The Australian dollar initially tried to rally during trading on Tuesday but gave back those gains to fall towards the 0.6050 level. However, later in the day we saw the Australian dollar bounce a bit in order to show signs of life. By doing so it suggests that the market is still trying to figure out its next move. The fact that the market blow out the range a little bit during the trading session actually makes trading the Australian dollar little easier. This expanded range of trading means that if we break out of the range on Wednesday, it shows that we are expanding the volatility and therefore we should see a significant move.

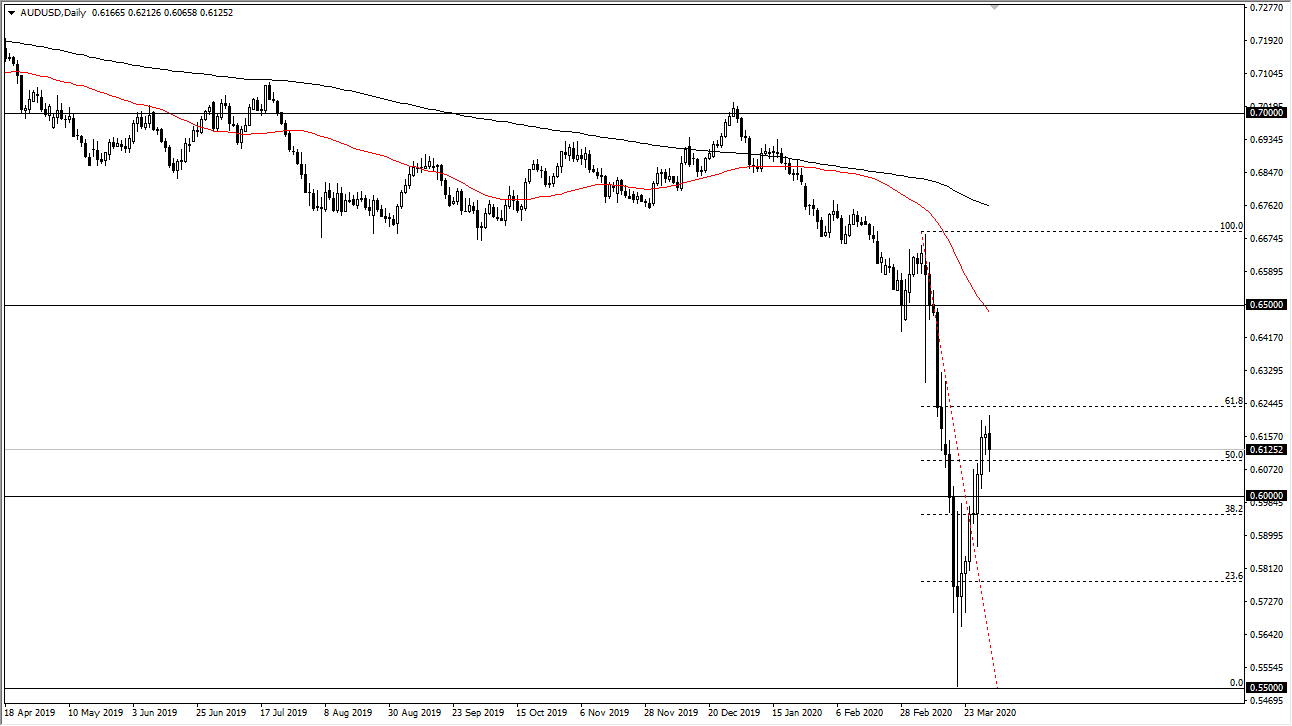

If we break down below the bottom of the range for the Tuesday session, it’s likely that the Australian dollar will then go to the 0.60 level, perhaps lower than that. However, the market was to turn around a break above the top of the range for the trading session on Tuesday, then I think it opens up the door towards the 0.63 handle, perhaps followed by the 0.65 level after that.

The Australian dollar is highly sensitive to the global supply chain and risk appetite, and with a world of uncertainty out there it makes quite a bit of sense that the Aussie would continue to show signs of weakness. Ultimately, even if the Australian dollar has bottomed, it’s very likely that we may need to get some type of pullback in order to pour more of a solid base for a rally. The Federal Reserve opening up liquidity to other central banks to ease dollar funding may help, but at the end of the day if there is no demand there isn’t much that central banks can do about it. In other words, the global supply chain will stay loose as long as it needs to, and certainly as long as it takes for the coronavirus to die off.

I think the one thing you can probably count on is a certain amount of choppiness in this market, but we should eventually see some type of decisive move. Once we do break out of this range, I anticipate that the rate of momentum should pick up quite significantly. We have had a nice bounce, but we still haven’t broken above the 61.8% Fibonacci retracement level. I mildly bearish but recognize anything can happen at this point.