Australian Prime Minister Morrison and his government is exploring options to pay for the massive stimulus announced in response to the global Covid-19 pandemic. He ruled out a tax increase, as suggested by some, noting the economy needs to recover, allowing taxpayers to return to work. It highlights one enormous issue as some countries are nearing the peak of the outbreak. The bailout costs were unprecedented, and while a temporary bridge was required, the long-term negative impacts need to be solved. The AUD/JPY maintains its bullish stance after transforming its short-term resistance zone into support.

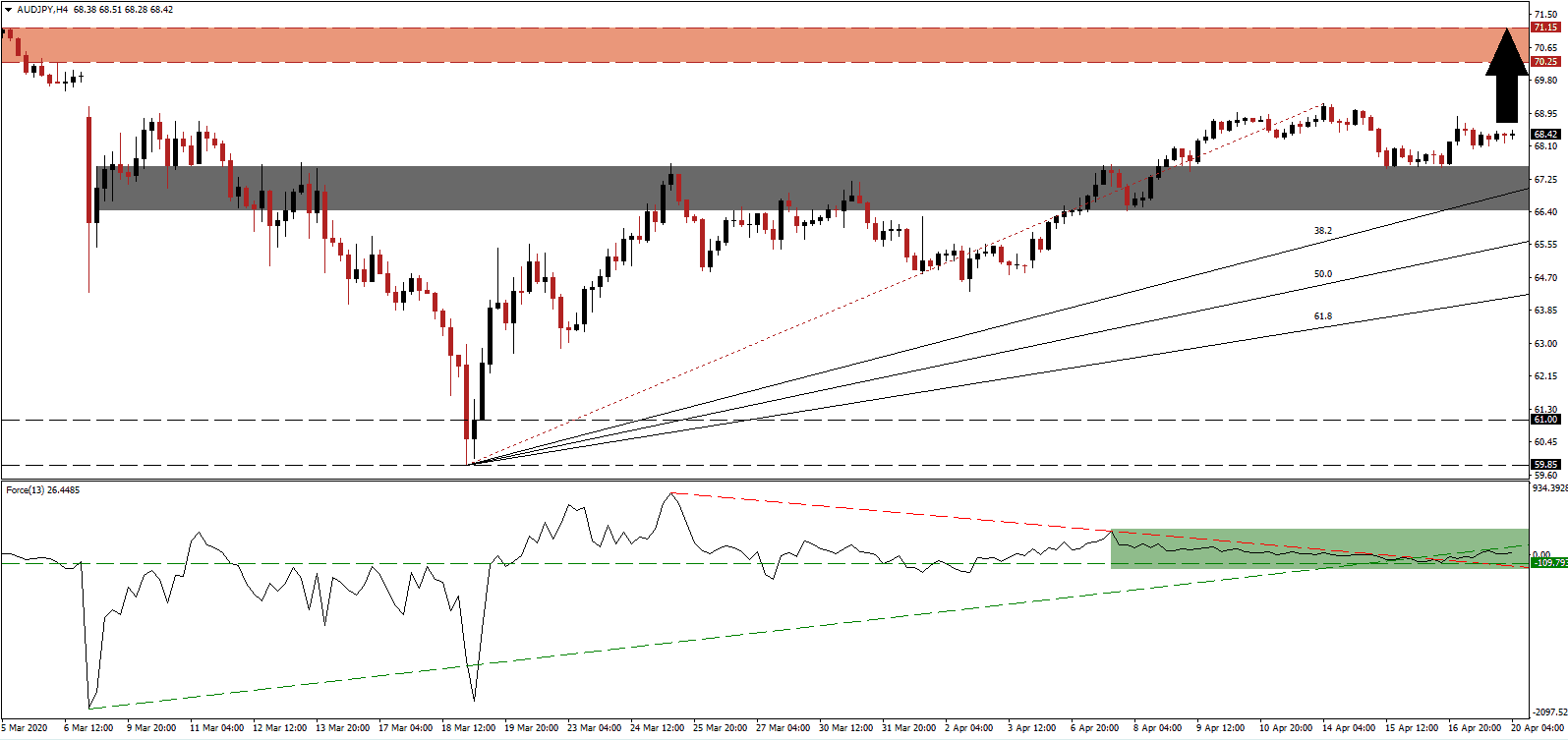

The Force Index, a next-generation technical indicator, rests above its horizontal support level after pushing through its descending resistance level. Momentum in this currency pair remains marginally bullish, and the Force Index is expected to eclipse its ascending support level, which serves as temporary resistance, as marked by the green rectangle. This technical indicator is positioned above the 0 center-line, suggesting bulls are in control of the AUD/JPY. You can learn more about the Force Index here.

Japan announced a steeper than forecast slump in March exports, resulting in a significantly reduced trade surplus. It provided new evidence that the global economy is in a deep recession, likely to last longer than currently priced into markets. The AUD/JPY is favored to extend its breakout farther to the upside, supported by the ascending 38.2 Fibonacci Retracement Fan Resistance Level. It is passing through the short-term support zone located between 66.42 and 67.57, as marked by the grey rectangle.

Australia is heavily dependent on China, and the Australian Dollar remains the primary Chinese Yuan proxy currency. Market reaction was muted to the second interest rate cut this year by the People’s Bank of China. Forex traders are advised to monitor the intra-day of 69.20, the present peak of the advance. A breakout in the AUD/JPY is anticipated to result in the addition of buy orders, providing the volume required to elevate price action into its resistance zone. This zone awaits between 70.25 and 71.15, as identified by the red rectangle.

AUD/JPY Technical Trading Set-Up - Breakout Extension Scenario

Long Entry @ 68.45

Take Profit @ 71.15

Stop Loss @ 67.55

Upside Potential: 270 pips

Downside Risk: 90 pips

Risk/Reward Ratio: 3.00

In case the Force Index maintains a breakdown below its descending resistance level, the AUD/JPY is likely to enter a corrective phase. Existing fundamental stipulations limit the downside potential to its 61.8 Fibonacci Retracement Fan Support Level unless more severe economic disappointments unravel. The next support zone is located between 59.85 and 61.00, with volatility expected to increase moving forward.

AUD/JPY Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 66.45

Take Profit @ 64.35

Stop Loss @ 67.35

Downside Potential: 210 pips

Upside Risk: 90 pips

Risk/Reward Ratio: 2.33