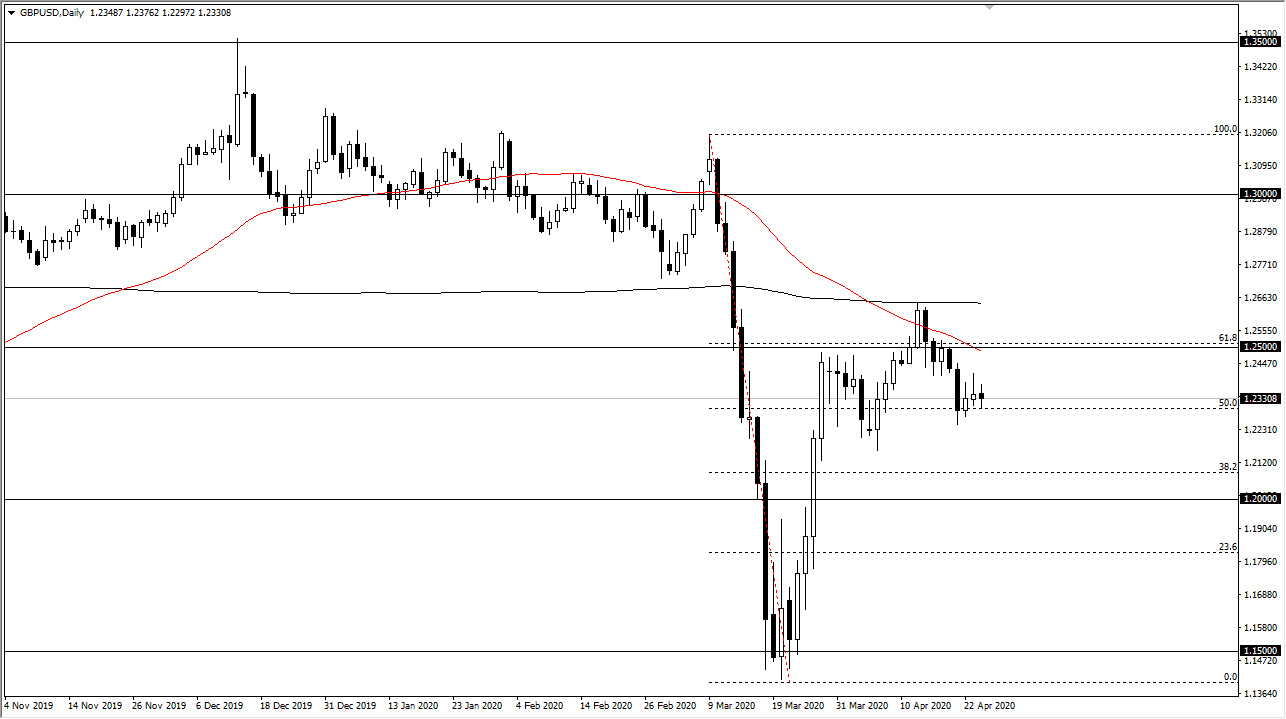

The British pound went back and forth during the trading session on Monday, as we continue to see a lot of noise in the market. At this point, I believe that the market going back and forth it is a simple function of the buyers running out of conviction. In fact, the 50 day EMA has now broken below the 1.25 handle and is sloping towards the price action. To me, it looks as if the 1.23 level is offering a bit of short-term support, but that is an area that will get broken through and we should then eventually go looking towards 1.22 handle next.

To the upside, the 50 day EMA should offer a lot of resistance, and the fact that we ended up forming a couple of inverted hammer’s suggests that we are ready to go lower. If we do break above the highs of the last couple of candlesticks though, that would be a bullish sign that has to be paid attention to. If we get a daily close above the 1.25 handle, then it is possible we break out to the upside. That being said, the British pound has a lot working against it, not the least of which will be the fact that the United Kingdom is going to be locked down much longer than many of the other countries around the world, not the least of which will be the United States that is already in the process of trying to open up certain areas in the next few days.

Furthermore, the treasury markets tend to attract a lot of money when people are concerned, as yields in the 10 year note have been falling for some time. As that demand picks up, it means that people need US dollars. That in and of itself can drive where this market goes next, especially when comparing the United States to the United Kingdom which also has to deal with the Brexit situation when all of the dust settles from the coronavirus problems. Retail sales fell much harder than anticipated during the trading session on Friday as well, so that is another reason to think that the United Kingdom is going to continue to lag a bit. Beyond that, it seems as if the United Kingdom seems quite content with being locked down based upon the most recent polls. If that is the case, economic movement in that country will continue to be stagnant.