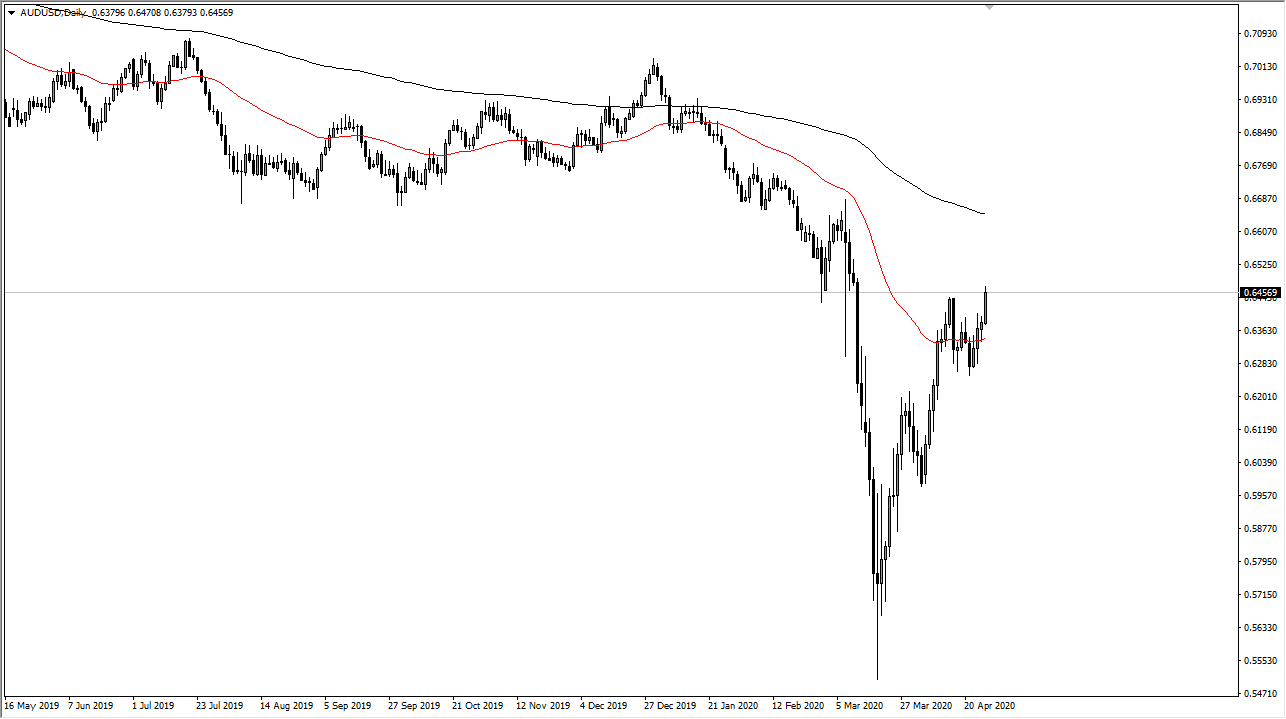

The Australian dollar has broken out during the trading session on Monday, as we have cleared the 0.6450 level. That being said, there is a ton of resistance above that the market seems to be attracted to. Quite frankly, the Australian dollar has been a bit of an anomaly as it has been so strong against the US dollar. This is remarkably interesting, considering that the market seems to be “front running” the idea of economies around the world opening up. However, this assumes that global economies are going to behave as they had before been locked down for the coronavirus. If you believe that the economy will go back to all things being normal, then by all means this market should continue to go higher. However, if you think real damage has been done, this is going to be a great place to start shorting at the right time and place.

Australia is heading into a recession for the first time in over 30 years. That can cause some issues, but I think the bigger problem that you are going to run to when it comes to the Aussie dollar is the fact that although China is opened back up for manufacturing, it does not have a lot in the way of clients. With that being the case, it is likely that we will see markets come back down to reality given enough time. Another thing that seems to be flying under the radar is that we are seeing the coronavirus cases returning in some places like Singapore and China. If that in fact does become an issue, the Australian dollar will get absolutely crushed.

To the downside, I anticipate that the market is probably going to go looking towards the 0.63 handle, and then eventually the 0.62 level. Furthermore, the US dollar continues to attract a lot of inflow due to the US Treasury market, which of course demands US dollars. This has been a very bullish move, and quite frankly if you have made profits from the bottom it is time to start thinking about closing out your position. Otherwise, you will be sitting on the sidelines and waiting for an opportunity to start shorting. For what it is worth, the 200 day EMA is currently sitting just above the 0.66 handle, so that is something to pay attention to as well.