Approximately 200 points was the sum of the GBP/USD losses during yesterday's trading session, as the pair retreated from the 1.2445 resistance to the 1.2247 support, before settling around the 1.2300 level in the beginning of trading today, Wednesday. The pressure on the pound increased, amid renewed fears about the future of Brexit, along with continued gains in the US dollar. Adding to the pressure on the pound, were details of the official figures for the British labor market, which suffers from a free fall. This confirms the extent of the negative impact from the application of government measures to contain the spread of Covid-19.

Details from the Office for National Statistics data showed that new unemployment claims increased by at least 400% between February and March. This is more than five times more than the previous monthly increase in new claims for unemployment benefits, which were set in July 1994. In total, 1.4 million people filed a claim for comprehensive credit from unemployment in March, which shortened the average monthly average of 235,000 from the previous year.

Commenting on the results, Tony Wilson, director of the Bureau of Statistics, said, "Today's numbers undoubtedly show the scale of the economic shock we went through over the past month. This increases twice as much as anything we have seen in the past forty years at least, and possibly in our entire history”.

The pessimistic results come a day after the British government's plan to retain jobs that will see the government cover 80% up to 2.5 thousand pounds of employees' salaries in private companies affected by the closure of the coronavirus. It was reported that 144,000 companies were affected by the closure of the coronavirus, which applied to obtain government support in one day, ensuring that taxpayers will now pay the wages of a million people at a cost exceeding 1 billion pounds. The government says employers will receive grants within six days to pay employee wages.

According to The Times, experts believe that the unprecedented intervention will ultimately cost the government more than £40 billion and enables 8.3 million people to apply for compensation.

Katal Kennedy, European economist at RBC Capital Markets, said: “We estimate that about a third of UK employees can sign a scheme that conceals the true extent of the increase in unemployment in the first phase of the Coovid-19 crisis.”

Before the closure, everything was going well for the job market in Britain, as official data from the Office for National Statistics showed that employment in the UK set a new record in February. UK employment grew by 172,000 in the three months to the end of February, bringing the total number of employed people to 33.07 million and the employment rate to a new record high of 76.6%. However, the unemployment rate increased from 3.9% to 4% after the number of individuals classified as unemployed rose from 1.33 million to 1.36 million.

The simultaneous rise in the unemployment and employment rate comes amid a decrease in the inactivity rate to a new record low of 20.2%, with about 8.37 million in the labor force not participating.

The course of Brexit negotiations between the European Union and Britain will have the greatest impact on the pound performance in the coming months.

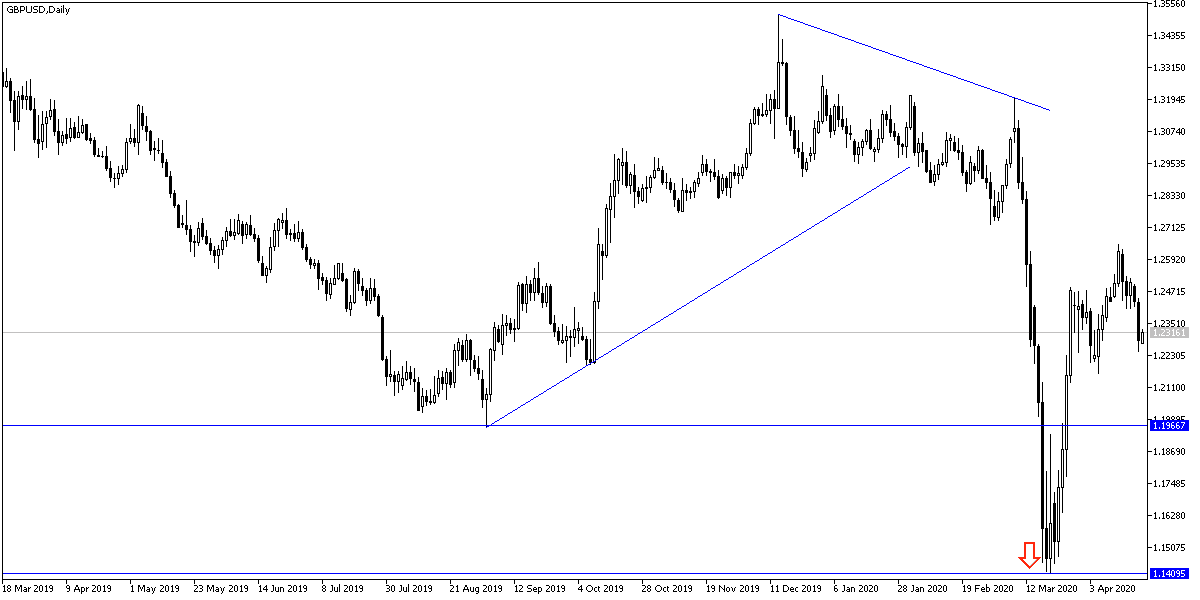

According to the technical analysis of the pair: On the daily chart below, it appears clear that there was a breakout of the bullish channel which culminated in testing of the 1.2647 resistance last week, the highest in more than a month. I stressed in recent technical analyses that the bears’ success in moving the pair below the 1.2320 support will support sell-offs on the pair. The closest support levels remain at 1.2245, 1.2185 and 1.2090 respectively, which confirm the strength of the bearish channel that was formed after yesterday's losses. Bulls are waiting for the 1.2600 resistance again to control performance.

As for the economic calendar data today: From Britain, inflation figures, consumer prices, producer prices, and retail prices will be announced. There are no significant US data releases today.