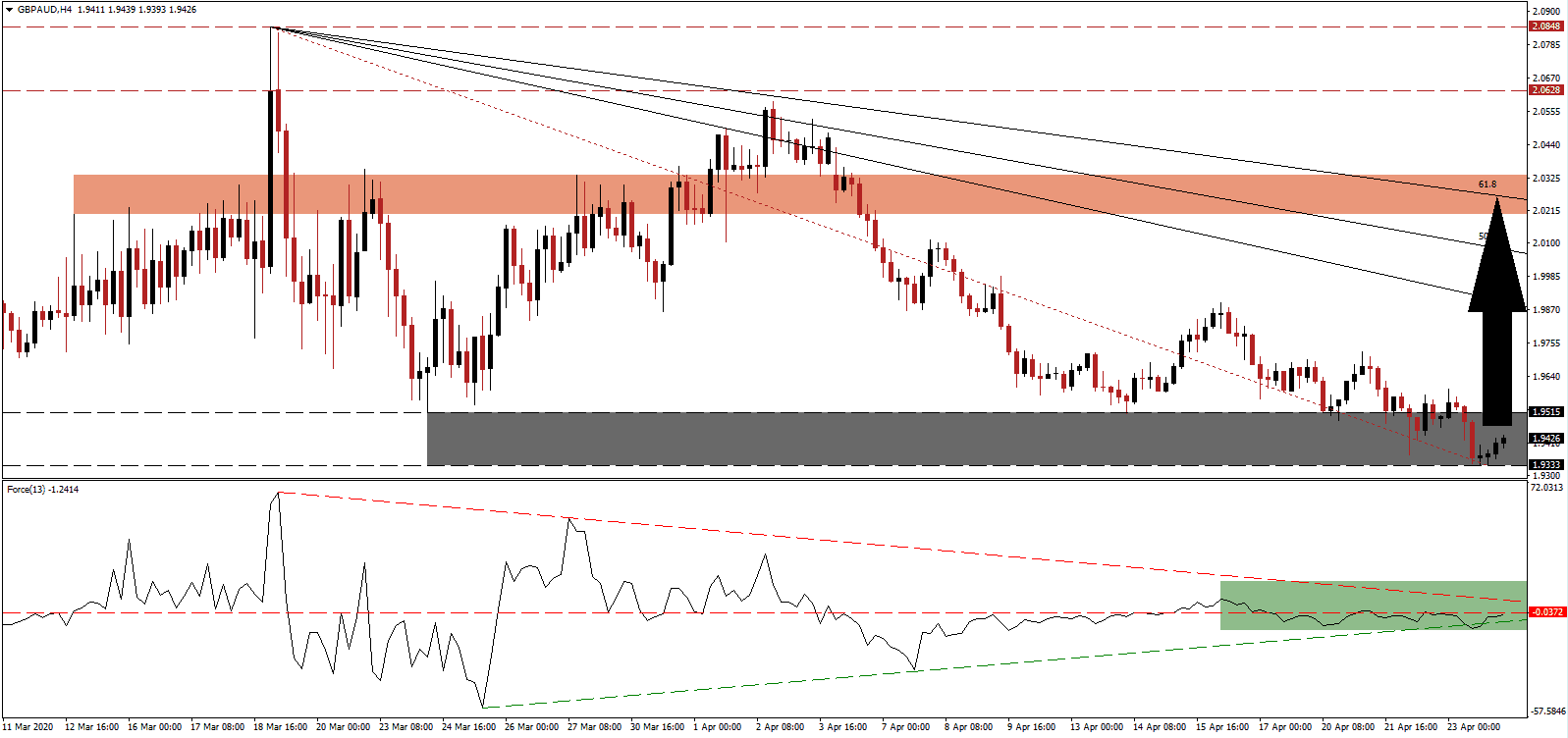

Preliminary PMI data out of the UK indicated a steep slowdown, mirrored across Europe, Australia, and the US, due to the global Covid-19 pandemic. Unlike the US Federal Reserve, which believes it is in control of the virus-beaten economy by becoming a buyer of financial assets, the Bank of England and the Reserve Bank of Australia issued warnings about a slow recovery following the gradual return to economic activities under new restrictions. Borrowing needs are spiraling out of control across the developed world, but the GBP/AUD stabilized from its sell-off after reaching its support zone.

The Force Index, a next-generation technical indicator, confirms the presence of a positive divergence following a significantly higher low while this currency pair drifted farther to the downside. Adding to upside pressures is the ascending support level, as marked by the green rectangle, favored to push the Force Index into positive territory. A breakout above its descending resistance level, due to its proximity, is expected to deliver a powerful bullish catalyst for the GBP/AUD. Bulls will regain control of price action after this technical indicator crosses above the 0 center-line.

Per one assessment, the UK lockdown could be lifted on May 18th, as new cases are slowing. One of the most significant risks remains a premature end to social distancing without a cure in place. It could lead to a second infection wave over the summer months, which most certainly positions to the global economy for a depression. The GBP/AUD embarked on a gradual advance inside of its support zone located between 1.9333 and 1.9515, as identified by the grey rectangle, with a build-up in bullish pressures anticipated to lead to a breakout.

A sustained push above the support zone is anticipated to spark a short-covering rally in the GBP/AUD, closing the gap to its descending 38.2 Fibonacci Retracement Fan Resistance Level. Forex traders are advised to monitor the intra-day high of 1.9894, the peak of a previously reversed breakout. A move higher is likely to attract new net buy orders in this currency pair, providing the required volume for more upside. The next short-term resistance zone awaits price action between 2.0200 and 2.0336, as marked by the red rectangle, with the 61.8 Fibonacci Retracement Fan Resistance Level passing through it.

GBP/AUD Technical Trading Set-Up - Short-Covering Scenario

Long Entry @ 1.9425

Take Profit @ 2.0225

Stop Loss @ 1.9250

Upside Potential: 800 pips

Downside Risk: 175 pips

Risk/Reward Ratio: 4.57

In case the descending resistance level collapses the Force Index below the present April low, the GBP/AUD may extend its corrective phase. Due to the existent economic outlook, any breakdown from current levels is predicted as a short-term event. Forex traders are recommended to take advantage of it with new net buy orders. The next support zone is located between 1.8848 and 1.8942.

GBP/AUD Technical Trading Set-Up - Reduced Breakdown Scenario

Short Entry @ 1.9150

Take Profit @ 1.8900

Stop Loss @ 1.9250

Downside Potential: 250 pips

Upside Risk: 100 pips

Risk/Reward Ratio: 2.50