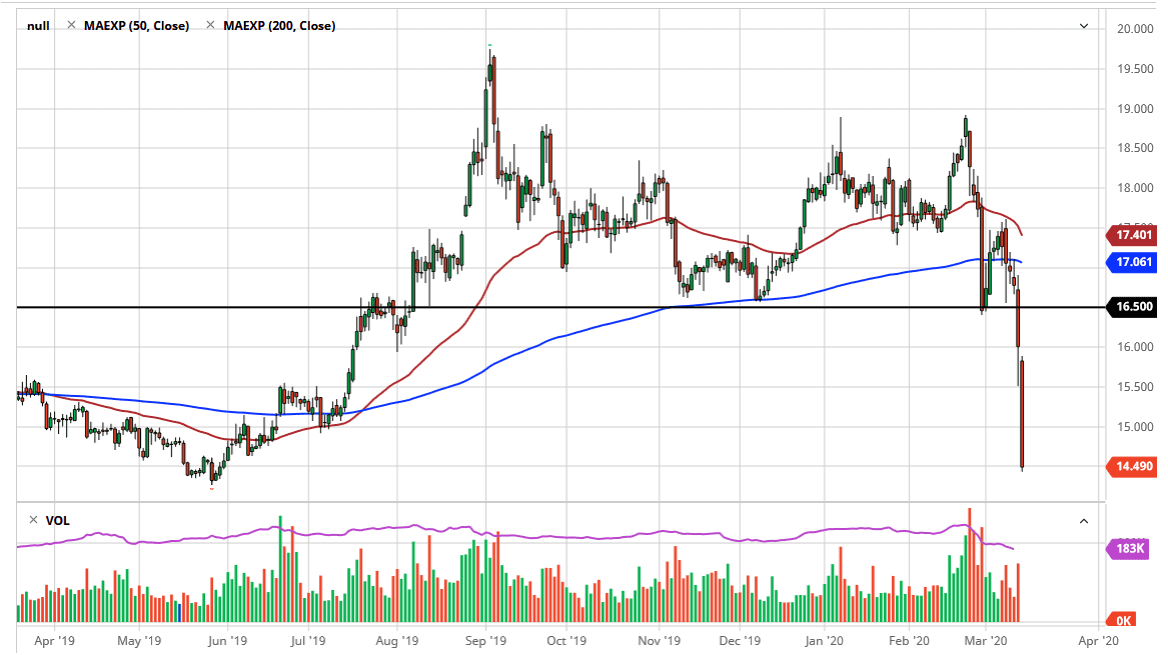

The silver markets collapsed significantly during the day on Friday, losing 10%. That being the case, the market looks very likely to see a massive snapback, but at the end of the day silver is going to be a lot different than gold in the sense that it also has an industrial component built into it. If that’s going to be the case, then silver will continue to lag behind the gold market. As precious metals got hammered during the trading session, it’s likely that the silver market will be one of the biggest losers.

As the market has broken towards the $14.50 level, we slice through the $15 level like it wasn’t even there. At this point, the market is closing towards the bottom of the range and that of course is a very negative sign. The fact that we are closing towards the bottom of the range suggests that there is further pain coming, but any rally at this point will be looked at with extreme skepticism. Remember, a lot of traders out there are being forced to liquidate gold and silver against due to the fact that they are losing in other trades and need to cash in profits in order to cover the margin.

At this point, silver looks extraordinarily negative, but I think some type of bounce is probably coming just due to the fact that it is so oversold. Look at that bounce as a potential selling opportunity, because quite frankly this type of momentum doesn’t stop at the drop of a hat. Furthermore, even if precious metals do rally, silver will do a lot less than gold because it’s impossible to turn around industrial demand like that. If precious metal suddenly get a bit of a “safety bid”, gold would be the place to go. If precious metals continue to break down significantly, then silver is to be sold. After the last couple of days though, obviously some exhaustion will enter the marketplace, and at the very least the market needs to calm down for a few days, if not get that relief rally that you often see. It will be a “dead cat bounce” though, so keep that in mind as silver is probably going to struggle for quite some time due to the industrial situation that we will certainly be facing over the next couple of months. That being said though, physical silver is still something I like, and silver markets will probably take off in a few months when industry fires back up.