Global financial markets have always waited for the reaction of the US central bank to the recent and successive collapse of US stock markets, and consequently global stocks, and a growing gloomy outlook for the future of global economic growth due to the outbreak of the COVID-19 epidemic that reached US soil and increased injuries and deaths in more than 60 countries with the epidemic beginning to cross the Chinese borders, the source of the epidemic. Jerome Powell's US monetary policy makers expressed their fear and willingness to intervene if things get worse, the US dollar is strongly affected and the price of the USD/JPY pair fell to the 107.50 support, the lowest in four months, before closing last week's trading around the 108.06 level. The pair’s performance last week was its worst weekly performance since December 2018.

Federal Reserve Chairman Jerome Powell sought to allay fears last Friday about the virus by issuing a rare statement of reassurance that the Fed would "use its tools" to support the economy - a strong sign of a future rate cut.

The US stock market fell 13% last week due to strong concerns that the Coronavirus will become a global pandemic and could push the United States and global economies into recession. Large and small companies are already reporting lower revenue and profits as companies and consumers cancel holidays and business trips.

Many economists warn, however, that price cuts and other economic tools from the Federal Reserve may not do much to mitigate the economic damage caused by the virus. "The fundamentals of the US economy remain strong," Powell said in a statement. However, the Coronavirus poses a growing risk of economic activity. The Fed is closely monitoring developments and their effects on the economic outlook. We will use our tools and act as necessary to support the economy.”

For economic news. The US Department of Commerce released a report showing that personal income in the United States increased more than expected in January, and the report also showed a smaller-than-expected increase in personal spending. Personal income rose 0.6 percent in January after revising 0.1 percent in December. Economists had expected personal income to rise by 0.3 percent, compared to an increase of 0.2 percent originally from the previous month.

Available personal income, which is personal income after deduction of current personal taxes, increased by 0.6 percent in January, after rising 0.1 percent in December. The report said that real disposable income, adjusted to remove price changes, rose 0.5 percent in January after falling 0.1 percent in December. Meanwhile, the Commerce Department said personal spending rose 0.2 percent in January after rising 0.4 percent in December. Personal spending was expected to increase by 0.3 per cent, in proportion to the increase originally reported in the previous month.

This week, focus will be on the details of the figures from the US Labor Department report on the numbers of new US jobs in the non-agricultural sector, average wages, and the unemployment rate. It is an important report because it comes at a time when the deadly Corona virus began to appear.

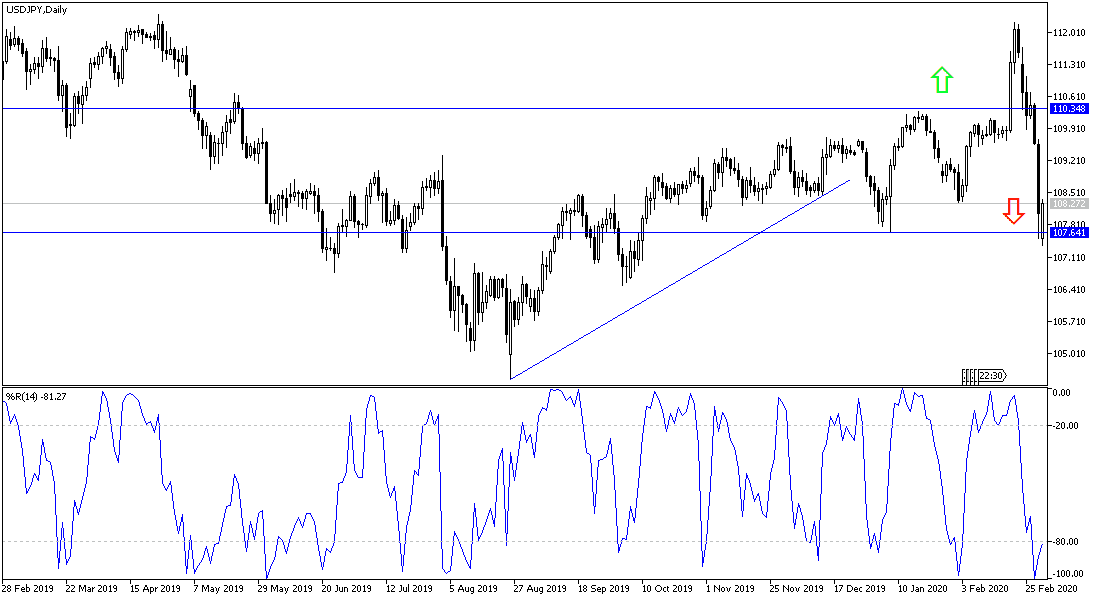

According to the technical analysis of the pair: On the daily and weekly chart, the general trend of the USD/JPY pair has been confirmed to be downward, while breaking the 110.00 psychological resistance and the price of the pair is still subject to more downward pressure if global concerns persist over the spread of the Corona pandemic and the increase of global human and economic losses from it. Stability below the 108.00 psychological support remains supportive of bear’s control. The pair correction can be used with purchases from the 107.20 and 106.35 support levels, respectively.

As for the economic calendar data: the focus will be on the US economic data, the ISM manufacturing PMI and the construction spending index.