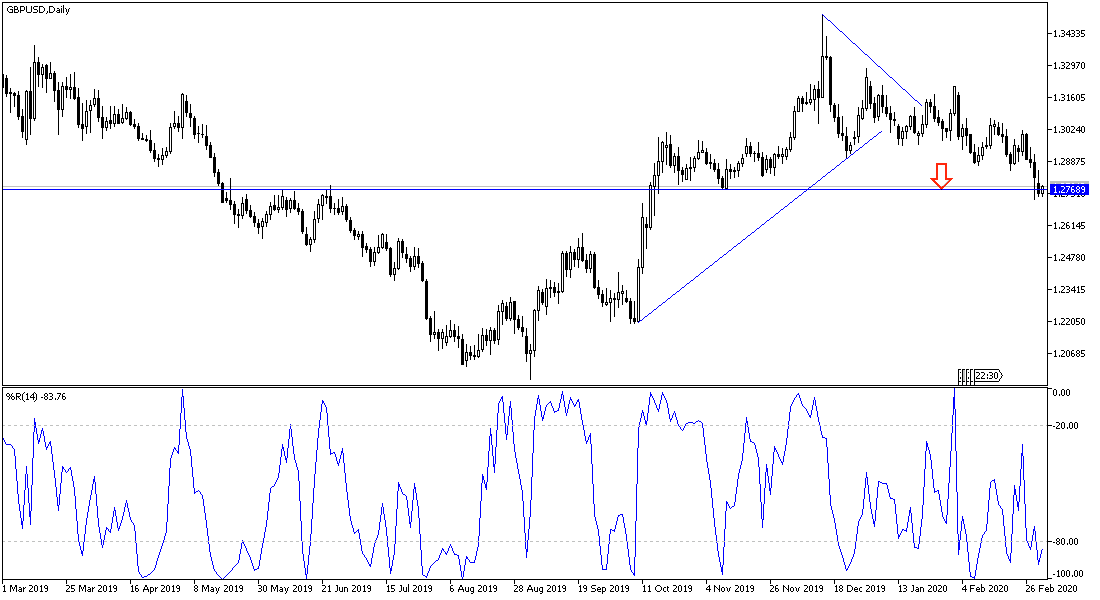

Pressure continue on the GBP and adversely affecting its performance against most other major currencies. At the beginning of this week’s trading, the GBP/USD pair remained negative, retreating to the 1.2739 support, close to the 1.2725 support, which was recorded at the end of last week’s trading, which is the lowest in four months. The pair tried to move up during yesterday's trading session, but gains did not exceed the 1.2850 level before it settled below the 1.2800 support again in the beginning of Tuesday's trading. The pressure on the Pound was supported by persistent fears of coronavirus and the pessimistic outlook for troubled trade negotiations between the European Union and the United Kingdom, which officially started.

Despite promises of additional support from global central banks, hopes for a decisive recovery in global stock markets have not yet occurred, and according to a well-known British economist, the deeper the economic impact from the virus outbreak, the greater the risk to the British pound. "The pound relies on a steady flow of external financing to maintain its value, and therefore higher risk-aversion rates will harm it," said Samuel Tompes, the UK's chief economist at the Pantheon Macromecics, an independent economic research body. "The pound will not be a safe haven if Covid-19 causes a global economic recession," he added.

Global markets suffered heavy losses last week, and the pound has begun to respond negatively to episodes of market fear of the Coronavirus, and it is now far from its highest levels in 2020, and seems increasingly bent on entering short-term downtrends against a number of currencies. Meanwhile, the market expectations for a rate cut from the Bank of England in March increased further to 65%, indicating that the market is currently pricing a rate cut. When expectations of a rate cut in a central bank grow, the currency it issues tends to decrease in value compared to other currencies.

According to the technical analysis of the pair: As we expected before, we now stress that the GBP/USD price breaking below the 1.3000 psychological resistance will technically support the downward pressure. The general trend has been strongly reflected downward, and reached the lowest level in four months, and prone to more pressure if one of the parties to the post-Brexit negotiation declares a negative path to the talks. The support levels closest to the targets of the bears are currently 1.2730, 1.2655 and 1.2580, respectively. There will be no chance to change the situation without breaking through the highest psychological resistance at 1.3000.

As for the economic calendar data: The focus will be on the announcement of the British Construction PMI, in addition to comments expected from Bank of England Governor Mark Carney. There are no significant US economic releases today.