The Australian dollar initially tried to rally during the trading session on Monday, but as you can see gave back quite a bit of the gains as we continue to see a lot of softness around the world. Commodities in general were a bit soft during the trading session, as there are a lot of concerns. Ultimately, this is a market that is wrestling with the idea of whether or not we are going to have any type of economic growth. I suspect we probably won’t, and one of the main markets that you are starting to see how little there is would be the crude oil market. Granted, the crude oil market is not a place that most Australian dollar traders play based upon one or the other, but it’s a significant global story and the fact that there is absolutely no growth.

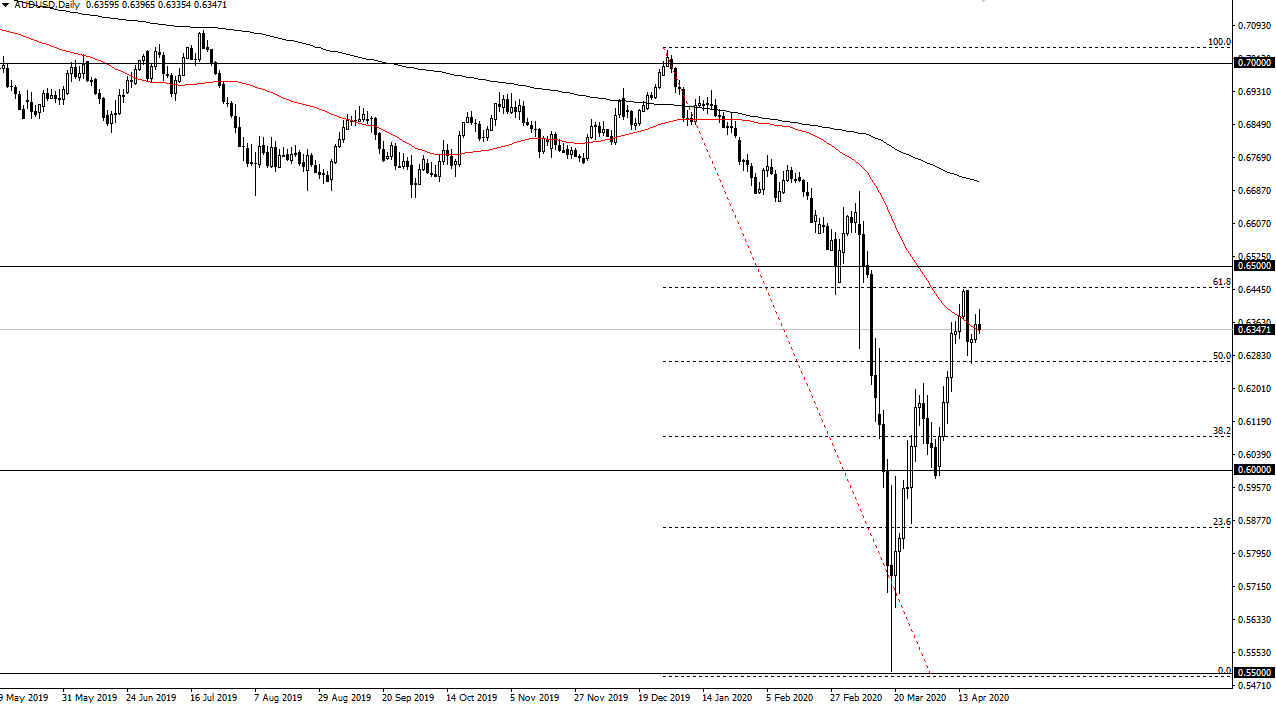

The Chinese economy is one of the main drivers of the Australian economy, both of which look horrific at the moment. Quite frankly, it doesn’t matter how much work China gets done in the factories, if there are no buyers out there. I think at this point we are likely to see a bit of a pullback, and if we can break down below the lows of the Thursday session it opens up the door to the 0.62 handle, and then eventually the 0.60 level. Ultimately, I think that the market has rallied far too quickly to be sustainable, so at the very least you would have to expect some type of pullback.

If we break down below the 0.60 level, this is going to end up being a very negative and ugly move, reaching down towards the 0.58 level. The alternate scenario of course is that somehow, we break above the 0.65 level, which I think would open up the door towards the 0.67 handle, possibly even higher but I think it’s going to take something rather significant to happen in order for the markets turnaround that drastically. At this point, I think that the Aussie is a logical place to start shorting on signs of weakness, and I also believe that the wins the candlestick of last week was the first salvo in what could be a deep retracement over the next couple of weeks. Keep your position size reasonable though, because we are clearly going to have a lot of noise.