Despite the massive stimulus plans announced by the British government and the Bank of England in a unified coordination between them yesterday, the price of the GBP/USD pair continued to drop to the threshold of the 1.2800 psychological support. The recent sales of the pair started from the 1.3200 resistance, which was recorded at the beginning of the week's trading and was the highest for the pair in about a month and a half. The Bank of England suddenly reduced interest rates by half a point, to 0.25% instead of 0.75%. Markets welcomed the rate cut and other measures in an effort by policymakers to help companies and families cope with the devastating effects of the Coronavirus, which is now spreading to 117 countries.

The Bank of England's outgoing Governor Mark Carney described that he is acting in "coordination" with the government to reduce the damage caused to the economy by the virus, and investors welcomed the move, especially as the US dollar faces pressure from the White House not announcing the stimulus plans, also they announced that political rivalries between Republicans and Democrats are impeding the government's response in light of the rapid spread of the epidemic in the United States.

The White House was expected to unveil its support package on Tuesday which was supposed to include helping families and some of the industries most affected by the virus, including cruise and airline industries. But the promised evening press conference never materialized, and President Donald Trump's short narration of conversations with Democrats, given to a reporter on Tuesday, suggests that politics plays a role in the slow-moving response that could lead to more losses to US stocks.

The Wall Street Journal reported that the US Treasury is exploring the benefits of delaying filing tax returns to the deadline on April 15, which will enable families to use tax money as a form of financing, because these measures can be implemented faster as they will not require House approval, which is controlled by the Democratic Party.

Returning to Britain, Chancellor of the Exchequer Rishi Sonak announced that £ 30 billion of immediate spending would be made available to counter the economic slowdown caused by the coronavirus outbreak, with an additional £ 175 billion in spending over the next five years. Forex currency markets have interpreted the payment in the 2020 budget as largely supportive of the pound sterling because it should provide a pillow for the economy as it faces the double challenges of virus spread and the shift in trade relations between the European Union and the United Kingdom.

Sonak says budget expenditures still meet the UK's financial rules, with enough room. However, the OBR numbers do not include financial measures to tackle the epidemic, which indicate that the government may violate the rules for this spending.

The focus of financial markets, including Forex market, remains on coronavirus outbreaks, and thus central banks and governments will be compared among themselves in terms of the measures they announce to deal with the economic impact of the virus, which leads to continuous adjustments in the value of currencies.

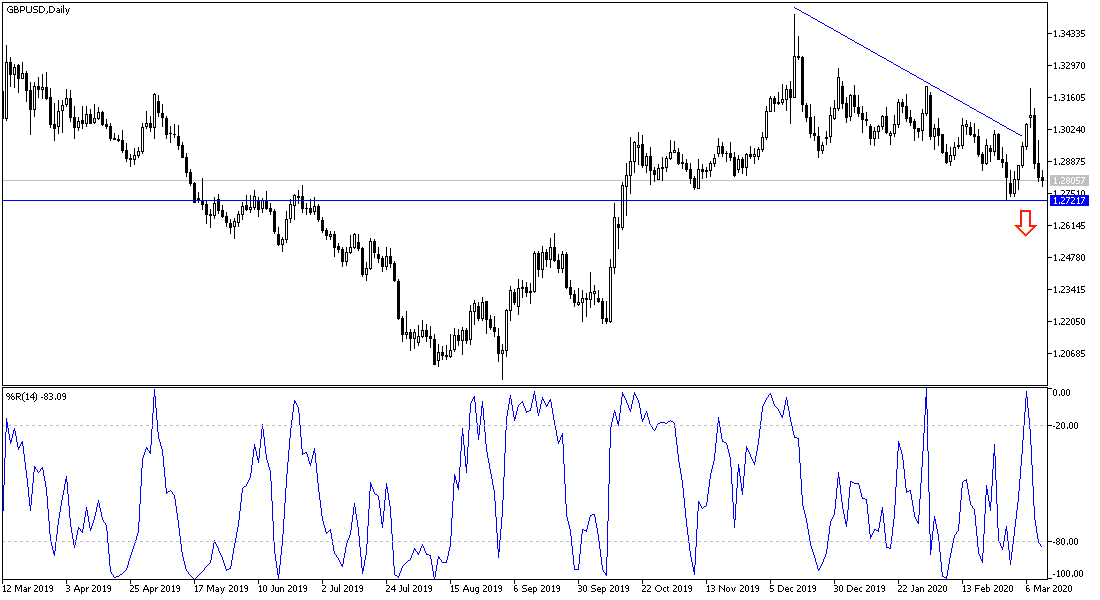

According to the technical analysis of the pair: As I expected before, I now confirm that the GBP/USD moving towards the 1.2800 support level will restore the bear's control over performance and support the reversal of the general trend after it was strongly bullish at the beginning of this week's trading. And there will be no new opportunity for bulls to take control without breaking through the highest psychological resistance at 1.3000 again. The best buying levels for this pair are from the support levels at 1.2790, 1.2720 and 1.2655, respectively.

For economic calendar data: The focus will be on the release of US data, the producer price index and unemployed claims. Besides the market reaction to the recent British measures.