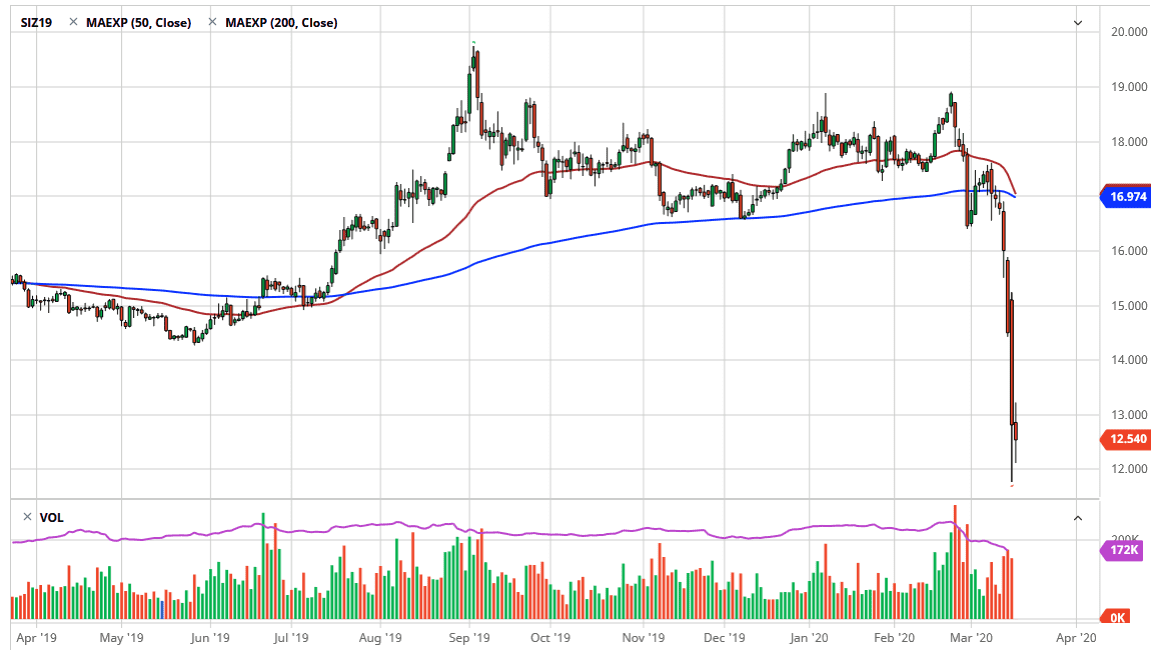

Silver markets went back and forth during the trading session on Tuesday, bouncing around just above the $12 level after massive selloffs have hit this market. If you are bullish of silver, this is exactly what you want to see as the market has been far too volatile. You need the market to come down in order for buyers to feel comfortable enough to jump in and pick up silver “on the cheap.”

The $12 level has been important on longer-term charts as well, so it makes sense that you would see a little bit of support there. The longer that we can spend in this general vicinity, it’s very likely that silver will turn things around and rally quite a bit. Overall, the markets are oversold so a little bit of calm is exactly what traders will wish to see. I believe that silver will rally given enough time, as it is a precious metal and of course has lost far too much into short of a time.

Looking at the candlestick for the trading session, it’s obvious that the market has gone back, and forth which is exactly what you would expect, considering that the market has shown such massive amount of volatility. After all, traders are exhausted, and it makes sense that we should continue to see a calming of markets in this type of situation. If we do break down below the $12.00 level though, then we could go as low as the $10.00 level underneath. However, if the market can clear the $13.00 level on the daily candlestick, then it’s likely to go looking towards the $15.00 level which has been important more than once. Longer-term, I believe that silver has a bright future and this will be especially true once the coronavirus starts to abate, as it has a huge industrial component to it, and it’s very likely that the market will rally based upon that alone once the global trade situation starts picking up again. One would have to assume that there is a lot of pent-up demand just waiting to be had at that point, and likely it’s going to be a situation where we could get an explosive move to the upside regardless. I have no interest in shorting silver, if we get a break down below the lows of the last couple of days, I will simply look to buy it at cheaper levels.