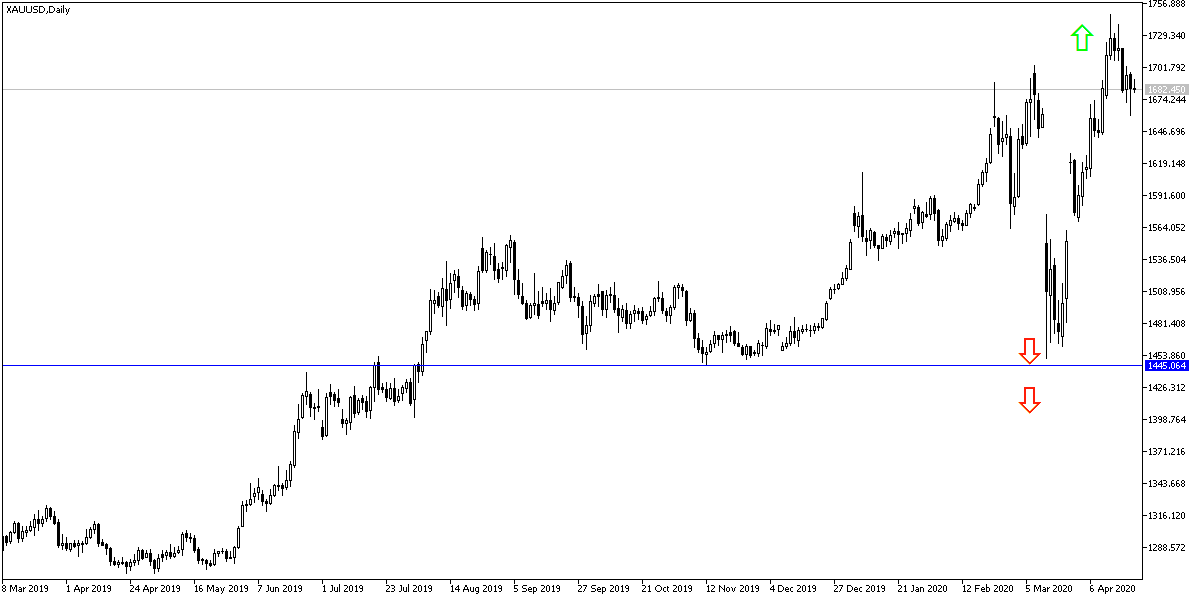

According to gold technical analysis: The recent sale of gold are an opportunity for investors to buy gold from new low levels, and the closest levels to do this are 1665, 1652 and 1640, respectively. Breaking above the $1700 psychological resistance will continue to support the bulls to move prices to new historical levels.

There are no significant US economic data today and gold will react to investor sentiment towards the future of the global economy in light of the Corona pandemic crisis.