The Japanese yen is still the strongest safe haven followed by investors in light of the continuing global concerns about a bleak future for the global economy due to the spread of the deadly Coronavirus in more than 60 countries around the world. The developed economies were among the countries most affected by the epidemic. Worries pushed the USD/JPY to move towards the 106.78 support, its lowest level in five months before settling around the 107.40 level at the time of writing. The sudden move of the US Federal Reserve to cut interest rates by half a point before the official meeting scheduled in two weeks, did not benefit the US dollar much, and US stock investors returned to react negatively at first, but US stocks returned to rise during yesterday's session with the absorption of the bank's goals in what was approved.

The American decisions, whether by the US central bank and the US Congress, confirm that the crisis is escalating, and that the US economy is not far from being affected by the epidemic and its catastrophic economic consequences. We have the greatest evidence in China. In light of that atmosphere, the International Monetary Fund Director, Kristalina Georgieva, said on Wednesday that the global economic growth this year will be much lower than the level of 2019, where the Coronavirus, or COVID-19, has spread in many countries, harming economic activity. "Under any scenario, global growth will decrease in 2020 from the level of last year," Georgieva told a news conference, joined by World Bank President David Malpas.

The Coronavirus crisis started to ease in China, but disturbing cases arose in Italy, Iran, South Korea, and Japan. The United States has more than 120 cases in at least 15 states, with 11 deaths, all but one are in Washington. Despite that, the US economic figures are still showing the strength of the US economy yesterday. The ADP survey of numbers of US non-farm jobs came stronger than expectations, so did the ISM services PMI reading. Tomorrow, Friday, anticipation will be for the announcement of details of the US Labor Department report on the rate of change in US non-farm jobs, average hourly wages and the unemployment rate.

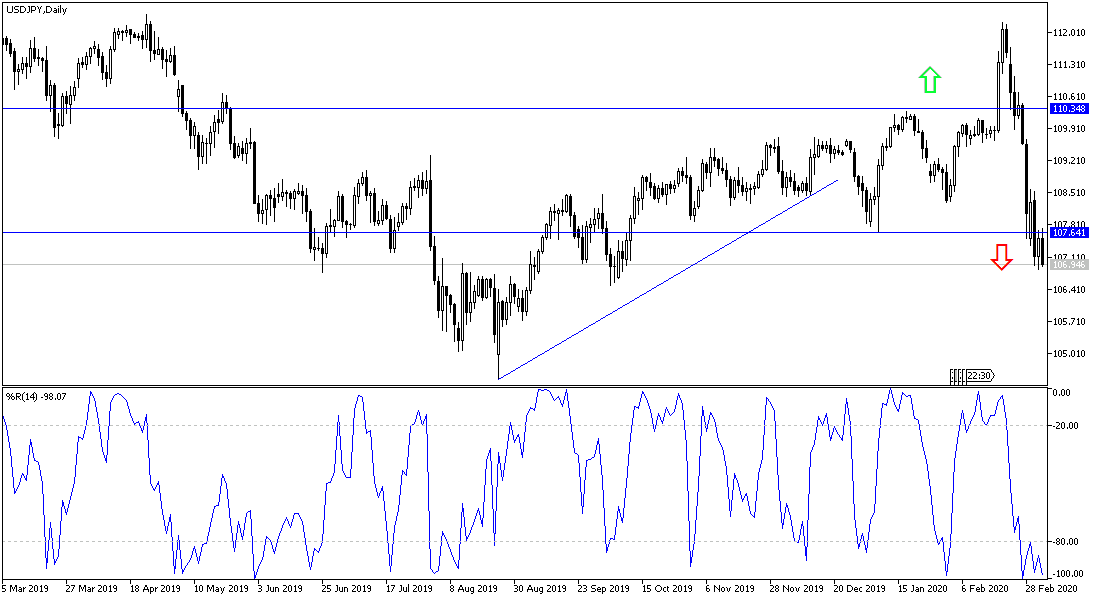

According to the technical analysis of the pair: On the daily chart, the USD/JPY path remains downward despite the technical indicators reaching strong oversold areas, but the pair still has further room for a downward correction in case global concerns about Coronavirus increase, along with its devastating effects on the global economy. Upcoming Bears targets are 106.90, 106.00 and 105.45 support levels respectively, the last of which is ideal for buying right now. And there will be no chance for the bulls to control the performance again without exceeding the 110.00 psychological resistance. Corona developments have a major impact on the pair.

As for the economic calendar data today: All focus will be on the US data, with the announcement of non-agricultural productivity, the cost of employment index, and claims for the unemployed.