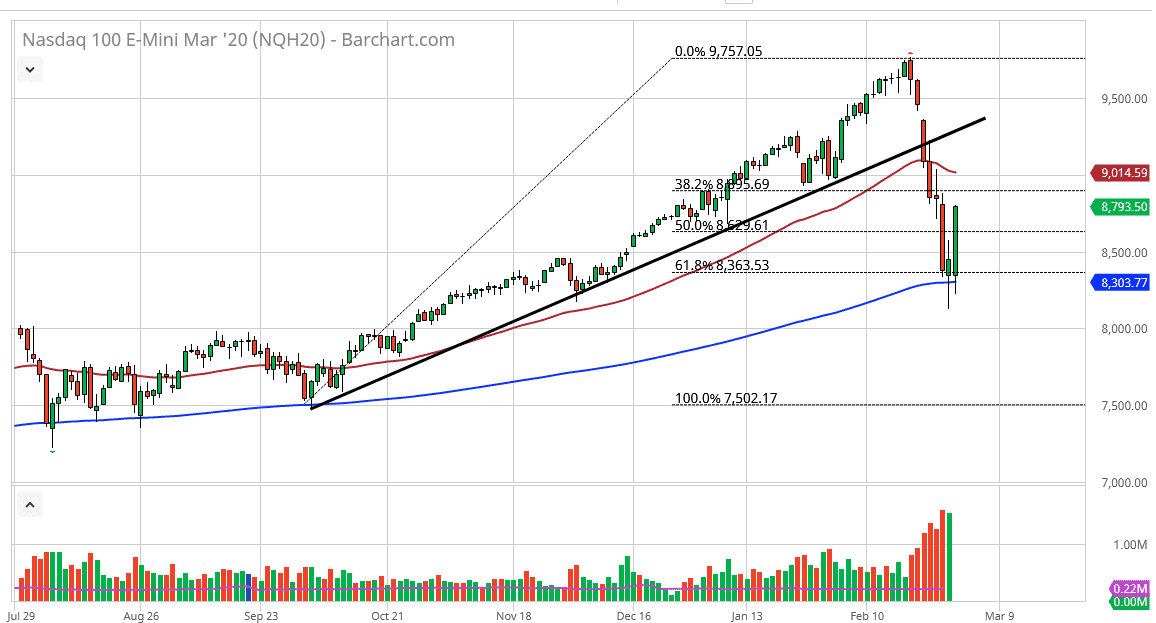

The NASDAQ 100 has exploded to the upside during trading on Monday after initially dropping below the 200 day EMA and the E-mini contract. By doing so, it has shown that traders out there are in fact trying to find a reason to go long. The most recent one was the idea of a 75 basis point interest rate cut coming during the month of March, which may be a bit much as far as I can see. I think at this point is very likely that those who are hanging their hands on that type of move are probably going to be very disappointed. Don’t get me wrong, I do think that the Federal Reserve will do its job and work for Wall Street again, but I don’t think that they will be able to cut 75 basis points in such a short amount of time.

The candlestick is very bullish and obviously very strong, but the 50 day EMA above could cause some issues. Furthermore, I think the uptrend line does. In the end, one of the things that people will be paying attention to will be the conference call for the G7 economies during the trading session on Tuesday, and what central banks around the world might be doing. Having said that, the market is likely overbought, so it’s only a matter of time before we rolled right back over. Quite frankly, after the move that we have seen during the previous week, it makes quite a bit of sense that we would see signs of exhaustion in this area just above. Most of the upward momentum will have probably been due to short covering, and the fact that traders love liquidity. In fact, that’s the only thing that has mattered for the longest time.

If we recapture the 50 day EMA and clear the uptrend line, then we will just simply shoot straight up in the air as we have been doing for weeks, but this type of volatility isn’t over and it’s likely that the market will continue to be very noisy so you will have to be cautious about the position size that she use, because the next couple of days are going to feature of lot of economic noise. One of the precursors to the G7 conference call is going to be the Reserve Bank of Australia and its interest rate decision early during the day.