Safe-haven assets are in strong demand, as evidenced by Singapore’s 242.5% surge in gold exports for March. The Japanese Yen and the Swiss Franc are the two currencies Forex traders seek, during risk-off sessions. Switzerland announced plans to gradually lift the nationwide lockdown with a three-phased approach, but normal activities will remain restricted for an unknown period. The Alpine country anticipates a severe recession followed by a slow recovery. Most governments believe the illusion of a quick recovery from the global Covid-19 pandemic. Since the Swiss leadership adopted a realistic approach, economic prospects are superior. The CHF/JPY is favored to enter a short-covering rally after correcting into its short-term support zone.

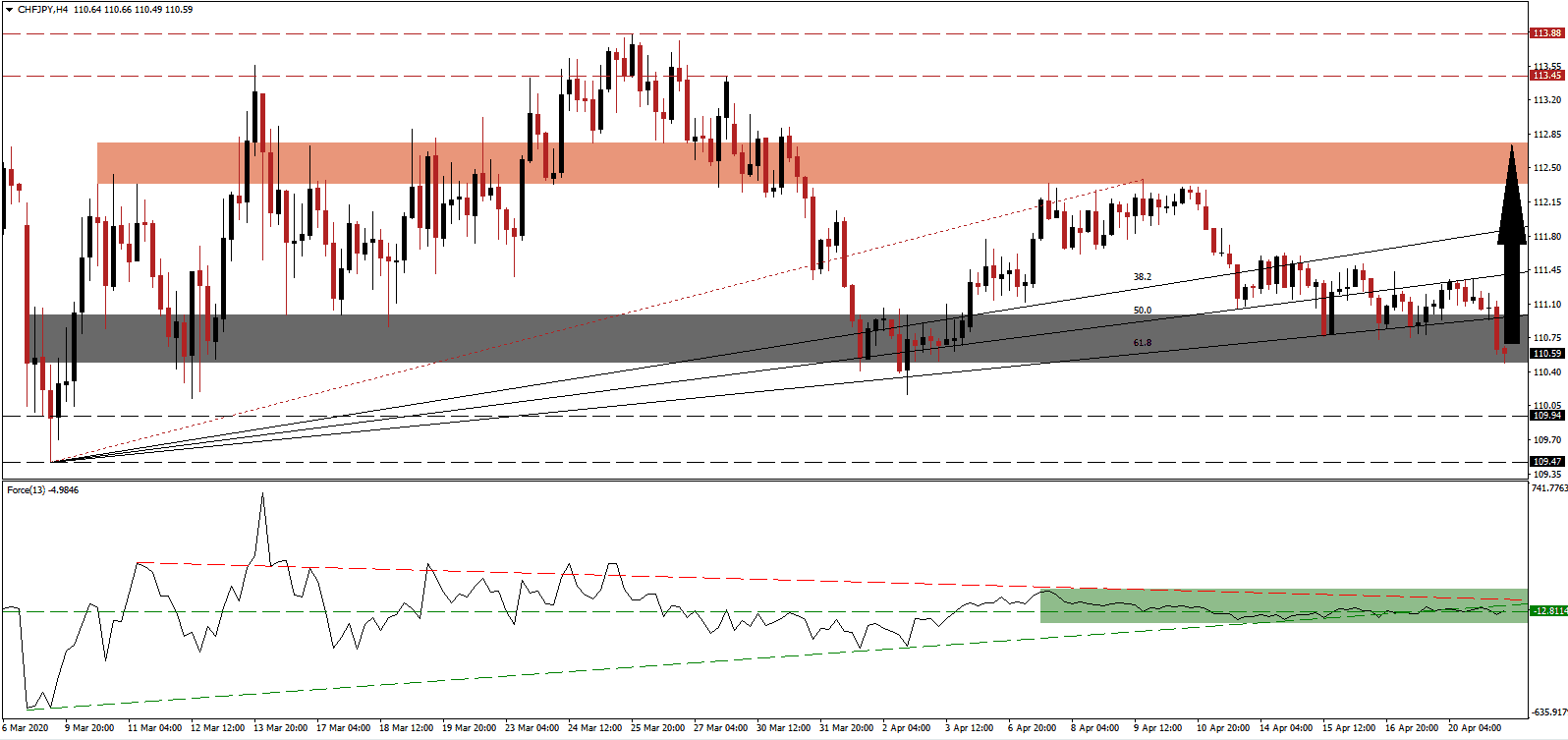

The Force Index, a next-generation technical indicator, entered a sideways trend, trading above-and-below its horizontal support level. It remains below the ascending support level, as marked by the green rectangle, with the descending resistance level closing in. Bears remain in control of the CHF/JPY as long as this technical indicator maintains its position below the 0 center-line. A minor bullish bias is emerging, expected to catapult the Force Index into positive territory, adding to short-term breakout pressures.

Switzerland raised its economic stimulus to CHF60 billion or 8.5% of GDP. It is significantly less than Japan’s upward revised ¥117.1 trillion aid package totaling over 20% of GDP. It suggests a more efficient approach by Swiss authorities, keeping long-term costs in check. The Swiss National Bank is heavily involved in the Forex market, manipulating its currency in support of exporters. Despite central bank interference, the CHF/JPY is exposed to dominant market forces suggesting a momentary breakout above its short-term support zone located between 110.49 and 110.99, as marked by the grey rectangle.

One essential development to monitor is the ascending 61.8 Fibonacci Retracement Fan Resistance Level, which is on the verge of exiting the short-term support zone. A double breakout will allow the Fibonacci Retracement Fan sequence to guide price action farther to the upside. The next resistance zone awaits the CHF/JPY between 112.33 and 112.76, as identified by the red rectangle. Volatility is likely to remain elevated with this currency pair restricted to its present trading range unless a significant fundamental catalyst emerges. You can learn more about a resistance zone here.

CHF/JPY Technical Trading Set-Up - Short-Covering Scenario

Long Entry @ 110.60

Take Profit @ 112.75

Stop Loss @ 109.90

Upside Potential: 215 pips

Downside Risk: 70 pips

Risk/Reward Ratio: 3.07

Should the descending resistance level pressure the Force Index deeper into negative territory, the CHF/JPY may be forced into an extension of its corrective phase. The downside potential remains limited on the back of Swiss central bank buying. Forex traders are advised to consider any breakdown as a short-term event and buying opportunity. The next support zone is located between 107.95 and 108.71.

CHF/JPY Technical Trading Set-Up - Limited Breakdown Scenario

Short Entry @ 109.35

Take Profit @ 108.00

Stop Loss @ 109.90

Downside Potential: 135 pips

Upside Risk: 55 pips

Risk/Reward Ratio: 2.46