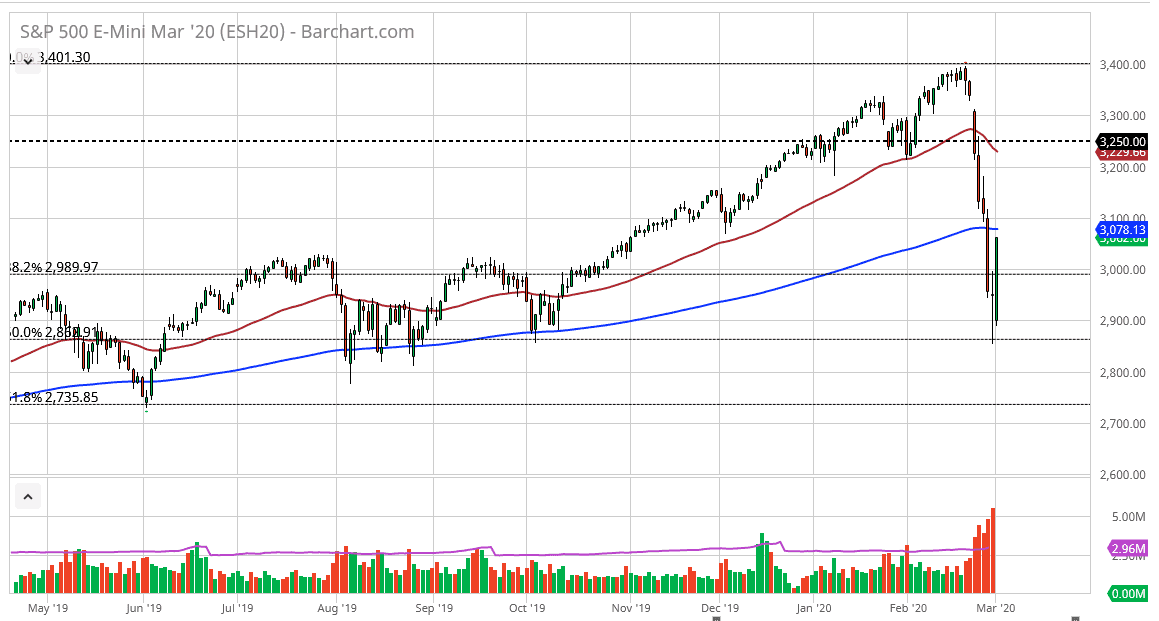

The S&P 500 has rallied significantly during the trading session on Monday, breaking above the 200 day EMA late in the session. Quite frankly, this is a market that is going to continue to be very noisy to say the least, but I think what we are looking at here is a bit of a short covering rally as the G7 economies are going to have a conference call on Tuesday. I think at this point people are starting to worry about what central bank actions will be, but quite frankly if you think about it this shows exactly what I’ve been saying for years: stock markets care only about liquidity, and not the economy. We had a bit of an overreaction recently, and now we are seeing that market turn things back around. At this point, the market is likely to rolled right back over given enough time, especially if we get close to the 50 day EMA.

That being said though, it’s difficult to get excited about one position or another due to the fact that the G7 conference call can produce almost anything at this point. There are indications that traders are banking on the Federal Reserve cutting interest rates this month, and I think they may very well do so. However, it should be noted that at the Chicago Mercantile Exchange, fed funds futures are suggesting that there are going to be 75 basis point cut at the next meeting. That’s ridiculous and isn’t going to happen. Because of this, the market is overreacting as it tends to do but you should also be aware the fact that the S&P 500 E-mini contract is highly levered by algorithmic trading.

In other words, it’s likely that the buying has beget more buying, and that is probably about all that’s been going on later in the session. Whether or not we can continue to the upside is an entirely different question and it probably won’t actually be settled until after the Tuesday session. That being said, I do think that the 50 day EMA is probably going to offer resistance, unless of course we rollover right away. The 3000 level being recaptured is a very good sign though, so that should now offer support. All things being equal, this is a market that should probably be avoided quite frankly. Yes, it got oversold but at the same time there are plenty of reasons to think that it should rollover.