Singapore was initially hailed for its approach to the global Covid-19 pandemic, but cases have soared over the past week. The majority were imported due to the island-nations reliance on foreign workers. New social distancing measures were implemented this week to act as a circuit breaker for the transmission of the virus. Forecasts place the economic cost at S$10 billion, approximately 2% of GDP. Singapore announced aid packages worth over 12% of GDP, granting the economy more time to manage through the global recession. The EUR/SGD bounced off of its support zone, but the lack of bullish momentum is expected to lead price action into a renewed sell-off.

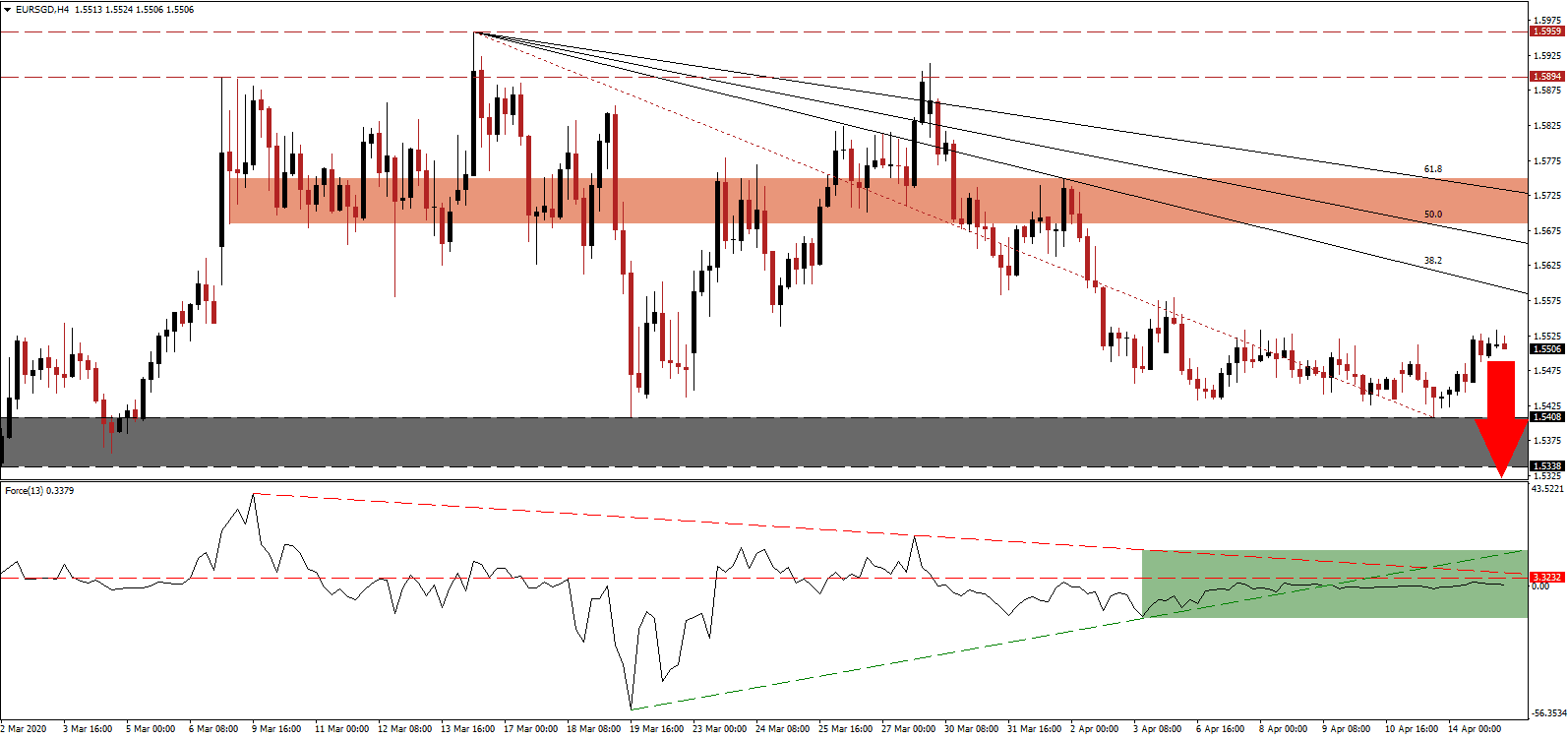

The Force Index, a next-generation technical indicator, remains below its horizontal resistance level. Adding to the rise in bearish pressures was the move below its ascending support level, as marked by the green rectangle. Intensifying downside momentum is the descending resistance level, favored to push this technical indicator into negative territory. It will allow bears to regain control of the EUR/SGD, leading the next breakdown sequence. You can learn more about the Force Index here.

After this currency pair recorded a lower high inside of its long-term resistance zone, it converted the short-term support zone located between 1.5685 and 1.5749, as identified by the red rectangle, into resistance. The descending 38.2 Fibonacci Retracement Fan Resistance Level enforced the downtrend. Eurozone weakness was evident before the outbreak of the virus and intensified deep divisions between member countries, anticipated to have long-lasting negative impacts on the fragile union. It provides a long-term bearish catalyst to the EUR/SGD.

One underestimated risk is the likelihood of a looming financial crisis, as noted by the trade minister of Singapore. Most economies are fiscally weak due to massive debt loads in response to the global financial crisis of 2008. The economy never recovered and was artificially kept alive. Governments have not added significantly more debt, which will create the pillars of a financial crisis more massive than 2008. The EUR/SGD is anticipated to complete a breakdown below its support zone located between 1.5338 and 1.5408, as marked by the grey rectangle. It will clear the path into the next support zone between 1.5090 and 1.5159. More downside is favored, but a new catalyst is required.

EUR/SGD Technical Trading Set-Up - Breakdown Scenario

- Short Entry @ 1.5505

- Take Profit @ 1.5090

- Stop Loss @ 1.5635

- Downside Potential: 415 pips

- Upside Risk: 130 pips

- Risk/Reward Ratio: 3.19

A breakout in the Force Index above its ascending resistance level, acting as current resistance, could extend the bounce in the EUR/SGD. The upside potential remains limited to the 61.8 Fibonacci Retracement Fan Resistance Level, crossing through the short-term resistance zone. Singapore’s relative fiscal strength as compared to the multitude of Eurozone issues favors an extended corrective phase. Forex traders should consider any advance from current levels an outstanding selling opportunity.

EUR/SGD Technical Trading Set-Up - Limited Recover Extension Scenario

- Long Entry @ 1.5655

- Take Profit @ 1.5720

- Stop Loss @ 1.5625

- Upside Potential: 65 pips

- Downside Risk: 30 pips

- Risk/Reward Ratio: 2.17