The South African Rand has gained against the US dollar during trading on Monday, as the US dollar got hit by just about everything on the planet. This of course has a lot to do with the Federal Reserve possibly cutting interest rates in the short term, and markets are even starting to price in a Fed funds cut of 75 bps during the trading session. They suspected that the Federal Reserve was going to do so during the month of March alone, as the futures in the CME are saying so. That of course is ridiculous, because that would be somewhat unprecedented for the last couple of decades, and quite frankly the US economy isn’t that soft.

Having said that, keep in mind that most emerging markets have debts based in United States dollars, and therefore the Federal Reserve is essentially the central bank to all of them as well. As the US dollar strengthens, it makes their debts so much more difficult to service. As the money flow had been running to the US, that has made a lot of Third World countries buckle under the strain.

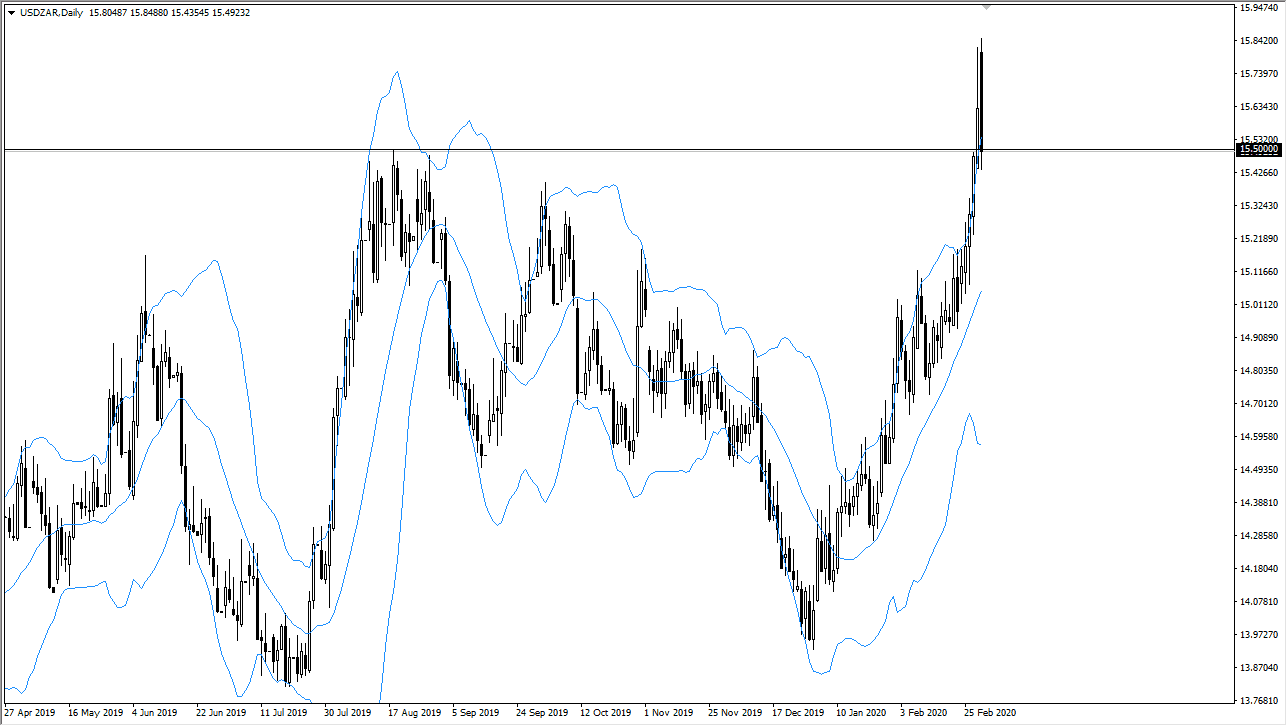

The South African Rand gaining against the US dollar will have been a bit of relief, but we are currently at the 15.50 Rand level. That is an area that was a previous high that we had broken through so the question now is whether or not we find support here. Technically speaking, it would make some sense, but I anticipate that we had gotten far ahead of ourselves, as we are well above the top of the Bollinger Band indicator, meaning that we are more than two standard deviations beyond the normalcy. At this point, the market could break down even further, and to get back to the 20 SMA we might be talking something a little closer to the 15.10 Rand level.

Ultimately, the market was to break above the highs, then it’s likely that we go looking towards the 16 Rand level, but I think it’s probably asking a lot for that to happen right now. We are simply getting a bit of a relief rally for the South African Rand before things turned back around. I don’t have any interest in shorting this market, rather I am looking for an opportunity to pick up a bit of value on a pullback that shows signs of support. Until then, there’s not much to do but I would certainly be interested in paying attention to that 20 SMA.