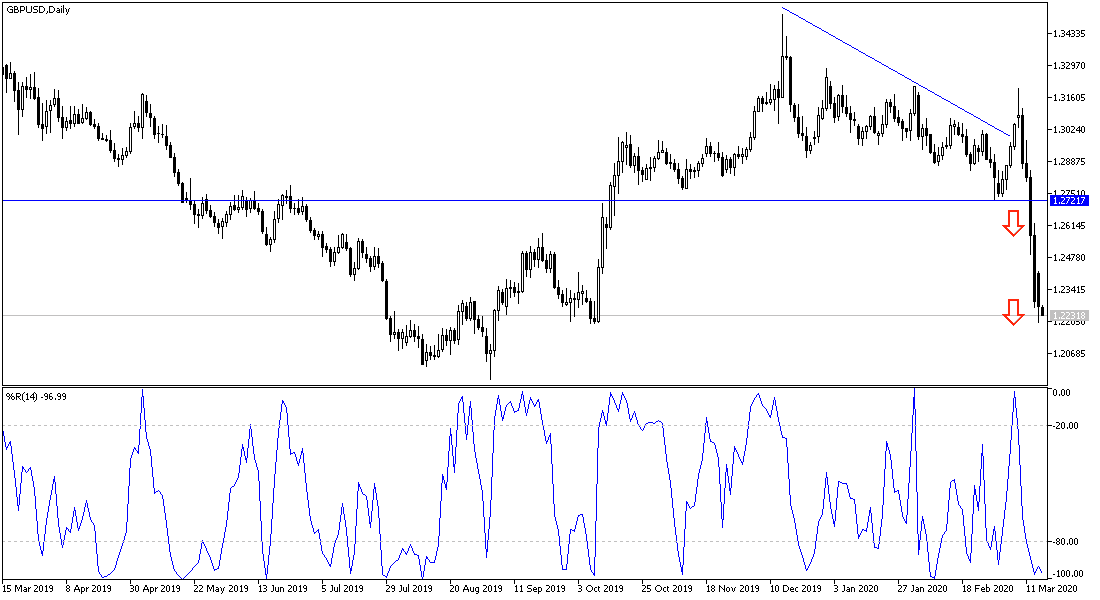

For five trading sessions in a row, the GBP/USD price is moving inside a violent descending channel that pushed it towards the 1.2201 support, the lowest in five months, before settling around 1.2270 at the time of writing. The pair collapsed from the 1.3200 resistance, which was recorded at the beginning of last week’s trading, and the correction was supported by fears that the British economy will suffer a lot from losses due to the outbreak of the Corona epidemic, and despite its exit from the European Union, it is vulnerable to the outbreak of the epidemic strongly in its territory, as is the case in Italy, which has become the biggest concern for all European countries. Investors rushed to buy the US dollar after successive measures by the Federal Reserve and the US government to stimulate the US economy in the face of the Coronavirus disasters.

Ahead of this week’s trading, the Federal Reserve cut interest rates back to zero and formally restored the quantitative easing program (QE), and the Federal Reserve said in a rare unscheduled announcement on Sunday that policymakers voted on a piecemeal decision to cut US interest rates to be between 0% and 0.25%, a record level in light of the financial crisis, from 1% to 1.25%. They also said they would buy at least $500 billion in treasury bonds and $200 billion in mortgage-backed securities.

In its statement, the US central bank said: "The spread of coronavirus has affected societies and disrupted economic activity in many countries, including the United States. In line with its legal mandate, the Commission seeks to promote maximum employment and price stability. The effects of the Coronavirus will affect economic activity in the near term and pose risks to the economic future. In light of these developments, the committee decided to reduce the interest rate target range to 0 to 1/4 percent”.

On the British side. The British authorities have significantly stepped up measures to combat the new coronavirus, urging all UK residents to avoid unnecessary contact with others, and to tell people in the older and most vulnerable groups to stay in their homes for three months. British Prime Minister Boris Johnson said that the number of UK cases had started to rise rapidly and "without radical action" could double every five or six days. As of Monday, Britain had 1,543 confirmed cases and 53 deaths.

According to the technical analysis of the pair: On the daily chart below, it appears clear the strength of the general trend reversal downside, and the increased bear control over the performance may push the pair to the 1.2000 psychological support very soon. There will be no opportunity for bulls to control matters without the pair returning to the 1.3000 psychological resistance. I still prefer to sell the pair at every upward bounce. Besides the fear of the Coronavirus, there is the concern about the future of trade relations between Britain and the European Union.

As for the economic calendar data: From Britain, British job numbers will be announced including average wages, the rate of change in unemployment and the unemployment rate. From the United States, retail sales and industrial production figures will be announced.