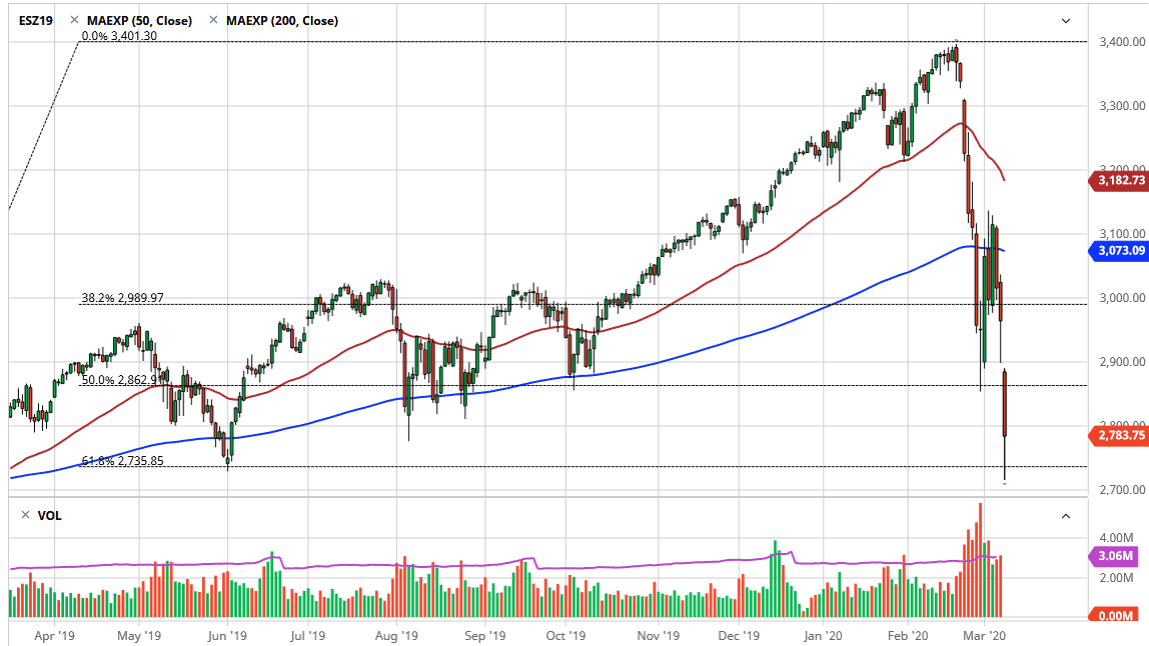

The S&P 500 gapped significantly lower to kick off the week on Monday, slicing all the way down towards the 2700 level. It will be interesting to see how this plays out longer term though, because one would have to think that it is only a matter of time before either the government or central banks get involved to calm the situation. Quite frankly, it’s not very often that the circuit breakers get kicked on after a major move in the futures market, but that’s precisely what happened on Monday. After losing 7%, the S&P 500 did bounce slightly but in the end, it still looks rather soft. It should be noted that the NASDAQ 100 was bouncing back a little bit more than the S&P 500, so it will be interesting to see how this plays out.

I do think that the 2900 level above is the beginning of a serious a gap, and that Could be tested given enough time. Rallies at this point offer opportunities to short this market on signs of exhaustion, barring some type of massive liquidity input by either the Federal Reserve or perhaps stimulus by the US government. One or both of those things almost certainly will be coming, because it is becoming rapidly clear that credit markets in the underlying companies of the S&P 500 could in fact cause major issues.

If we break down below the 2700 level, it’s likely that the S&P 500 will come down to the 2600 level, perhaps even the 2500 level. At this point in time, the market is a bit oversold, so a bounce would make quite a bit of sense but it’s likely that will only offer an opportunity to get short again unless we get that impulsive push by either the government or the central bank. When that happens, it will be an extraordinarily large move, and will begin a “melt your face off rally” that happens in these situations. However, without some type of serious interaction by large players such as central banks or governments, any rally will have a limited shelf life in this market. Pay attention to newswires, and look for the words “liquidity”, and perhaps even “asset purchases.” Those will be the key phrases that a lot of funds will be looking to either get involved in the market or perhaps simply to short cover.