The British pound initially tried to rally during the trading session on Thursday but gave back quite a bit of the gains to form a bit of a shooting star. This looks like a market that is running out of momentum, and quite frankly it is only going to need to see some type of push to break things down. At this point, I believe that the market will probably continue to show favor for the US dollar, due to the fact that the greenback of course is the currency need to buy US Treasuries. Beyond that, there are also a lot of concerns about the United Kingdom and its economy.

The United Kingdom is essentially on lockdown, and it should be for some time. At this point, I believe that fading any rally continues to work, as the US dollar probably reaches towards the 1.22 level underneath, which is an area where we have seen buyers in the past. If we were to break down below that level, it is likely that the market goes to the 1.20 level after that. Either way, this is a market that I think will eventually continue to see sellers come in, and quite frankly it had gotten far too ahead of itself.

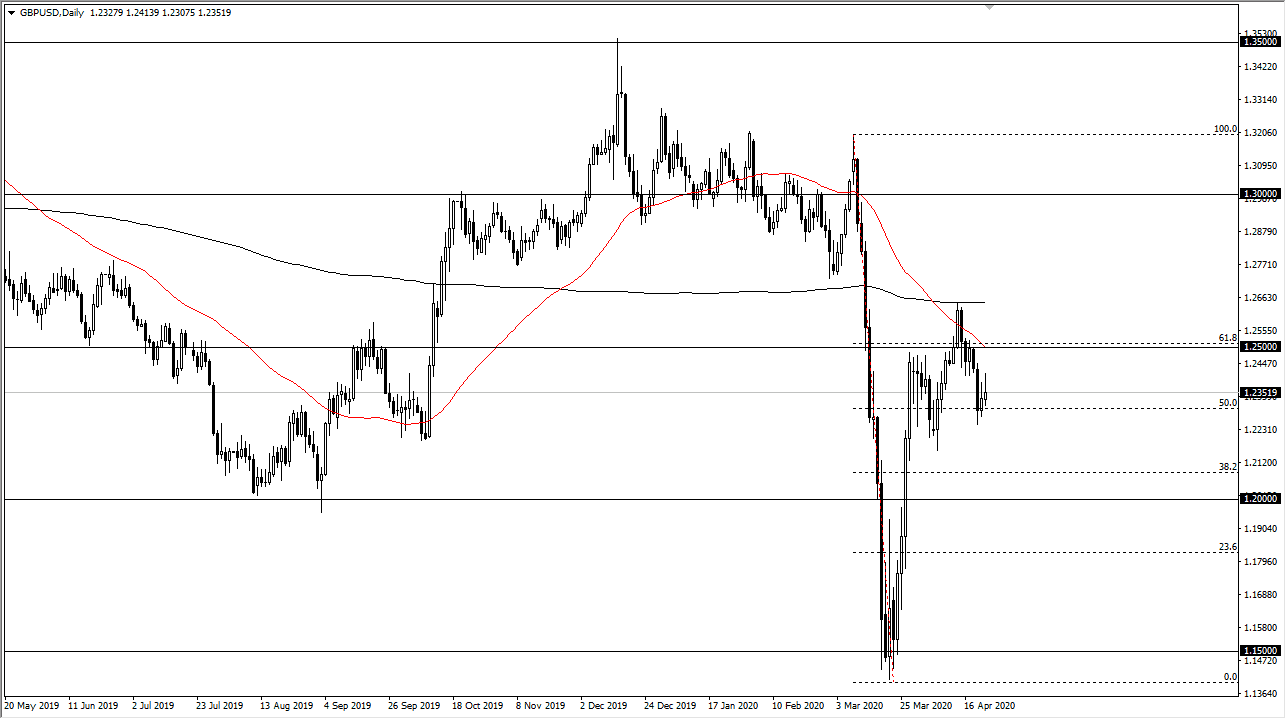

What else is worth noting is that the 1.25 level is right where the 61.8% Fibonacci retracement level is sitting, just as the 50 day EMA is as well. The shape of the candlestick for the day of course does not invoke a lot of faith, so at this point it looks like there is a massive amount of sellers above just waiting to pounce every time the market tries to gain. After all, the British also have to deal with the Brexit given enough time, so there is no real argument for the British pound to go higher in the meantime. It is highly likely that we will reach down towards 1.22 level, and then eventually break down to the 1.20 level given enough time. If we can break down below there, then we could be looking at a move down to the 1.1750 level, but that is quite a way from happening right now. I believe at this point the market is going to continue to fade rallies and therefore that is how I will have to play this currency pair. With that being the case, I like the idea of adding to a position as it breaks down as well.