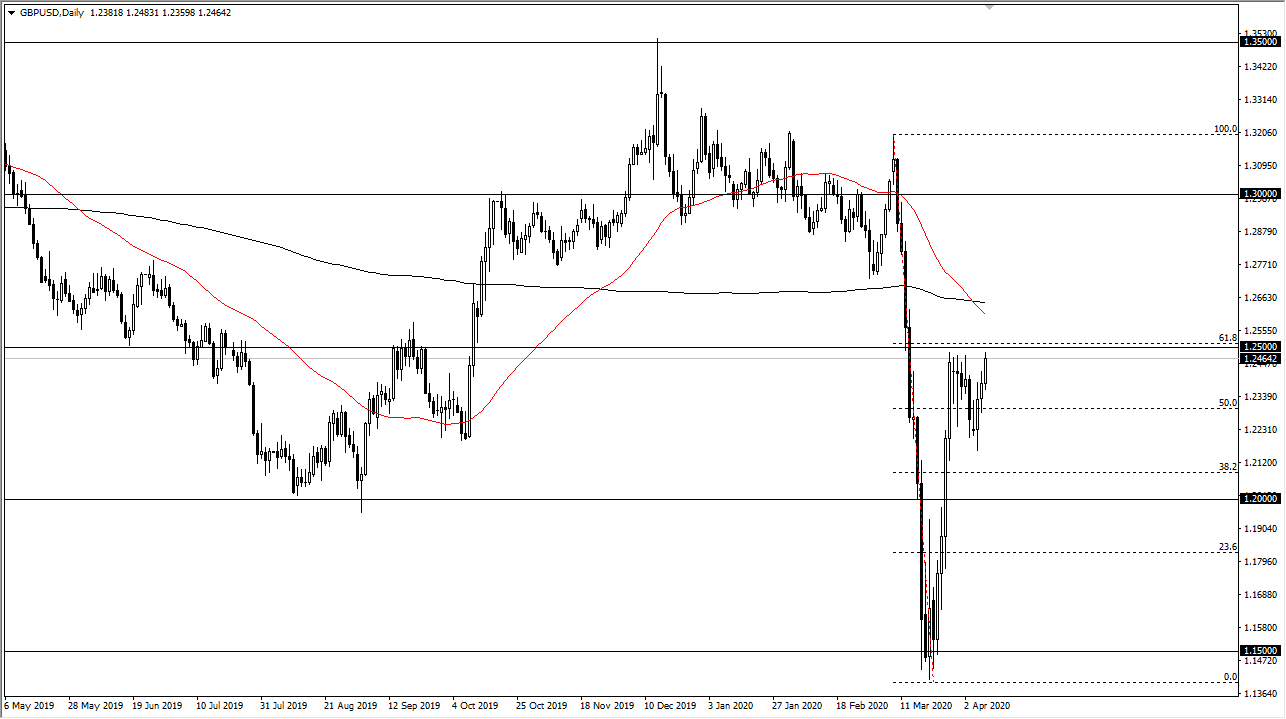

The British Pound has been rallying during the trading session on Thursday, reaching towards 1.25 level yet again. That’s an area that is massively resistive as we have seen multiple times. The question now is whether or not the British pound can not only break above the 1.25 level, but perhaps even stay above there. If it can, that would be a very bullish sign, and should send the British pound towards the 1.2750 level. At this point, I believe that the market will have to make a serious decision, but it should be noted that the British pound has tried as hard as it could to break out, so the question is whether or not we have a lot of momentum left in the Pound?

There are mixed signals based upon this chart, not only showing signs of strength, but at the same time showing serious concern around the 1.25 handle, and I do question as to whether or not we can continue to go higher. I believe that the next 24 hours could be rather crucial, because quite frankly this will be the fifth time that we are trying to break out. If we fail here, then it’s possible that the momentum will finally fail, and we go lower.

We have recently seen the so-called “death cross” with the 50 day EMA that has broken through the 200 day EMA, showing signs of weakness. That being said, this is a signal that is more often than not way too late for it to be of use, but that doesn’t necessarily mean that people will be paying attention to it. This is more or less a signal for longer-term traders.

The size of the candlestick is rather encouraging, but again I can’t get past the idea that this level has been so difficult, so the next move could be crucial. If we fail here, then it’s very likely it could be a rather significant break down, perhaps sending this market all the way down to the 1.20 level. However, a break higher it would be explosive, because there must be an absolute ton of selling orders just above to keep this market somewhat leveled. Ultimately, how this market closes at the end of the week, meaning at the end of the day on Friday, could give us a huge hint as to how traders feel about Sterling and of course the US dollar.