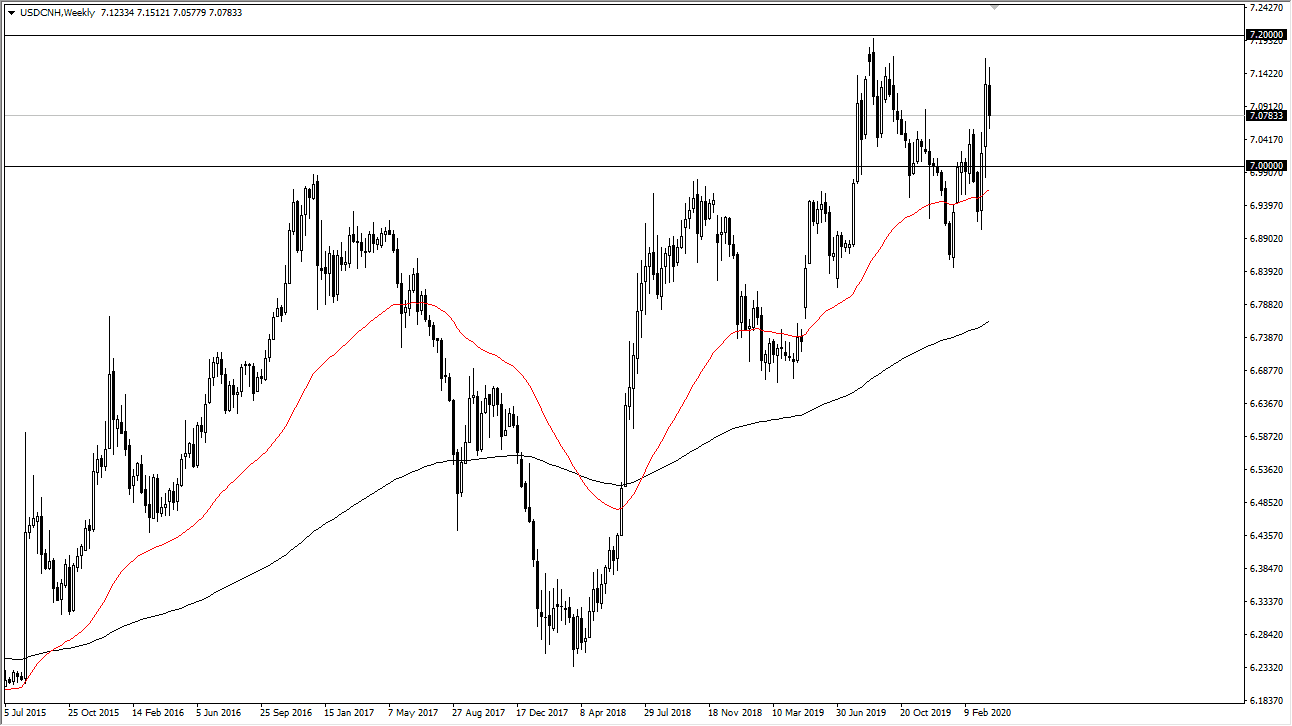

The US dollar has rallied a bit during the month of March against the Chinese Yuan, and while many of you will trade this pair, this is perhaps one of the most important currency pairs that you can pay attention to. This is because China is the very essence of risk appetite when it comes to Forex traders, with the currency losing value when people are concerned. What’s particularly telling about this chart is the fact that the Yuan has continued to sell off, despite the fact that stock markets around the world have had a nice bounce. With that in mind, the question then becomes: “What does this tell us?”

What this tells me is that it’s very important to watch the recent highs near the 7.20 CNH level. This is an area that if broken during the month of April, it’s very likely that it will kick off a lot of panic in risk appetite. If that’s going to be the case, then if you do not trade this currency pair, you can use it as a proxy to tell you what to do about such things as stock markets, indices, and the like. This would work against a lot of commodities, as it would show concerns about growth in general.

If we pull back from here, that would be a good sign for stock markets again, as we can see the 7.00 level tested again. Ultimately, I think that the market is likely to see the 50 day EMA in that area offer a significant amount of support as well, so a breakdown below that would in fact signal that the market is ready to explode in an upward trajectory. At this point, we are in the process of trying to make a “lower high”, but it’s not until we break down through the most recent swing low that you can confirm that the market is rolling over for something bigger. If it does, if you can’t short this pair you should be looking at indices. All things being equal, this is an excellent tertiary indicator risk appetite in general, and that’s typically what I use it for, not so much the actual trade prospect. The US dollar is the most important currency to watch, and therefore measuring it against a country like China tells you a lot. China currently awaits the rest of the world to get back to work so they can start buying things, and as a result it’s a bit of a waiting game. Let this currency pair guide where you go next.