The pair benefited a lot from the noticeable improvement in the health of British Prime Minister Boris Johnson from Coronavirus symptoms, along with a weak US dollar. Therefore, the GBP/USD price succeeded in moving up to test the 1.2486 resistance, its highest in a month, before it closed last week's trading around 1.2435, and continues to rise with the beginning of this week’s trading, and settles around 1.2510 at the time of writing. Trading this pair could see a relatively quiet period amid Easter holiday celebrations. At the same time, the coronavirus pandemic appears to be nearing its peak in the United Kingdom after hitting a record number of deaths last week. In the United States, forecasts still point to the possibility of significantly increasing infection numbers over the next two weeks. As this epidemic still determines the movements in the global financial markets amid the closures of global economies to contain the disease.

The latest economic data results seem to slightly favor GBP gains, especially after the rise in initial jobless claims in the United States to 16.6 million. Last Thursday, the numbers came at 6.606 million to be added to the previous week's toll. The ongoing claims were slightly better than expected but this did not boost the dollar. In the UK, the change in industrial production (on an annual basis) for February was -2.8%, better than expectations at -2.9%. On the other hand, manufacturing production exceeded expectations, and on a monthly basis, recording 0.5% against forecasts of 0.1%. However, February's gross domestic product posted a slowdown of -0.1%, compared to expectations for a 0.1% growth.

British Prime Minister Boris Johnson has been discharged from a hospital in London where he has been treated in intensive care for symptoms of coronavirus, while the UK has recorded more than 10,000 deaths from the Corona epidemic, and is the fourth European country to surpass this large number. Johnson's office said he has left St. Thomas Hospital and will continue to recover in Checkers, the Prime Minister's country house. According to the statement, "On the advice of his medical team, the prime minister will not return to work immediately." “He would like to thank everyone in St. Thomas for the wonderful care he received.”

Johnson was in hospital for a week and spent three nights in the intensive care unit. After his condition improved, he said that he owes his life to the National Health Service medical workers who treated him. "I cannot thank them enough,", “Rather, I owe them my life.” Johnson said in his first public statement since he left intensive care Thursday night.

And Johnson, who is 55 years old, was the first global leader to confirm his illness. His symptoms were initially said to be mild, including coughing and fever, and he was working from home during the first few days. But as the condition deteriorated, it was necessary to receive the necessary treatment in intensive care. Johnson's recovery will increase investor confidence.

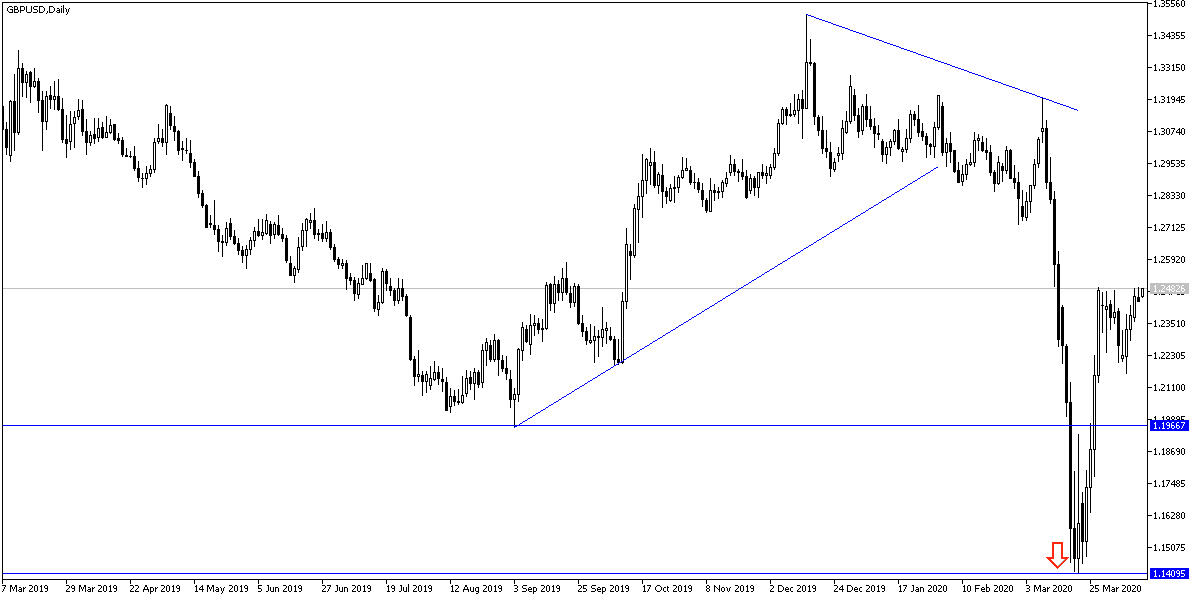

According to the technical analysis of the pair: On the daily chart, it seems that the GBP/USD has recently bounced from its multi-decade lows at the 1.1424 historical support. From there, the pair bounced more than 60%, making up for a large portion of losses. It is now just below the 61.80% Fibonacci level and on the way up. Bulls will target long-term profits at the 76.40% Fibonacci level of 1.2761 or higher at 1.3209. On the other hand, bears will look to bounce back at 38.20% and 23.60% Fibonacci levels at 1.2108 and 1.1826 support levels, respectively.

And on the short term, the pair appears to be experiencing a short-term bullish bias depending on market sentiment. It moves above the current levels of SMA lines for every 100 hours and 200 hours. It also appears to be heading towards overbought levels for the short-term RSI. Therefore, bulls will look to extend the current gains towards 1.2600 or higher at 1.2724. On the other hand, bears will target declining profits at around 1.2356 or less at 1.2211.

As for the economic calendar data today: Due to the Easter holiday, the agenda has no important data from Britain or the United States of America.