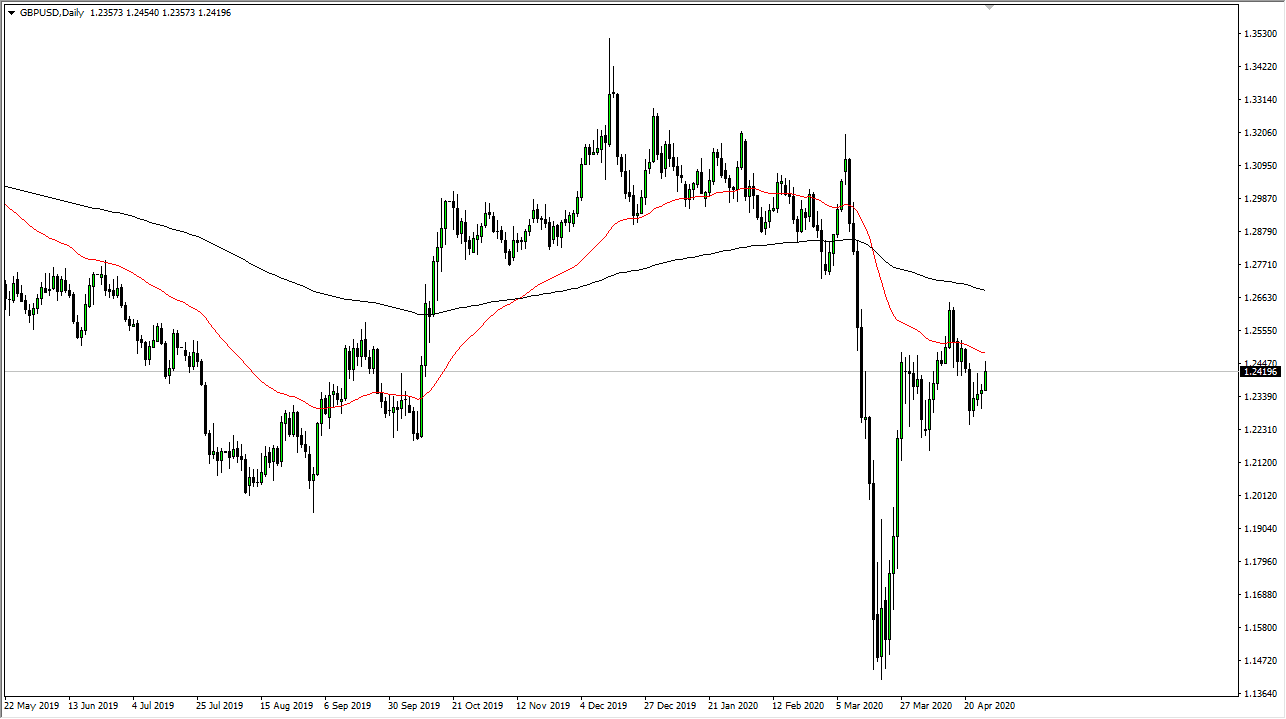

The British pound has rallied a bit during the trading session on Monday to kick off the week, but we continue to see sellers in the same region, essentially the 1.25 handle. The 50 day EMA is currently crossing that level as well, so it should attract a certain amount of attention by technical traders as it is important and of course sloping lower. With that, I believe that the market is ready to pull back just a bit as we may have gotten a bit ahead of ourselves again.

Recently, we had seen the British pound break above the 1.25 handle, but it only stayed above there for a few days. The weekly candlestick was a shooting star, so it certainly shows that we have a lot of work to do if we do try to take off to the upside, something that I do not anticipate happening. The US dollar of course will be favored as the United Kingdom is under lockdown, and of course if there are certain negative aspects out there, the US dollar does tend to pick up a bit of attention. At this point, the market almost looks as if it is trying to form a bit of a head and shoulders pattern, but that would be projecting out into the future.

To the downside I anticipate that the 1.2250 level would be an area of support, and if we were to break down below there it is likely that the GBP/USD pair will go looking towards 1.20 handle. I do not think that is going to be easy, but it is very possible over the longer term. After all, the United Kingdom is going to be much slower to open up than the United States, so that in and of itself should continue to throw money out of America. Beyond that, you also have the US Treasury market that continues to be a place where safety trading happens, and as long as there are a lot of concerns out there, it makes quite a bit of sense that more money flows into that market, which of course demands US dollars. Beyond that, when I look at European currencies on the whole, they are being shunned from a longer-term perspective, and needless to say Great Britain is highly exposed to Europe. Fading rallies continues to be the way I play this market.