Despite the gains in the global stock markets after the recent measures by the global central banks to ease monetary policies, the price of gold maintained its recent gains near its highest level in seven years. Gold prices tested the $1652 resistance before settling around $1635 level at the time of writing. Gold reacts positively to the continuing global human and economic losses from the deadly Corona epidemic. Americans have become more concerned about the potential of COVID-19 infection in their communities, which has prompted many drug companies to compete for a vaccine that eliminates the virus, and have announced new plans to develop vaccines or treatments for the new coronavirus.

The United States saw this week a significant increase in COVID-19 cases, now reporting 138 cases and nine deaths, and all deaths occurred in Washington, which reported a group of infections primarily in Snohomish County associated with the Life Care facility in Kirkland, Washington, and about 20% of cases in the United States are located in Washington.

Worldwide, there are now a total of over 96,000 COVID-9 cases and at least 3,250 deaths. About 51,000 people worldwide have recovered from the virus. It was first discovered in December in Wuhan, China, and greatly affected people in China's Hubei Province, which reported 2,881 deaths. While the number of new cases continues to decline in China, there are still growing groups of infections in Iran, Italy and South Korea. Where in Iran there are 2922 cases and 100 deaths; in Italy there are 3,089 cases and 107 deaths; and South Korea has 5,621 cases and 35 deaths.

Italy has reportedly closed all schools and universities for two weeks, and, according to Italian media reports, several airlines have canceled flights to Milan. The travel industry, in particular, has witnessed a direct impact as a result of government travel restrictions and public fears of an outbreak. The American Travel Association expects international travel to the United States to drop 6% in the next three months.

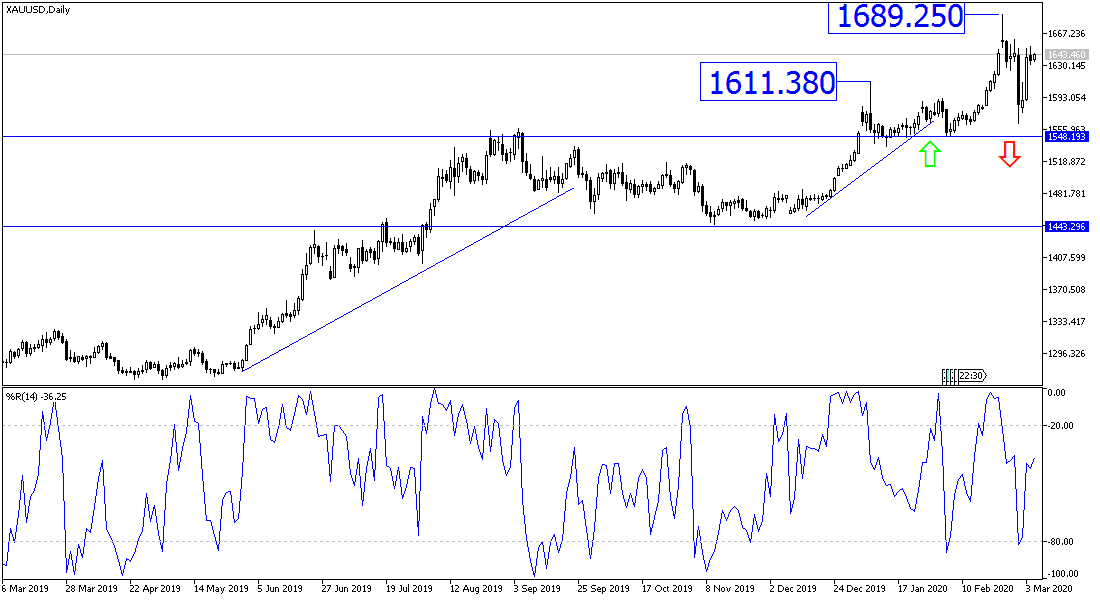

According to the technical analysis of gold: The continuation of the Corona epidemic, by affecting the future of global economic growth, will continue to support gold price gains on an ongoing basis. As for the performance of technical indicators, they are still in areas saturated with purchase and successive measures from global central banks and governments to face the consequences of Coronavirus, it will weaken gold opportunities to continue achieving strong gains, as it was at the beginning of the crisis. Resistance levels at 1655, 1670, and 1700 are still legitimate targets for bulls, as the overall trend remains upward. There will be no real break and trend reversal without the gold price moving towards the 1630, 1615 and 1590 support levels, respectively.

Besides observing Corona's developments, gold will react to any sudden actions of global central banks, US non-farm productive economic data, and jobless claims.