Since the beginning of this week’s trading, gold prices has been instable by trying to rise to the $1611 an ounce, and then returning to the $1584 support before settling around the $1600 level an ounce. Developments regarding a global outbreak of the Corona epidemic still determine the fate of gold. Concerns about a bleak future for the global economic growth due to the epidemic, contributed to a recent move by global central banks towards more stimulus by lowering interest rates and introducing more stimulus plans to counter the potential global economic slowdown.

Despite China's huge economic losses due to the epidemic. There was one benefit as China's far-reaching efforts to control the spread of the new coronavirus led to factory closings and airport emptying, and thus led to a sharp drop in carbon emissions and other pollutants. However, analysts caution that the decline in pollution is likely to be temporary. The important question now is how the Chinese government will respond to compensate for the lost economic activity - as happened after the 2008-2009 financial crisis - the government's usual response has been to launch massive stimulus packages.

Since January, China has imposed a widespread travel ban, put about 70 million people in quarantine and urged many people to work from their homes. As of Monday, China had recorded the vast majority of new coronavirus cases in the world - 80,026 - in addition to deaths, which now amounted to 2,912 people.

Global health officials have sought to reassure the public that the virus remains a controllable threat. "Containment is possible and should remain a top priority for all countries," said WHO President Tedros Adhanom Gebresos. Around the world, the crisis has reshaped the daily routine of millions of people.

As for the economic impact. The Organization for Economic Cooperation and Development warned that the global economy may contract this quarter for the first time since the global financial crisis more than a decade ago. "The global economic outlook remains weak and very uncertain," it said in its report. The results of the latest Chinese and Australian economic data were very shocking and forced the Reserve Bank of Australia to cut interest rates today to a record low. As the Australian economy is closely related to the Chinese economy.

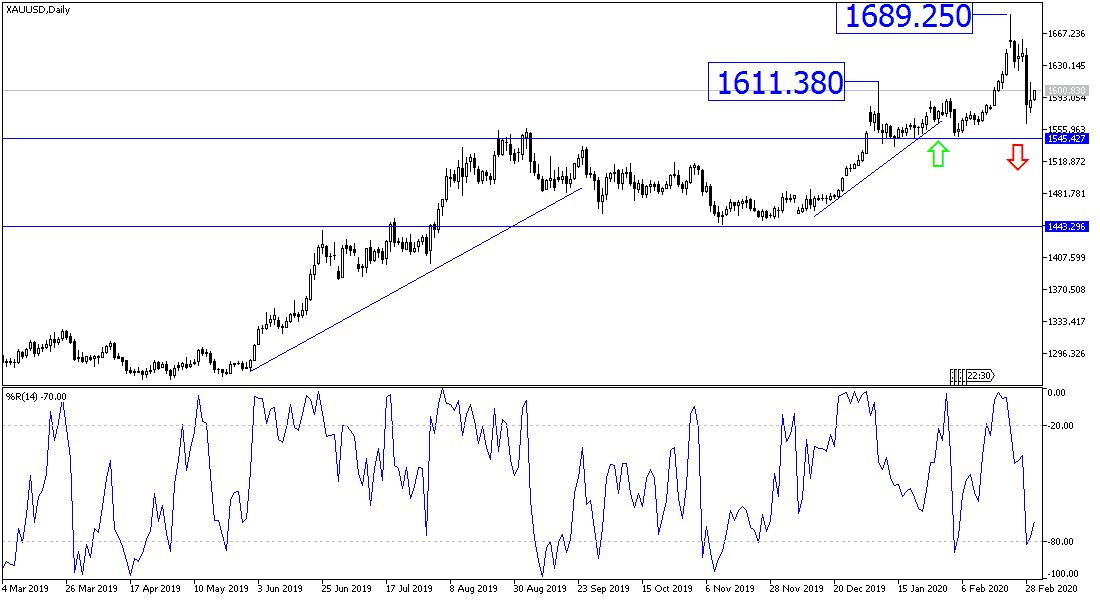

According to the technical analysis of the gold price: Gold price is still moving within a bullish channel whose supported by the move around and the above the %1600 psychological resistance and as long as the global crisis persists due the outbreak of the Corona pandemic, gold investors will remain keen to return to buying with every drop in prices. The closest support levels for gold are now 1589, 1578 and 1560, respectively. As for the targets of the bulls, the closest levels are now 1610, 1625 and 1675, respectively. Taking into consideration that arriving at a vaccine that faces the disease and eliminates it quickly will support strong and violent sales of gold at any time.

Gold will react today with the announcement of the Reserve Bank of Australia monetary policy, then the Bank of England monetary policy report and inflation and unemployment figures from the Eurozone.