Sterling's recent gains were halted as markets digested news that Fitch Ratings downgraded Britain's sovereign debt over the weekend. The pound sterling may have started the week's trading in a better position if it was not for the surprising news. The GBP/USD pair fell to the 1.2316 support after gains at the end of last week pushing it to the 1.2485 resistance, and is stable around 1.2390 in the beginning of today’s trading.

The UK's rating was downgraded by one degree from AA to AA- by Fitch after the markets closed on Friday due to the large increase in financial spending announced by the government in order to mitigate the negative economic impact of the coronavirus, as well as due to uncertainty about the post Brexit trade relations between the UK and the European Union.

With the UK's sovereign credit downgrade, Fitch said it had taken into account "the deep damage to the British economy in the short term due to the Coronavirus outbreak and the continuing uncertainty regarding trade relations between Britain and the European Union after Britain emerged from the bloc."

On Thursday, British Chancellor Rishi Sonak announced additional spending plans with a large number of support packages for freelancers. According to an analysis by Capital Economics, the latest initiative raises the government's total support package from tax and direct spending measures to 119 billion pounds (5.3% of GDP). Fitch estimates that the entire package will cost 4.4% of GDP in 2020.

Fitch Foundation's baseline projections show that the government's deficit will rise by about 9% of GDP in 2021 from 2.1% of GDP in 2019.

** Sovereign rating and its impact: Agencies such as Fitch issue ratings on state bonds, reflecting how secure they are, and if the government issues small amounts of debt relative to the size of its economy, the rating agency will rate it with a high value, because it believes the government will comfortably service that debt. Meanwhile, the rating drops if the agency believes that the state will struggle to service debt, thus making the bonds it issues less attractive to investors. This is important, as countries with lower ratings tend to have to compensate investors more with their debt.

For currency markets, lowering the debt rating can often lead to a devaluation of the currency, as investors around the world sell local bonds in response to debt reduction. However, the British pound has so far shown little negative reaction to Fitch's decision, but nevertheless the move could have long-term effects on the currency if UK bonds become increasingly unattractive to foreign investors.

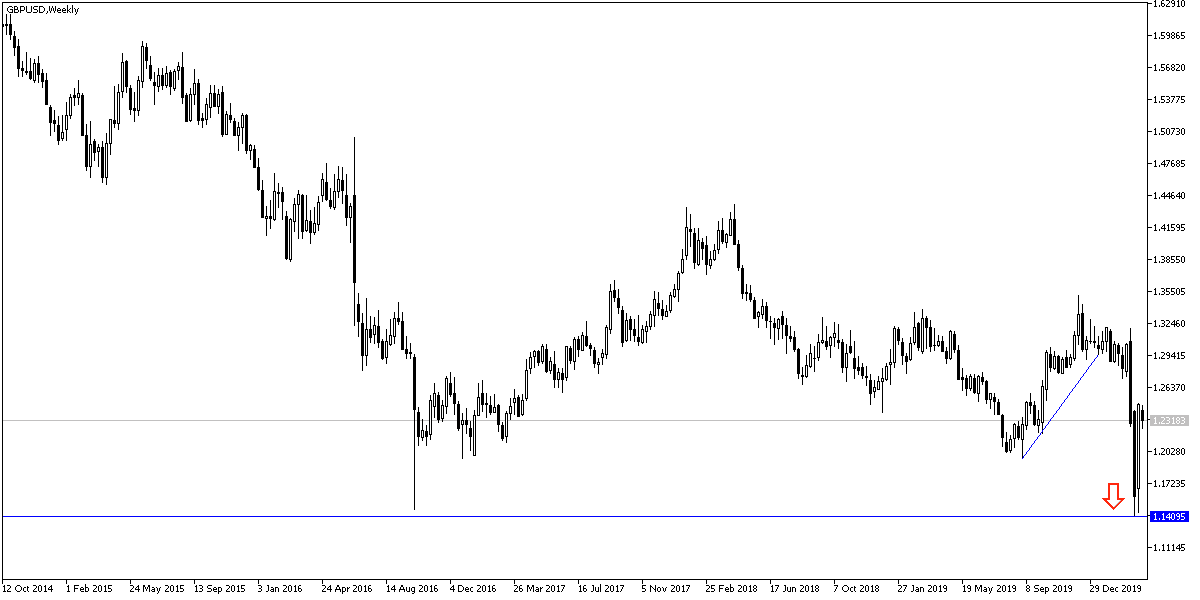

According to the technical analysis of the pair: Despite the GBP/USD decline in the beginning of the week's trading, it still maintains the possibility of a bullish correction if it continues to move within the formation of the last bullish channel. Bulls need to push the pair to the resistance levels atv1.2585 and 1.2750 to confirm the general trend reversal, which is still bearish on the long run. The pair may return to the downside path again if it moves towards the support levels of 1.2280 and 1.2190 respectively, because it will support the move towards the 1.2000 psychological support again.

As for the economic calendar data today: From Britain, the current account, the GDP growth rate and the investment rate in assets will be announced. During the US session, the US Consumer Confidence Index will be announced.