Selling pressure pushed the EUR/USD towards a stronger lower level at 1.0811, but losses were stopped, albeit temporarily, due to improved ZEW sentiment index readings for the largest economy in Europe, which contributed to a limited correction of the pair towards the 1.0880 resistance before settling around the 1.0860 level in the beginning of trading today, Wednesday, awaiting any developments. The ZEW survey warned of the prolonged German recession and slow recovery from the coronary virus crisis in German, the Eurozone and the world.

The ZEW analyst six-month forecast for the German economy rose by 77.7 points to 28.2 in April, a record increase from a negative reading of -49.5 previously, and expectations were for a rebound of -40 points only. Although this follows a record decline from the previous month. The current economic conditions have deteriorated dramatically with the index dropping 48.4 points to -91.5, the lowest level ever. The picture of the Eurozone was not better, as the expectations index rose 74.7 points to a reading of 25.2 points for the month of April, while the current situation index fell -45.4 points to a new low at -93.9.

Commenting on the results, Achim Wambash, president of the ZEW Institute, said: “Special questions about the coronavirus crisis included in the survey show that experts do not expect to see positive economic growth until the third quarter of 2020, and economic output is not expected to return to pre coronavirus outbreak levels before year 2022 ”.

For the ZEW survey, 300 financial analysts were asked for their opinions on questions related to the market and the economy. Both components of the survey have risen in recent months, indicating less severe expectations in response to the Brexit withdrawal agreement from October and the "Phase 1 deal" between the United States and China to stop the fierce trade war between them.

ZEW's expectations for Germany have been downward for years to come due to the coronavirus crisis, although Europe's largest economy is now facing a longer period of slowdown even though it appears to be the first major economy to emerge from the closure of the economy, with people going out of their homes to factories and companies. Large parts of the Eurozone have started to hit a standstill since late February when it became clear that Italy had a serious problem of Coronavirus.

The shutdowns of entire economies are expected to lead to an unprecedentedly massive two-digit GDP drop for the first and second quarters in all countries, with similar large increases in unemployment and government spending as a share of GDP currently in progress or expected for the coming months.

Spain, the largest epidemic outbreak center in Europe and the second largest in the world, said at the weekend that children from April 27 will be able to exit according to certain circumstances, but also, the third extension of the national ban will keep most people confined to their homes for another three weeks.

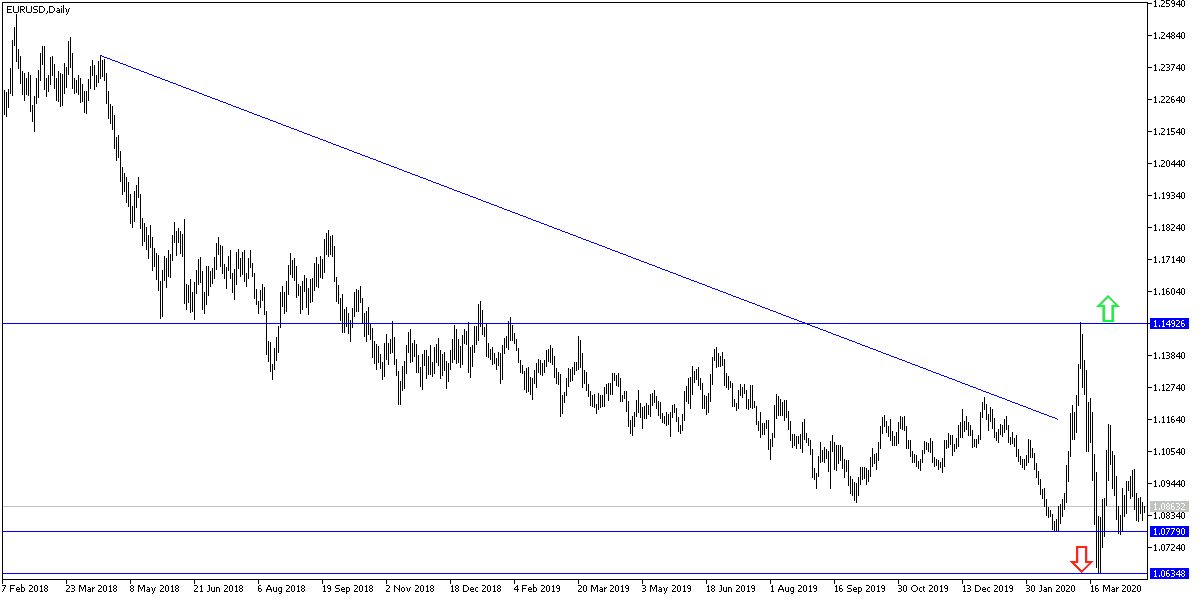

According to technical analysis of the pair: The EUR/USD price path is still bearish, as is the performance on the daily chart below shows. As I mentioned before, I now confirm that the 1.0800 psychological support still confirms the bear's control over performance, and therefore the pair is poised to move towards stronger support levels, and the closest ones are currently 1.0815, 1.0745 and 1.0690, respectively. There will not be a real opportunity for an upward correction without breaching the 1.1000 resistance, and I still prefer selling the pair from every upper level. The contrast between economic performance and monetary policy for both the Eurozone and the United States of America is in favor of a stronger dollar.

As for the economic calendar data today: The Eurozone consumer confidence index will be announced. There are no significant US economic releases today.