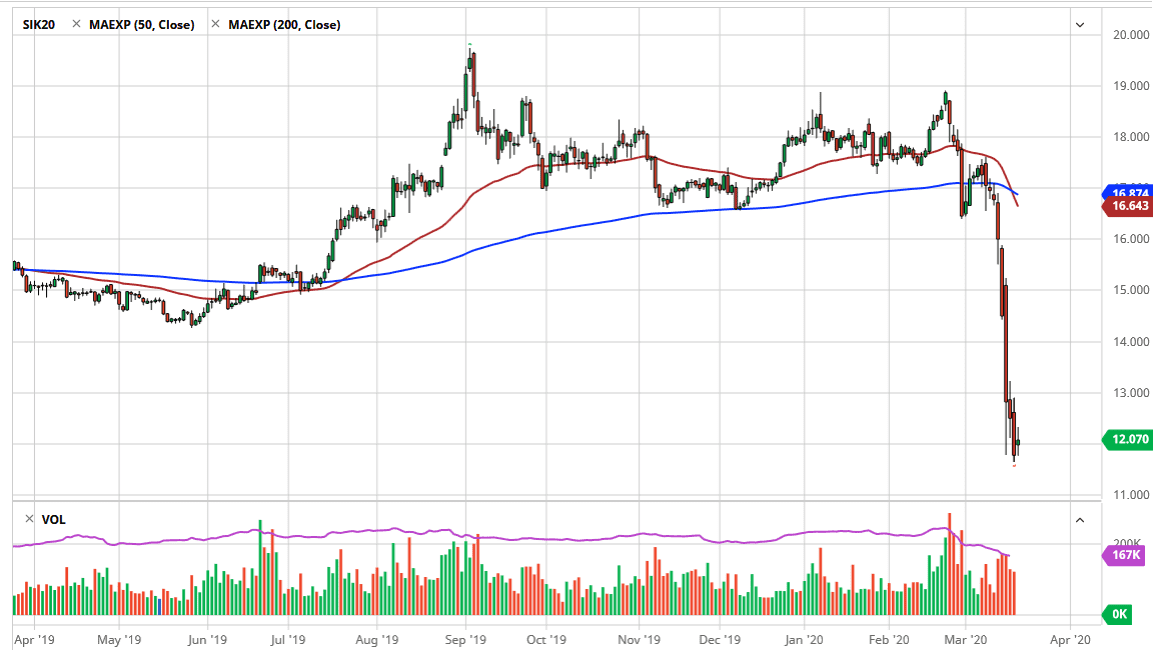

Silver markets gapped to the upside during the trading session on Thursday but then pushed back and forth in rather volatile trading. At this point, the market is likely to try to stabilize right around the $12 handle, and as a result it will be a very interesting situation. I do believe that there is a lot of value in the silver markets, because quite frankly most of the selling has been due to forced liquidation of bullish and profitable positions to take care of stock positions that have taken such a meeting. I think at this point, the silver market will probably bounce right along with the stock markets as the pressure abates, and as a result I think that it’s probably important to watch both market simultaneously.

Looking at this chart, I do believe that the $12 level should hold as support, but I don’t necessarily think that it will be an easy trade to take. If we do break down below the most recent low of the last couple of days, then it’s possible that we could drop all the way down to the $10 level. That level is even more support of over the longer term, so at this point I think it’s only a matter of time before we do get a bullish run. On a break above the $13 level, it’s very likely that the market should then go looking towards the $15 level above which of course has a certain amount of psychological importance built into it, not the least of which is the fact that it had been such an important support in the past.

The recent selloff has been rather drastic, which is part of the reason why it’s so obvious that there has been a certain amount of force selling. Furthermore, even if there was an important fundamental reason for silver to fall on the longer-term time frames, we are overdone. The market of course will more than likely be very volatile in general, but I do believe in the longer-term efficacy of silver, as central banks around the world continue to cut rates and do plenty of things that could bring in inflation over the longer term. The central banks around the world will more than likely lead economies run rather for some extended amount of time, allow economies to run much hotter than anticipated, thereby driving the price of metal much higher.