The British pound went back and forth during the trading session on Monday as we had initially gapped lower, but the market recovered during the day. This was an interesting currency pair during the Monday session because both the Federal Reserve and the Bank of England have stated that they were willing to step into the market and do what was necessary to maintain calm in order. In other words, both of them were very likely to cut rates sometime in the future. Because of this, money is trying to figure out where to go next due to the fact that the central banks around the world will certainly be taking some type of action on monetary policy due to the coronavirus slowing down global economies. However, at this point it comes down to who goes more aggressive than the rest and went the interest-rate statement will look like.

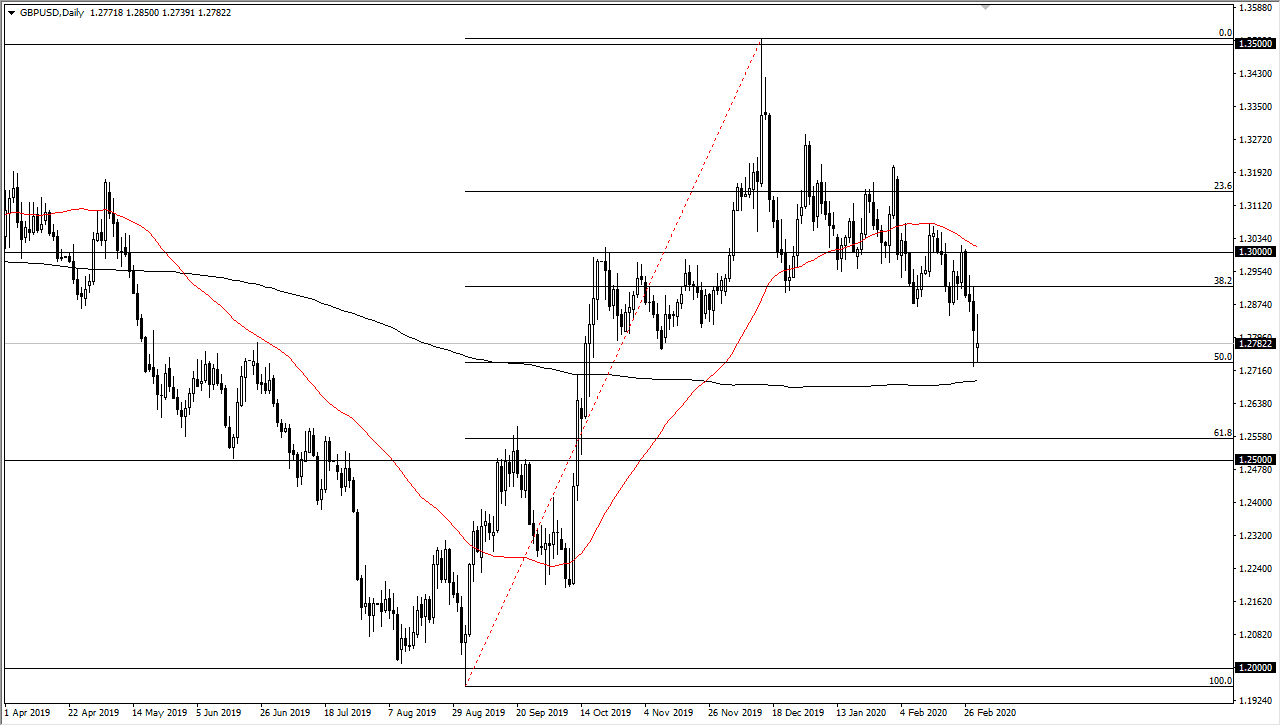

The 50% Fibonacci retracement level sits just underneath, and it’s likely that the markets are paying attention to that, but more importantly is the fact that the 200 day EMA sits just below there as well, and therefore a certain amount of interest will be paid attention to in that general vicinity. It looks as if the market is going to pay attention that, but if we do break down below the 200 day EMA it could open up the door down to the 1.25 handle underneath, or perhaps just above which is where the 61.8% Fibonacci retracement level sits.

To the upside, if the market was to break above the top of the candlestick for the trading session on Monday, then it’s likely that the British pound will go looking towards 1.30 level above. At this point, the 50 day EMA is sitting right at that level, as it is starting to drift lower from there. If we can break above the 1.30 level, then it’s likely that the British pound will recover. That’s a bit difficult to imagine though, because the situation with the negotiation between London and the European Union continue to drag on, and of course there are an increasing number of coronavirus cases in the United Kingdom. Don’t get me wrong, I don’t think that the British pound is about to collapse it’s just that one of the few things keep in this pair up at the moment is the fact that the US dollar is starting to get hit rather hard.