The Australian dollar initially pulled back a bit against the US dollar during the trading session on Thursday, but then rocketed towards the 0.64 handle later in the day. However, as Wall Street closed out, we started to see a lot of negativity and for what it is worth we have formed a shooting star on the four hour chart. The 0.64 level seems to be a bit of a barrier, so at this point I anticipate that we are probably going to pull back a bit, perhaps reaching towards the 50 day EMA underneath.

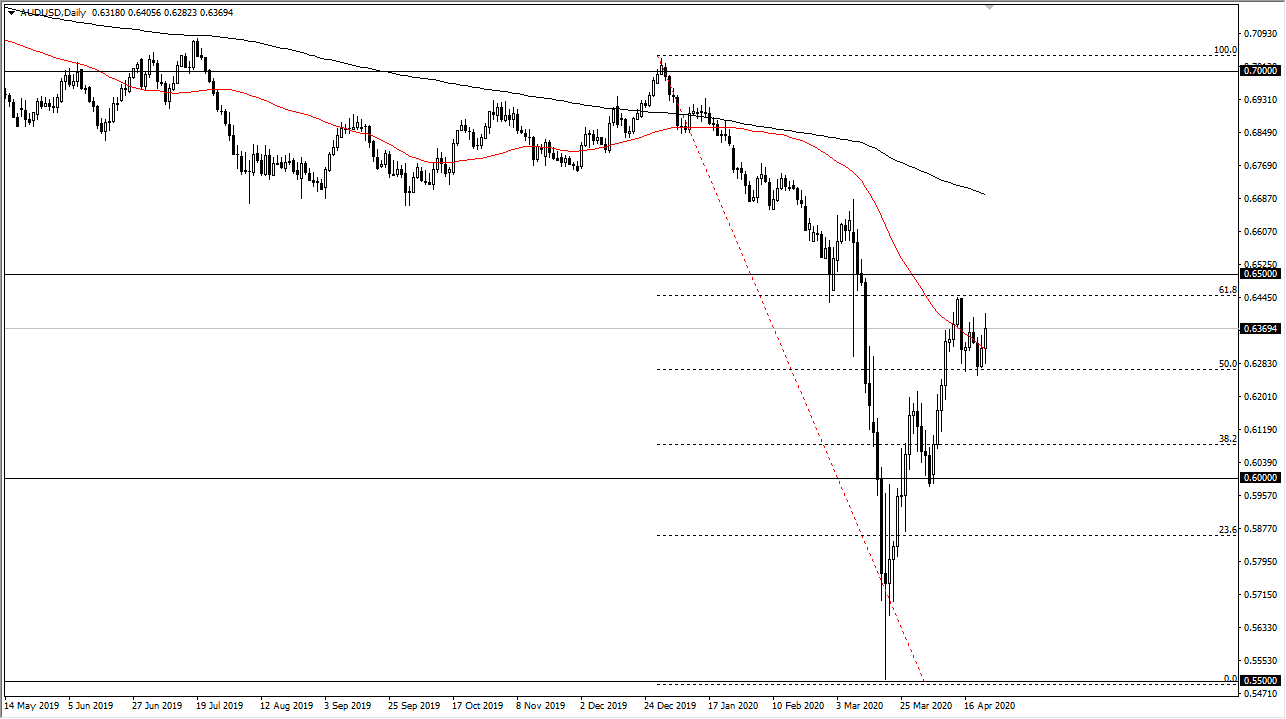

Keep in mind that the 0.64 level is a large, round, psychologically significant figure but I also believe that there is extensive resistance all the way to the 0.65 handle. The 61.8% Fibonacci retracement level recently has repelled the rally, so the question now is whether or not we can continue to go to the upside. If we cannot, that could have very well been the high for the most recent rally. I do not like the idea of buying the Australian dollar, because quite frankly there is not much in the way of a fundamental reason to do so.

Keep in mind that the Australian dollar is overly sensitive to the global growth situation, as Australia provides a lot of the raw materials for China. While China is starting to get back to work, the reality is that the rest of the world is still essentially locked down and has a whole host of issues to overcome before they start buying a lot of Chinese goods. In other words, the Australian dollar should continue to fall from a longer-term fundamental standpoint, and I think it will eventually catch up with the Aussie going forward. That being said though, it is obvious that there is a lot of momentum and there is a lot of “hopium” out there looking to trying to put money to work, as is the typical situation. The volume in the stock markets have been extraordinarily light during the recent rally, and I think that probably sheds light on why this market has rallied, we may not be seen as much in the way of volume here either. I believe in fading rallies, and I do believe that eventually we will probably break down to a fresh low and go looking towards the 0.62 handle. That being said, if we were to break above the 0.65 level, then it would obviously be a major shift in sentiment.