For three straight trading sessions, the GBP/USD pair is trying to counter the gains of the US dollar and prevent further collapse, especially with the support exceeding 1.2300 so as not to sell. Last week, the pair plunged to the 1.2247 support before closing trading around the 1.2330 level. With the beginning of trading this week, the rise returned to the 1.2395 level at the time of writing. The Pound may get some support this week, albeit limited, from the return of British Prime Minister Boris Johnson to work. The British pound fell -0.94% against the dollar last week, as the drop in oil prices undermined all currencies that are linked to it, including the British currency, although the subsequent recovery helped push the pound back towards its 21-day moving average at 1.2405 and failed to override it.

The GBP recovery this week is likely to require a supportive environment for other risk assets, such as stocks and commodities, as well as more risky commodity currencies such as the Australian, New Zealand and Canadian dollars, which have an increasing relationship with sterling this year, which may pave the way for their gains, is the fact that many countries have sought to reopen their economies from the closures caused by the Coronavirus. In light of the global economy’s suffering from that policy.

Optimism for the return of the British pound gains still faces a number of UK-specific threats that could negatively distinguish it from the major currencies in the coming days. It should be noted that Brexit fears are back to influence sentiment and it appears that the UK is also ready to fall behind its main counterparts in reopening the economy from the coronavirus closure, partly because it was among the last countries to be affected by the disease and also will be the lack of testing equipment and the lack of basic personal protective equipment for everyone, all of which will be factors influencing the outbreak.

Experts believe that the opening of the British economy may end up being slower than anywhere else. Daily tests (per 1,000 people) are very low in the UK compared to other major countries.

British Prime Minister Boris Johnson will return to work starting Monday after his battle with the coronavirus and will come under intense pressure from all angles, the first of which is the resurgence of the British economy. Potential losses from the Coruna epidemic, as well as skirmishes with the European Union, regarding the future of the post-Brexit transition period. A slow exit from the closure could be an additional downside burden for the GBP, which is now also risking new fears about Brexit. UK and European Union negotiators said on Friday that only "limited progress" had been made in resolving differences at the end of the first round of Brexit negotiations that would take place since the start of the Coronavirus crisis in Europe, which shed light on the deadline at the end of June. .

Concerns are growing that lack of progress in negotiations will raise new concerns about the Brexit "brink" and that it will eventually be "without a deal."

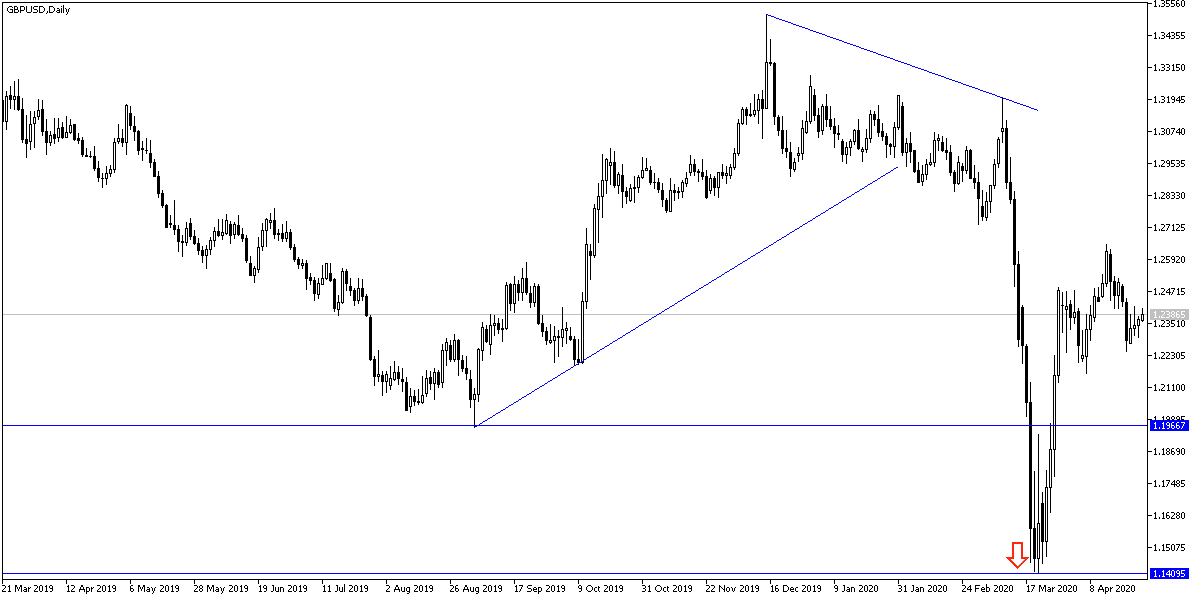

According to the technical analysis of the husband: On the daily chart, the GBP/USD pair is in a neutral mode with a greater desire to move lower, especially if it settles below the 1.2300 support, because it will support the move towards stronger support levels reaching 1.2255 and 1.2180 and the 1.2000 psychological support. I still prefer to sell the pair from each upper level and the closest resistance levels are now at 1.2420, 1.2500 and 1.2630 respectively.

There are no significant economic data releases expected from Britain or the United States of America today.