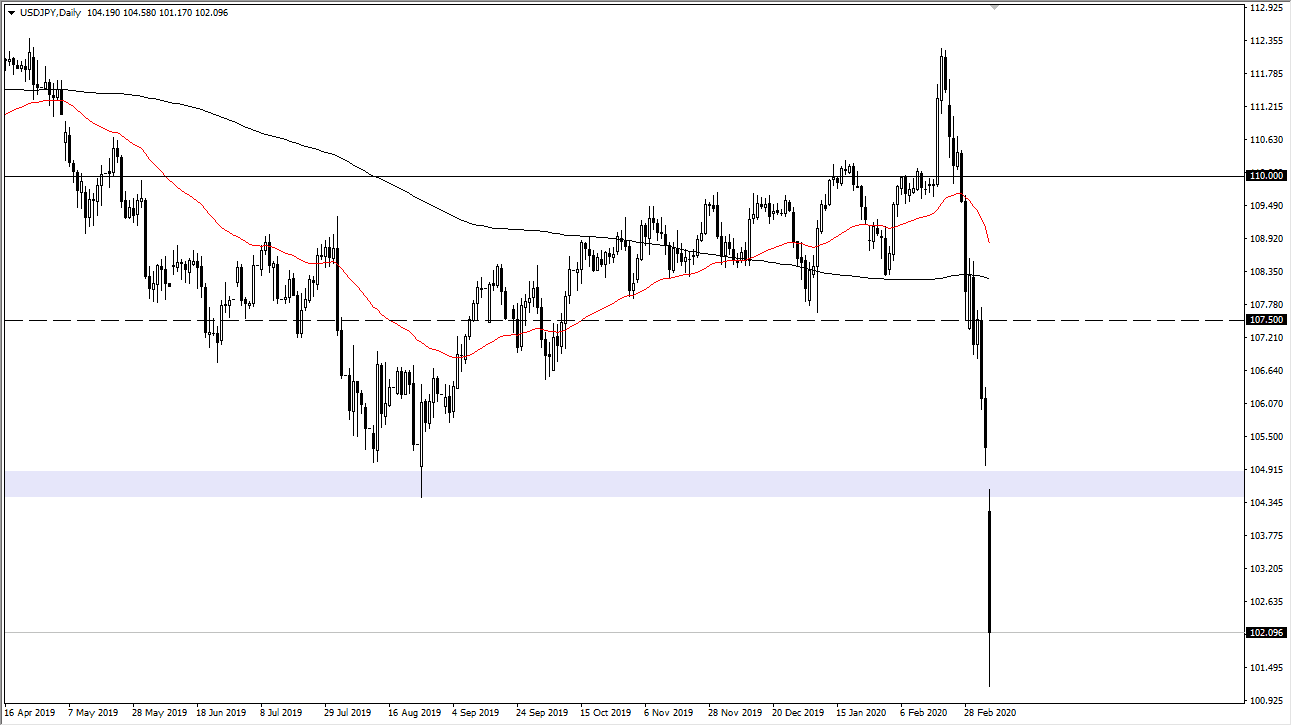

The US dollar has gapped lower at the open on Monday, and then breaking down rather significantly after that showed just how weak the US dollar had become. The Japanese yen is of course a major “safety currency”, so as a result it’s unsurprising that the market then started picking up the Japanese yen as quickly as it could. That is seen across almost all currencies, but the US dollar was harder hit than many others, do perhaps to the fact that the Federal Funds Rate futures are price and then another 50 basis points of cuts almost immediately.

At this point, the market breaking below the ¥105 level the way it has, by gapping below it and completely ignoring it, shows just how soft this market truly is. This is a market that is basing the idea of the Federal Reserve being one of the few central banks around the world that can cut interest rates, much more than the other majors and therefore the US dollar is taking it on the chin. Eventually, the Federal Reserve will cut those rates and then things will start to get put on a somewhat equal footing. If and when that happens, then the US dollar may see strength again. Until then though, it’s very likely that we will continue to see the greenback take a bit of a beating.

If the market was to break down below the ¥100 level, then it’s very likely that the market would start to worry about the Bank of Japan intervening, something that they are known to do on occasion. The size of the candlestick is awfully long as well, so that does suggest that the market should continue to see sellers. Rallies at this point should be selling opportunities, with the ¥105 level above being resistance. Any signs of exhaustion in that area would be a very good signal to start selling, but at this point I don’t see much in the way of a buying opportunity, unless of course the market was to form some type of a hammer or bullish candlestick on a weekly timeframe. With this, it’s a simple “fading the rallies” type of scenario that we are looking at in this market, and perhaps even many of the other yen related pairs as the Japanese yen suddenly is the one currency everybody seems to want to hang onto.