For the second straight day, the GBP/USD pair is trying to compensate for the losses that pushed it towards the 1.2726 support, its lowest level in more than four months. Reversion to the 1.2871 level during Wednesday's session. Gains stopped awaiting for new stimulus. It seems, as we had expected previously, that the pound will remain under pressure from fears of a rapid failure of the ongoing trade negotiations between the European Union and Britain, as well as anticipation of the Coronavirus outbreak in Britain after it reached 60 countries around the world, including the United States of America itself. The sudden move by the US Federal Reserve to cut interest rates by half a point to support the US economy from the aftermath of the deadly epidemic and its threat to global economic growth. It increased speculation that global central banks would work hard to implement a move such as the Federal Reserve.

Some recent statements by some of the monetary policy makers of the Bank of England confirm that the bank is monitoring the situation carefully and , the bank is ready to move when the effects of the epidemic appear affecting the economy of the country. A meeting of the G7 finance ministers and major central bank governors pledged on Tuesday "to use all appropriate policy tools ... to protect against the negative risks ... posed by the COVID-19 virus ... and that they are ready to cooperate more in taking effective measures at the appropriate time."

To counter the COVID-19 epidemic, British authorities on Tuesday developed response plans, saying that the new coronavirus might spread within weeks from a few tens of confirmed cases to millions of infections, with thousands of people in the UK at risk of death. Officials hope that no tougher measures will be needed. And unlike the most affected European countries such as Italy or France, the UK has only 51 confirmed cases of infection and lower social unrest. Health officials have advised people to work, socialize and travel as usual - as long as they follow prevention methods. Prime Minister Boris Johnson said it is "very likely" that the number of Coronavirus cases in Britain will increase.

"Our plan means that we are committed to doing our best, on the advice of our world leading scientific experts, to prepare for all possibilities," he said at a press conference on 10 Downing Street. British officials say they cannot contain the virus, as they believe they can at least slow its spread.

Despite the global fears of the epidemic, the US economy is still showing steady performance as we have seen from the results of the ADP survey of the change in the numbers of US non-agricultural jobs, according to the ISM Services PMI reading. The survey cited the Federal Reserve Report, known as the Big Book. That American economic activity has grown at a modest to moderate rate over the past few weeks. Most of the twelve Federal Reserve regions are still expecting modest economic growth in the near term, but they pointed to potential risks from the outbreak of the Corunavirus and the upcoming presidential elections.

While most of the Federal Reserve regions reported modest to moderate growth, the central bank said that the St. Louis and Kansas City regions reported no change during the period. The Beige Book also added that consumer spending generally increased, but noted that growth was uneven across the country, including mixed reports on car sales. Meanwhile, the report said, there are indications that the Coronavirus has had a negative impact on travel and tourism in the United States, where growth in tourism has been described as steady from modest.

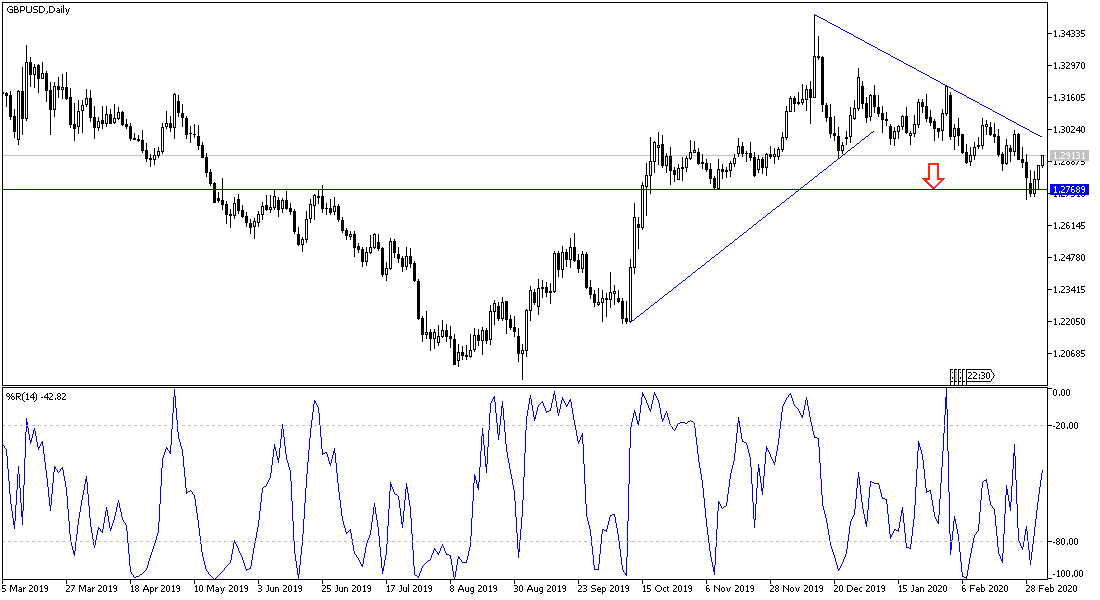

According to the technical analysis of the pair: Gains of the GBP/USD pair remain the focus of forex traders to return to selling, as the future of the post-Brexit deal still faces a specter of failure at any time. The closest resistance levels to this pair might be 1.2885, 1.2935 and 1.3020, respectively. On the long term, the general trend of the pair remains bearish, as shown on the daily chart below. A move towards 1.2800 and 1.2725 support levels confirms that the bears are in control.

As for economic calendar data today: The sterling will react to comments by Bank of England Governor Mark Carney. Then from the US, the non-farm productivity data, employment cost index, and claims of the unemployed.