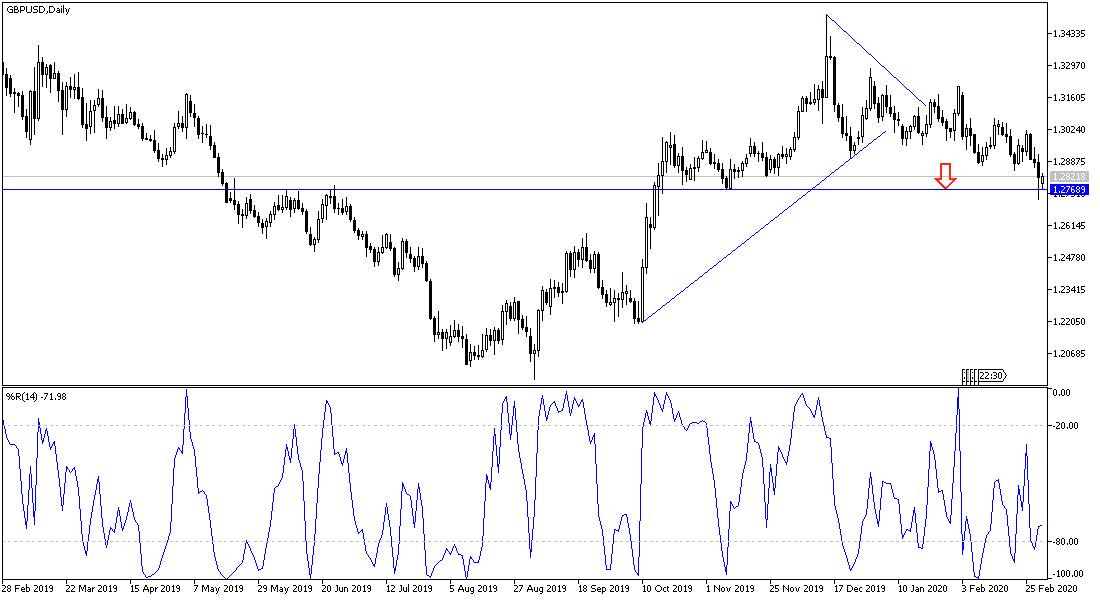

Undoubtedly, the month of February was painful to the performance of the Pound against majority of other major currencies amid a sharp gap between the European Union and Britain to determine the path of negotiations between them before the official negotiation rounds begin in March to determine the trade relations between the two in the post-Brexit phase. The price of the GBP/USD pair collapsed from the 1.3200 resistance, reaching the 1.2725support, the lowest in four months before closing last week’s trading around the 1.2821 level. The fluctuation of the sterling price has not ended yet, it is widely expected that the negotiating rounds between the two sides of the Brexit will witness many surprises and threats, which will lead to the rapid collapse of the negotiations between them.

Global stock markets fell sharply. In light of these losses, one of the Fed officials suggested that he would not lower interest rates to save investors from these losses. The pound fell against all safe-haven currencies, as investors dropped risky assets from their investment portfolios and sought to invest in sovereign government debt, forcing bond yields that are usually negatively associated with stock markets, to reach new record levels.

James Pollard, who runs the St. Louis Federal Reserve Bank and a non-voting member of the Federal Open Market Committee this year, said that financial markets may “overestimate the risk” posed by the Corona virus, which is spreading so quickly outside China as the figures announced by the second largest Economy in the world indicates that its infection is now under control.

Pollard told the Fort Smith Regional Chamber of Commerce that continued falls in bond yields, driven by investor fears of the effect of the coronavirus on the global economy, are likely to remain low until the virus is clearly contained, and that this would stimulate the US economy. He acknowledged that corporate profitability would be affected by the impact of the virus on Chinese and global economies, but undervalued the stock market decline, noting that “even with recent declines in stock prices, the value of the corporate sector traded in the United States has increased at an annual rate of about 4.7% over the past two years. ”

He also indicated that the FOMC will stick to its current plan that interest rates are in good shape after three “insurance” cuts last year and that it will require a fundamental change in the outlook to change that, before saying that Coronavirus will only change the course of expectations If "it has already evolved into a global pandemic with health effects approaching a common influenza scale."

According to the technical analysis of the pair: The general trend of the GBP/USD pair was confirmed to be bearish with stability below the 1.2800 psychological support as we mentioned in the recent technical analyzes, and the pair’s gains will at any time remain selling targets by traders. In addition to the fears of coronavirus, there is a greater risk to the pair in the shape of quick failure of trade negotiations between the European Union and Britain, which means a further collapse of the pair. Although technical indicators have reached strong oversold areas, there are no signs of a bounce back up. The 1.3000 psychological resistance will remain the most important stage for an upward correction for the pair.

As for the economic calendar data: From Britain, the PMI for services will be announced. From the United States, ISM Manufacturing PMI and Construction Expenditure Index data will be announced.