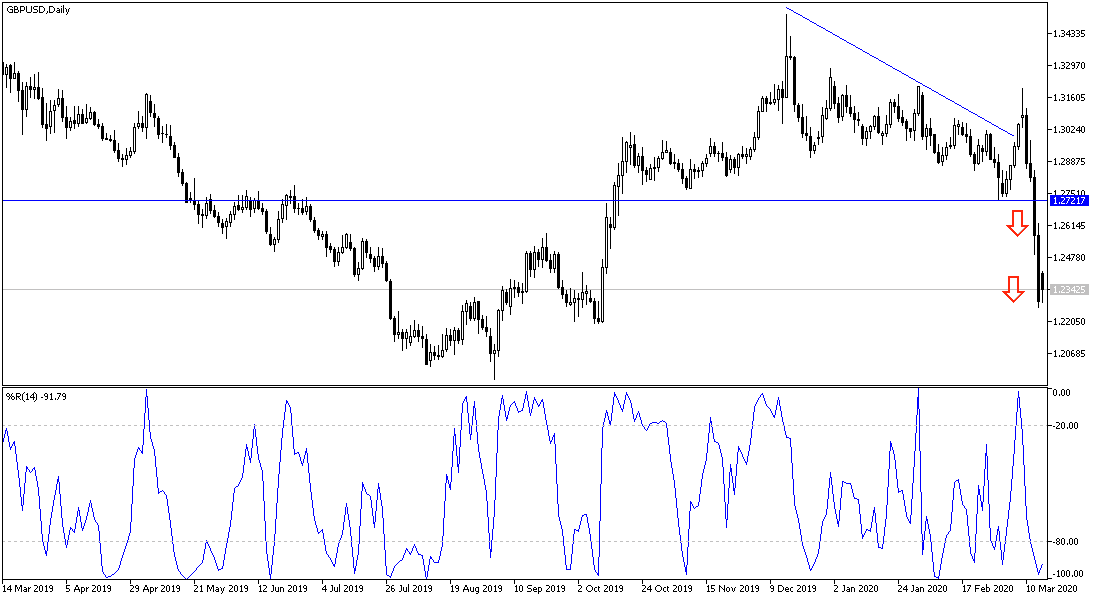

At about 900 points, the price of the GBP/USD pair collapsed at the end of last week’s trading. In the beginning of trading, the pair pushed towards the 1.3200 resistance, but with the British government announcing that it is a target of the deadly Corona virus and that the number of infections and deaths in the country will increase on a daily basis, the stability of the Sterling evaporated quickly, as the pair tumbled to the 1.2265 support before closing the trading around the level of 1.2290, and is stable around the 1.2340 level at the time of writing, after gains reaching 1.2420 in early trading today. The pair is subject to more downward pressure. The GBP/USD recorded its worst weekly loss since the Brexit referendum, down by -5.9%.

All markets experienced extreme volatility last week and many stock indices were subjected to historical collapses and were on track for the worst week in history before Fed actions and a major announcement by President Donald Trump stopped the bleeding of losses, even if temporarily.

At first, Britain boasted that it was the least affected by the deadly epidemic, compared to other European countries. However, optimism soon turned into a nightmare, as infection numbers rose rapidly in recent days, and government and society are increasingly preparing for more increases in cases as the disease spreads well. There were 1,372 cases in the UK as of 09:00 on Sunday, with 35 deaths. Both figures rose sharply from 387 cases and 6 known deaths on Wednesday, March 11th. This had major negative effects on the cable.

Investors returned to buy the dollar strongly as it is the world's strongest and highly liquid reserve currency, which means that it is often a destination for investors in times of risk aversion. This safe haven’s situation has not always been evident in recent weeks, but as financial markets see extreme volatility, some argue that it would be foolish to bet on the dollar.

In light of that global crisis. There are only two factors that will shape investors’ sentiment and financial market conditions; COVID-19 losses data and the response of global monetary policy makers to the crisis. Global human and economic losses due to the epidemic are still increasing around the clock. But the Fed's recent action gave some hope to the markets.

Next Wednesday, there will be another meeting for the US Federal Reserve and is expected to further cut US interest rates, along with the announcement of some economic stimulus plans to counter the effects of the deadly Corona epidemic on the future growth of the world's largest economy.

According to the technical analysis of the pair: On the daily chart below, it seems clear that the GBP/USD is moving strongly downward after breaking its last upward channel and started forming a stronger descending channel. The pair does not care that the technical indicators reach the oversold areas, as the fear of Corona exceeds all trading norms and therefore we expect more fluctuation in the price of the pair with emphasis on bears controlling the performance, especially if they were able to breach the 1.2200 psychological support, which is the closest level at the moment. The worsening situation in Britain, according to government expectations, could push the pair towards a record low at 1.1960, the lowest since September 2019. Without moving again towards and above the 1.3000 psychological resistance, the trend will remain strongly bearish.

As for the economic agenda data today: There are no significant and influential economic data from Britain or the United States of America. The decisions of the G7 emergency meeting will have a strong reaction to investors’ and markets’ sentiment.