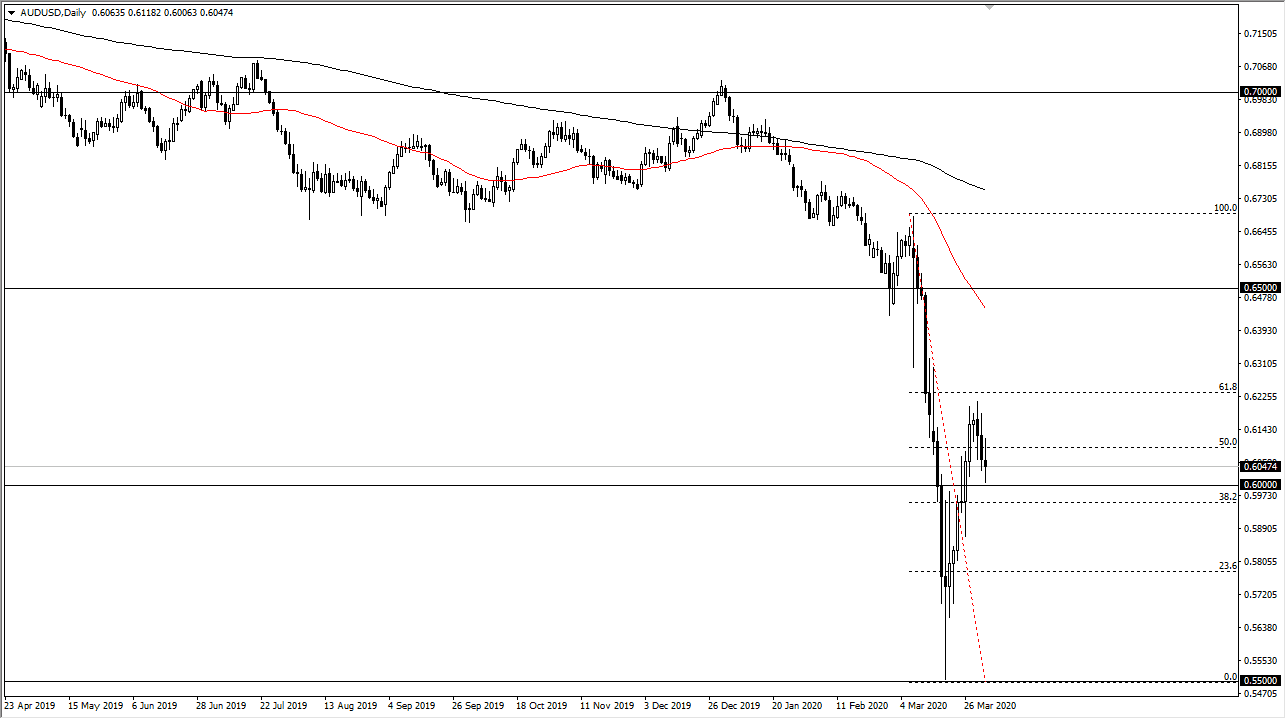

The Australian dollar has gone back and forth during the trading session on Thursday and what could best be described as choppy and pointless trading. All things being equal, the most important thing on this chart is probably the 0.60 level, which is where we bounce from during the trading session. If we were to break down below that level it would obviously be very negative sign, but I don’t know if that happens between now and the jobs numbers coming out of the United States.

Looking at this chart, the candlestick for the trading session on Thursday certainly looks to be balanced in neutral, so I think we are waiting for the next catalyst. The next catalyst is more than likely going to be the jobs report, but you should also keep in mind that coronavirus numbers and of course the economic figures including employment. If the market was to break down below the 0.60 level, then it’s likely that the market goes looking towards the 0.50 level after that. Alternately, the market was to break above the top of the candlestick during the trading session on Thursday, then the market is likely to go looking towards the 0.6225 handle. If we were to break above the 0.6250 level, then it opens up the door to a bigger move, perhaps even as high as the 0.65 level over the longer term.

That being said, the next 24 hours are going to be crucial and simply figuring out which side of the neutral candlestick for Thursday that we break out of on a daily close probably points out where we go next. I think it is difficult to get overly excited about this market one way or the other, at least until we get a little bit more clarity. Clarity is something that we simply don’t have at this point, and of course that doesn’t help the Australian dollar to say the least. As a general rule, when a market sits at a large number and forms a neutral candlestick, it’s often best to wait until the next daily close or at least the next close where we break out of that range to start putting money to work. I suspect that will be the case here, as the jobs number is a huge issue to deal with. Once we do break in one direction or the other, we probably have 200 pips or so to go until the next short-term move is fulfilled.