The recent decisions of the US Federal Reserve Bank to reduce the interest rate to the threshold of 0% with more quantitative easing plans along with the strict efforts of the US government to stop the bleeding of record losses for the US stock markets, failed as the Dow Jones Industrial Average fell by nearly 3000 points. , Or 13%, its biggest one-day drop in decades. In the beginning of this week’s trading, the USD/JPY tried to bounce back up, but its gains did not exceed the 107.56 level before returning down around the 105.13 support and settling around the 106.00 level in the beginning of today’s trading. The liquidity crisis in the financial markets continues to support more volatility in the Forex market, as well as in the rest of the global financial markets.

The US central bank was forced to make these surprising decisions. The number of cases in the United States has risen to about 3,800, with the Corona epidemic claiming at least 70 deaths, and nearly two-thirds of cases are in the severely affected Washington state.

There are about 82 million people, or three-fifths of the workforce in the United States, working by the hour. Many of them will not receive a salary if they do not work. These include those working in restaurants, hotels, parks, and casino workers, and only a third of them will get paid sick leave. Accordingly, Kevin Hassett, former economic advisor to President Donald Trump, told CNN that "the chances of a global economic recession are close to 100% at present" and the US is expected to lose about one million jobs in April.

In a letter to US President Donald Trump and congressional leaders, the American Chamber of Commerce called for speedy legislation, including the abolition of some taxes for three months and the expansion of corporate loans, to "mitigate the potentially devastating economic impacts."

The US economy appears to be slowing at a much faster rate than the 2008 financial crisis. If economists ’expectations for job losses are accurate, it will be just two months after the government announced a strong increase of 273,000 jobs last month. According to a health expert from the United States, the number of Coronavirus cases in the United States may reach a level similar to that recorded by the Italy two weeks ago - a sign that it is expected that cases will rise in the U.S. Italy has reported 25,000 cases and more than 1,800 deaths.

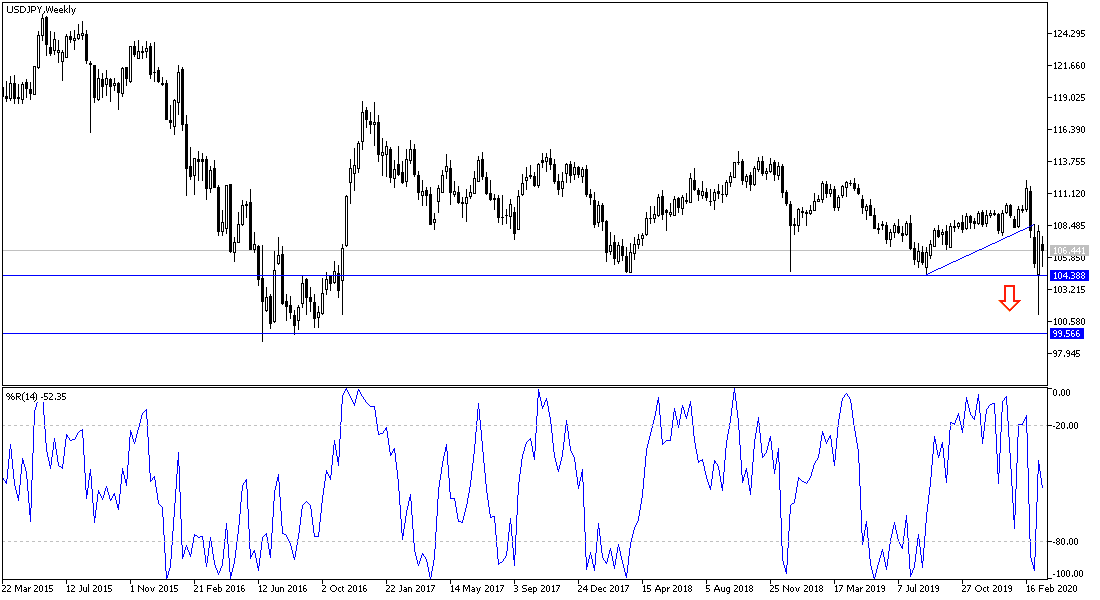

According to technical analysis of the pair: Investors may eventually have to strongly seek buying of Japanese yen as a safe haven, especially if the American economic and human losses from the Corona epidemic, increased. That could push the USD/JPY to decline strongly again towards the support levels 105.30, 104.25 and 103.00, respectively. Despite attempts of an upward correction, the pair's overall trend remains downward.

As for the economic calendar data today: The focus will be on announcing the announcement of US retail sales figures and the US industrial production rate data during the U.S session.