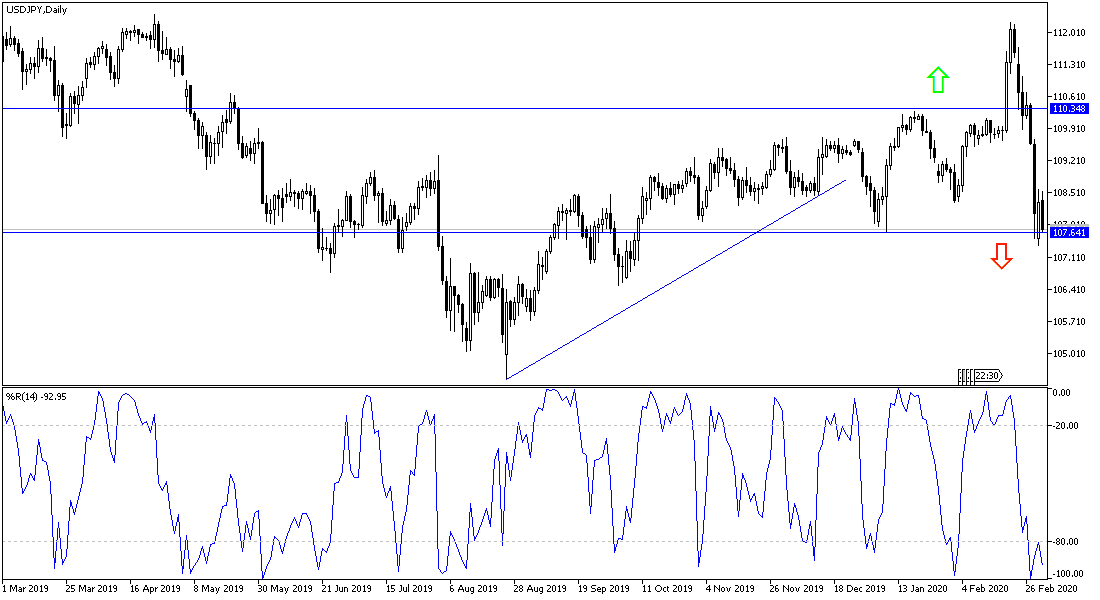

The death toll from the Coronavirus in the United States has risen to six and the disease has spread to more countries and capitals around the world, even as the number of new cases in China has fallen to its lowest level in six weeks. This frightening situation has increased investor appetite for safe havens, and of course the Japanese yen is ideal for this goal, and as a result, the price of the USD/JPY pair remained under downward pressure with the beginning of this week’s trading, and the pair tested the 107.36 support, the lowest level in more than four months, before trying to rebound above the 108.12 level of in the beginning of Tuesday’s trading. The US dollar lost the investor’s desire to buy it as a safe haven after the massive losses in the US stock markets and the threat of a possible of US rate cut soon.

The Covid 19 virus first appeared in New York, Moscow and Berlin, and cases of the disease rose around the world. In the United States, health officials have announced the death of four other people, bringing the total to six, all in Washington state, where researchers say the virus may have been circulating without being detected for weeks. The death toll in the world has risen to more than 3,000 people, and the number of infected people has reached 89,000, amid the rapid spread of the disease in South Korea, Italy and Iran, reaching 60 countries around the world.

The Fed and its global central bank counterparts have helped save stock markets over the past decade by lowering interest rates, stimulus programs, and promises of support. This was evident during the 2008 financial crisis and the European debt crisis in 2011. Intermittent fears about the looming recession, and the measures taken by central banks have helped to set a minimum share price. One of the results was the longest rising US market.

Now, with the Standard & Poor's 500 US stocks down 12.8% in less than a week - the steepest decline for the index since the financial crisis in 2008 - many investors are calling for the Fed to merge again with interest rate cuts and possibly other stimulus plans.

On the economic side. A report by the Institute of Supply Management showed that manufacturing activity in the United States witnessed a slight growth in February. ISM said its PMI fell to 50.1 in February from 50.9 in January, and a reading above the 50 level still indicates growth in the manufacturing sector. Economists had expected the index to drop to 50.5.

"Global supply chains affect most, if not all, of the manufacturing sector," said Timothy Fury, head of the ISM Industrial Survey Committee. And “In general, sentiment this month is marginally positive regarding growth in the near term.”

The modest drop for the main index came as the new orders index fell to 49.8 in February from 52.0 in January, indicating a slight decrease in new orders. The production index also fell to 50.3 in February from 54.3 in January, while the employment index rose to 46.9 from 46.6 but it still indicates a decline in manufacturing jobs.

According to the technical analysis of the pair: Bears will continue to dominate the performance of the USD/JPY pair with stability below the 108.00 support. Continued fears of the consequences of the fatal Corona pandemic will remain a strong support for investors to go to safe havens, the most important of which is the Japanese yen. Accordingly, the pair is expected to decline further, with the closest support levels currently are 107.55, 106.80 and 106.00, respectively. There will be no chance for a correction higher without moving above the 110.00 psychological resistance and as the epidemic continues, investors are still waiting for a bounce back to return to sell the pair again. The crisis is taking more time, which has forced global central banks to announce the start of stimulus.