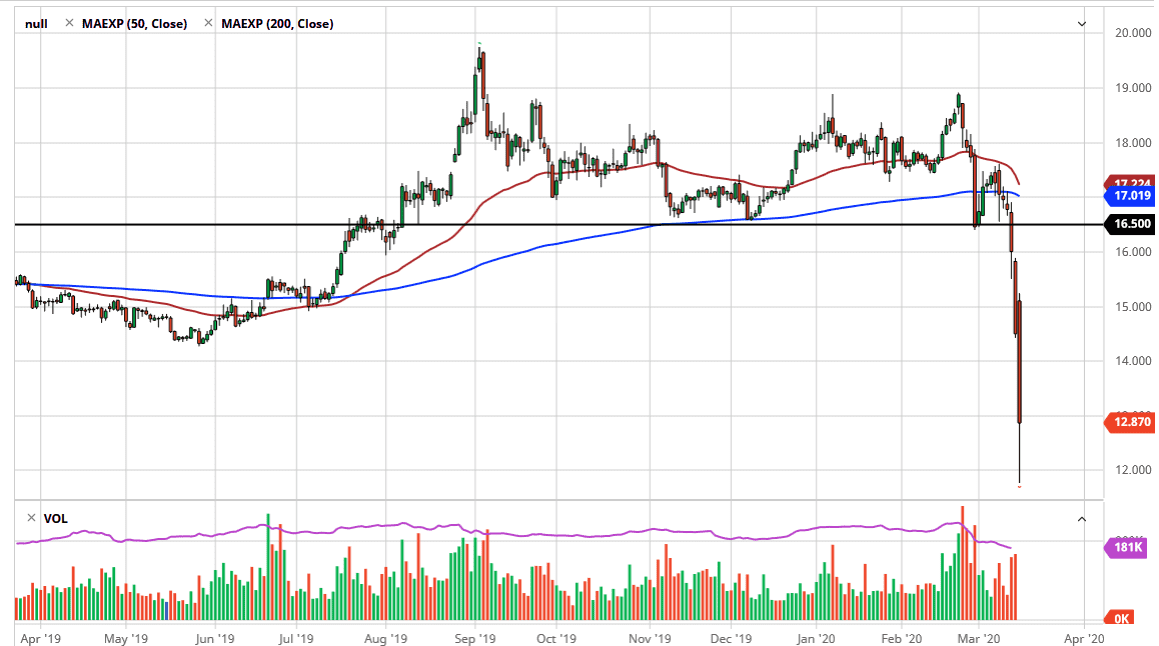

Silver markets got absolutely hammered during the trading session on Monday, losing 15% at one point. In fact, the market drop down below the $12.00 level, an area that I have been talking about a longer-term charts as a potential target for the sellers. They’ve hit it, and quite frankly may have hit it just a little too quick. With that being the case it’s very likely that we are due for a significant bounce. In fact, towards the end of the session we have seen Silver reach towards the $13.00 level, in and of itself a sizable move.

That being said, you need to be very cautious about how levered you are when it comes to silver. It does tend to be very volatile to say the least, and as a result you had to be cautious about going “all in” when it comes to the futures markets or the likes. The silver markets will continue to be very volatile, just as everything else is, mainly based upon the idea that the silver markets are driven by industrial demand is as much as precious metals demand.

The top of the candlestick for the trading session on Monday is $15.00 roughly, and I think that’s eventually where this market tries to bounce towards. However, this is more of an investment than a trade, or at the very least you have to be able to have the ability to trade in very small position sizes. With silver acting the way it has, you will need to be especially cautious with it, but if you are a longer-term trader or an investor, this could be a nice area to start adding silver to your portfolio. I bought physical silver myself today, as eventually we will see this market continue to grind higher. That being said, keep in mind that silver will probably lag gold as it has much more in the way of industrial demand than gold does, so at this point it’s very unlikely that the silver market can rally without goal doing the same, but luckily it has bounced over there as well. The oversold condition might finally start to attract a certain amount of attention as forced selling in the precious metals markets to cover losses elsewhere seems to be abating a bit. If that’s going to be the case, then we should have a nice rally in the short term.