The S&P 500 covered quite a bit of ground during the trading session on Tuesday, reaching towards the 2865 level in the E-mini futures markets. The 2900 level above still offers resistance, just as the gap above there will. It looks as if we may try to fill that gap, but it probably will offer quite a bit of resistance. Keep in mind that the S&P 500 is currently waiting to see what the federal government is going to do as far as fiscal stimulus, so that of course has a major influence on what happens next.

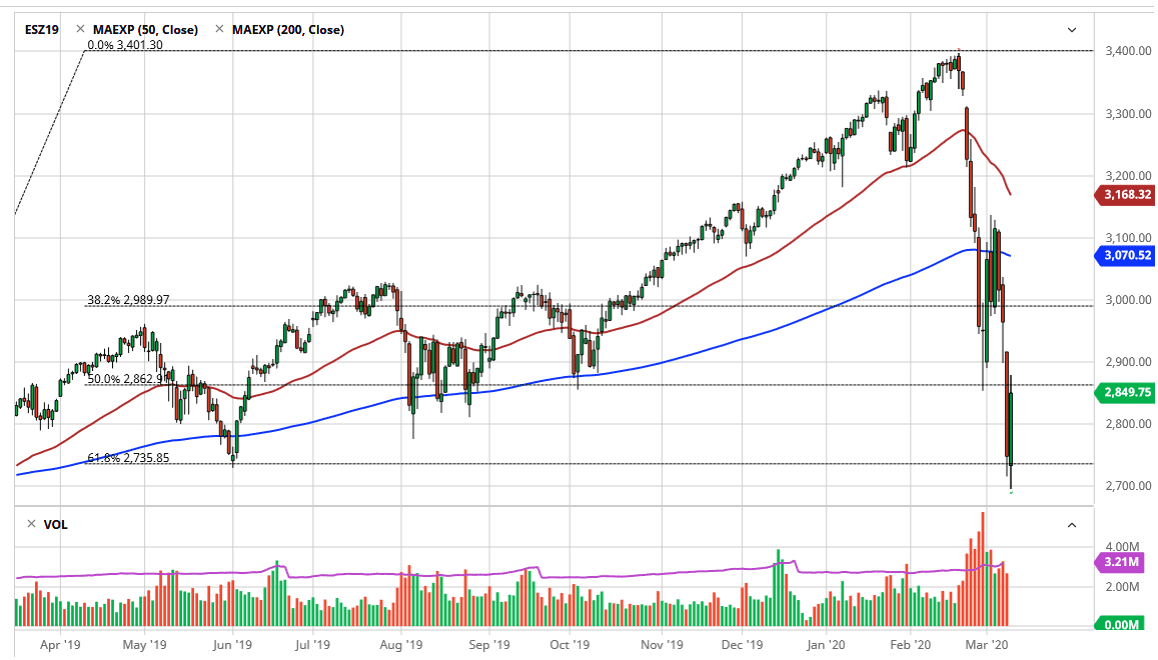

I anticipate that there should be sellers above, it should be noted that just above the gap is the 3000 level, an area that will attract a lot of attention. The 200 day EMA is at 3070 and starting to slope lower, looking towards the 3000 level over the longer term. Overall, signs of exhaustion should be sold into, as there are plenty of reasons to worry about the markets on the whole. However, if the government does enough to assuage traders and the Federal Reserve steps in with massive amounts of liquidity, it is possible that the market could turn around. I am not comfortable buying the S&P 500 E-mini contract until we clear the 200 day EMA though to be honest.

The candlestick for the day was rather impressive, but at this point the market is likely to see a lot of volatility and volatility generally leads to a soft marketplace. The market continues to struggle, and I think that we have further to go to the downside. Keep in mind that the market does get the occasional massive bear market rally, and I think we are starting to see that come home. The gap above will be interesting, and massive resistance. I suspect that if the US government makes another misstep, it’s likely that this market will turn right back around. The coronavirus will have a longer-term effect on growth, and at this point the markets are still trying to price in an uncertain future that will certainly bring slower growth. Even if the virus itself becomes somewhat contained, public gatherings decreasing will of course have a lot of an effect on GDP, so markets are trying to figure out what that’s going to be, but one thing is for sure: it’s been far too overvalued and likely to be lower than we are now.