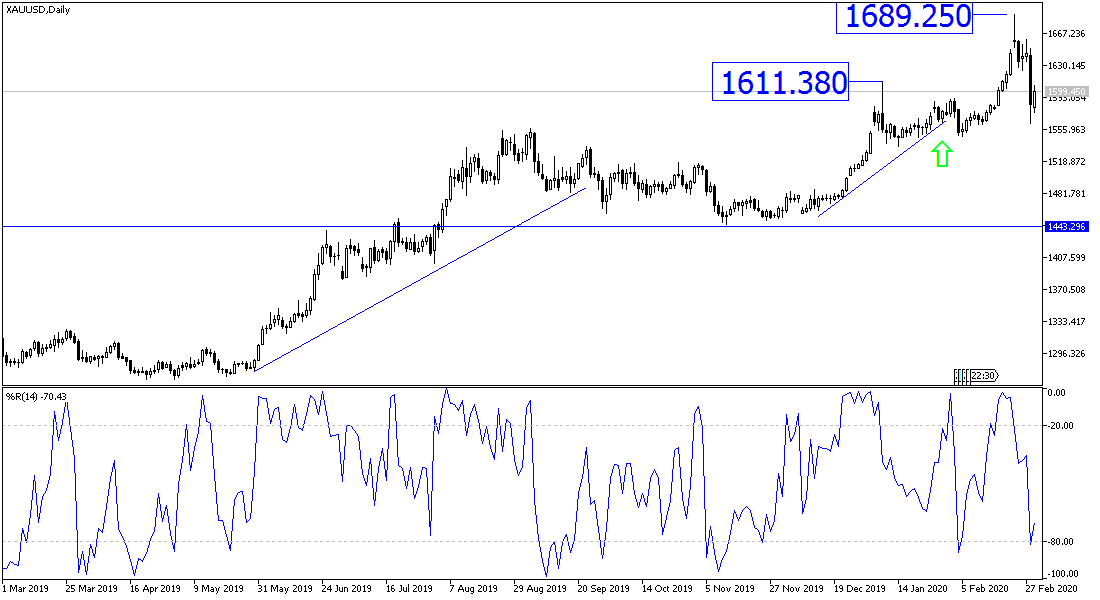

Gold prices plunged by $90 during last Friday's trading session, a collapse from the $1660 resistance, its highest in seven years, to the %1563 support, before closing around the $1585 level. The collapse came amid strong profit-taking selling operations after the record gains in gold prices to the level of $1689 resistance at the beginning of last week’s trading. The price collapse came with the support of a general trend for global central banks, including the Federal Reserve, to intervene to stimulate the global economy facing the specter of recession due to the outbreak of the deadly Coronavirus in more than 60 countries around the world, and with more than 86,000 cases and the death of more than 2,900 people. The epidemic, as it crossed China's borders, did not differentiate between developed and developing economies.

Some economists see. Lower interest rates can help the economy by calming the financial markets as well as supporting lending. But many heavily indebted companies may face higher borrowing costs if the economy slows down.

The decline in gold prices came in conjunction with the decline in global stock markets below exception. The strong retreat came as investors prepared for more economic pain from the outbreak of the Coronavirus, which pushed American markets to the worst weekly close since the financial crisis in 2008. The damage from a week of continued selling pushed the Dow Jones Industrial Average down 3583 points, or 12.4%. Microsoft and Apple, the two most valuable companies in the S&P500 index, lost $300 billion. In a sign of heightened concern about a possible economic strike, hence, price dropped by 16%.

US stock market losses were temporarily halted after the Federal Reserve issued a statement saying it was ready to help the economy if necessary. Investors increasingly expect the Federal Reserve to cut interest rates at the next policy meeting in mid-March.

The recent losses have erased the S&P500 gains dating back to October. Overall, the main index remains 6.1% higher over the past twelve months, and does not include dividends. Its weekly loss of 11.5% was the largest since its decline by 18.2% in the week ending by October 10, 2008.

According to the technical analysis of the gold price: On the daily chart, there is a clear break of the general trend of bullish gold prices, and at the same time the trend will not turned downward as long as it remains stable above the $1500 psychological resistance. In the long run, the gold trend remains bullish. Especially since it is currently closest to returning to the next psychological resistance at $1,600. Coronavirus has not stopped, and even a vaccine to combat the disease has not been announced. Thus, gold investors may take advantage of the recent decline by returning to buy gold. Support levels at 1565, 1545, and 1520 may be the most appropriate time to buy.

The gold price will react to the release of the Manufacturing PMI from China, the Eurozone, Britain and the United States of America.