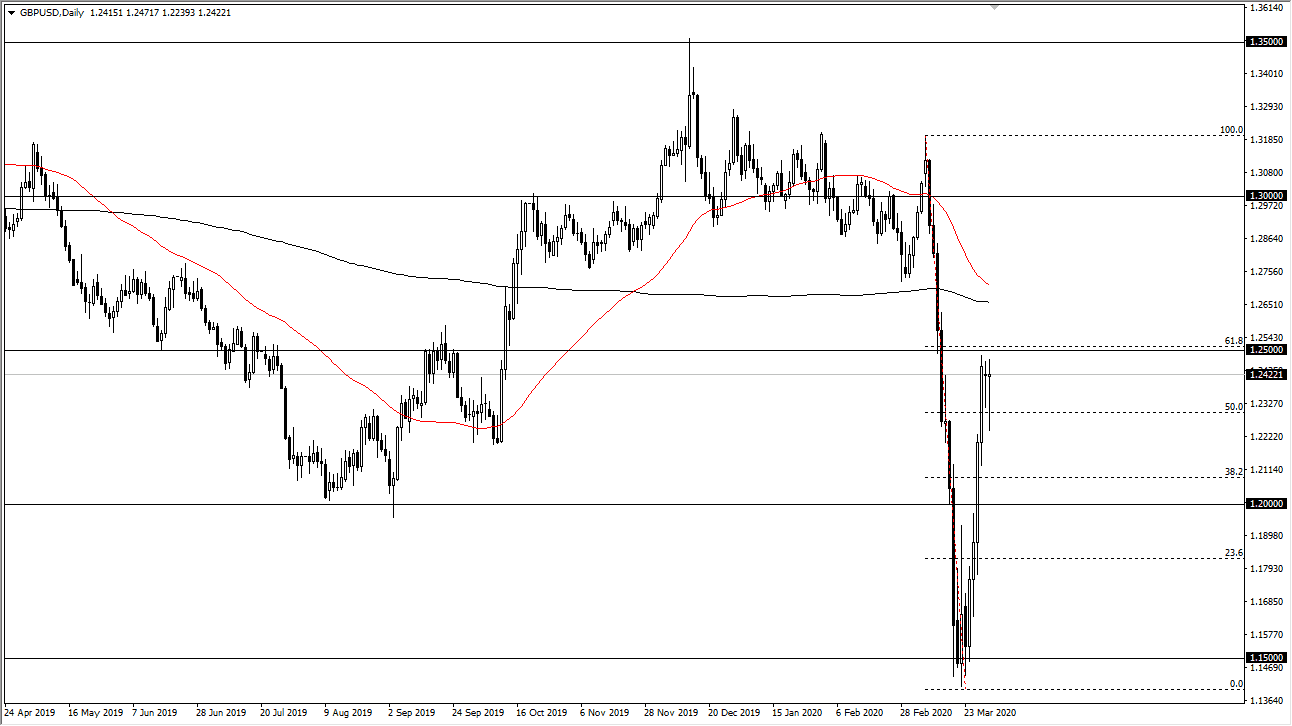

The British pound fell initially during the trading session on Tuesday but bounced significantly to turn around and reach towards the 1.25 handle again. This is an area that of course will capture a lot of attention due to the fact that it is a psychologically important figure, but the last couple of days have seen this market knocking on the door. If we can finally break above that level, it’s likely that the British pound will continue to take off and go looking towards the 1.2750 level initially. Keep in mind that the 61.8% Fibonacci retracement level is sitting just there as well, so it of course pays a lot of attention.

A breakdown below the bottom of the range during the trading session on Tuesday could open this market to much lower levels, perhaps down to the 1.20 level. At this point, we are clearly getting ready to make some type of decision but one thing that I would point out is that the British pound has been so resilient. The bounce that we had seen during the previous week was unprecedented, but the fact that we can’t seem to give up this rally shows you just how bullish this pair is.

With the Federal Reserve opening up a repo market for central banks around the world, it does suggest that perhaps we could see some easing of dollar strength, but quite frankly this move of 7% during the previous week was done before that was announced. The question is whether or not the United Kingdom is a place where money will continue to flow towards. I find that difficult to believe, but at the end of the day price is price. A break above the 1.25 handle I will be forced to start buying the pound again. Otherwise, if we break down below the bottom of the range, the market then could go much lower and quite rapidly as it would blow out a lot of long orders underneath. All things being equal though, it does look like we are trying to rip through a lot of long positions. Expect a lot of noisy trading, but eventually we should get some type of clarity, but it may not be until the end of the week after we get through the jobs figure on Friday. Expect noise, that’s probably about as good as it will get.