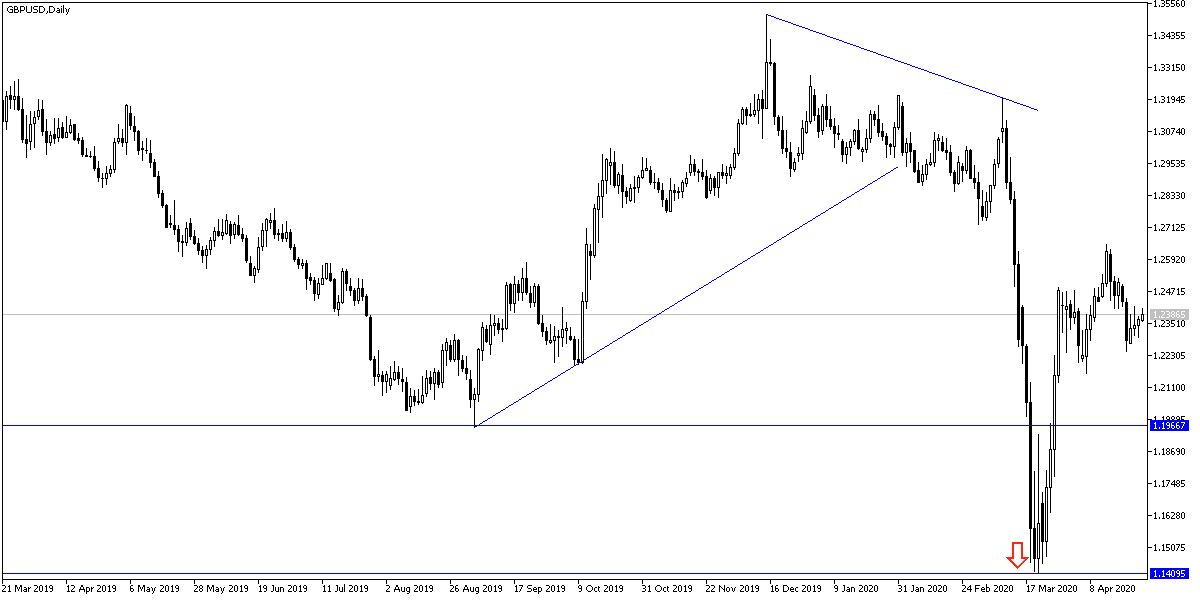

The GBP/USD formed a “head and shoulders” candle on the daily chart, increasing with a special strength, with the pair failing to overcome the 1.2517 resistance, among which the drop fell again towards the 1.2425 support at the beginning of trading today, and before the announcement of important and influential US data. The Pound received new support from investors' risk appetite amid optimism in financial markets from the tendency of global economies to reopen and end closure policies, which pushed the global economy into the worst crisis that may exceed the 2008-2009 global financial crisis. Currency investors appear to have doubts about the usefulness of plans by British Prime Minister Boris Johnson in the coming days to gradually ease the UK's "closure". Because this came at a time when fears increased about the future of negotiations between the two sides of Brexit.

The US dollar is overvalued by most analyst models and its yield to investors has been greatly reduced through Fed rate cuts and quantitative easing plans, which could make it a less attractive asset for investors to hold. But these conditions alone are not sufficient to ensure any continued weakness in the dollar, says Goldman Sachs. The recovery in global growth that gives investors a viable alternative currency to buy is also required to weaken the dollar and raise the price of the pound sterling against the dollar sustainably.

But growth outlook and investor sentiment towards global economy could get attention if it turns out that expectations for a -3.9% contraction in the US economy in the Q1 were overly optimistic. A larger-than-expected contraction cannot be ruled out as the US economy tends to produce its weakest Q1 numbers, which are often lower than economic estimates. This may cause markets to fear that recovery after Coronavirus will be slower than many have assumed so far.

With recent correlation of sterling with the oil prices; yesterday's low energy prices caused a new pressure on the pound. Oil prices fell again and seemed to be heading towards zero after the US Oil Fund said it would change the shift from West Texas crude contracts in June to decades of subsequent months in a clear attempt to avoid negative prices that caused a historical panic in the markets last week. Therefore, the fund lost -66% of its value this year, and its efforts to exit from the June futures contracts threaten to increase pressure on its prices, which could have negative effects on oil-sensitive currencies.

According to the technical analysis of the pair: As I mentioned before, that the head and shoulders formation on the daily chart gives the bears new downward momentum and return to the 1.2320 support area will open the way to test stronger support levels. 1.2590 and 1.2720 resistance levels change these expectations and support the return of bullish momentum again. I still prefer to sell the pair from every higher level.

As for today's economic calendar data: All focus will be on US economic data, the rate of GDP growth, pending home sales, oil stocks, Federal Reserve monetary policy decisions and the statements of its Governor Jerome Powell.