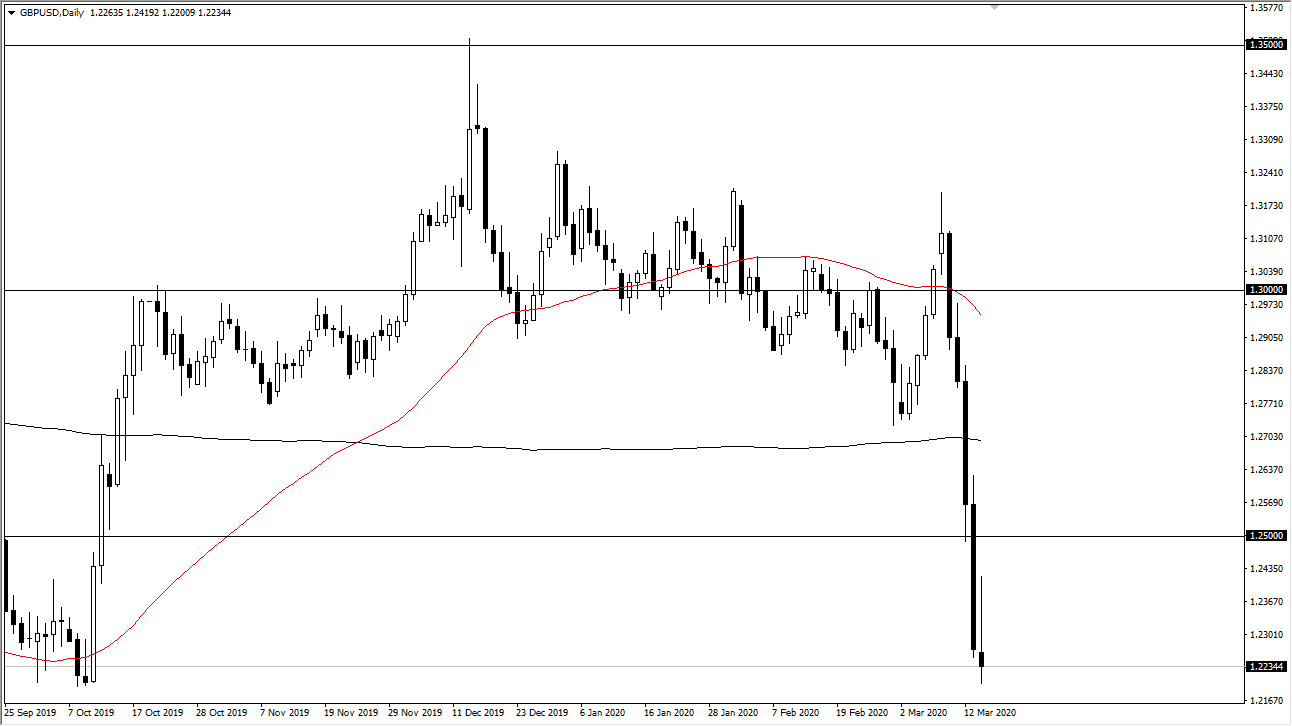

The British pound initially tried to rally during the trading session on Monday, reaching as high as 1.24 before rolling over and showing signs of exhaustion. Ultimately, this was driven initially by the Federal Reserve cutting 100 basis points in interest rates, but at this point that doesn’t seem to be helping the market as they are concerned about what happens next. After all, while this might help the overall financial situation down the road but it’s unlikely to do much at the moment.

The US dollar will more than likely be looked at as a safety currency, and it appears that the United Kingdom is suffering from the explosion in cases as well. Rallies at this point will more than likely be sold into as we continue to see a lot of uncertainty, as the market is likely to continue to find sellers. I think that at this point the 1.20 level underneath might be the target based upon longer-term charts, and it’s obvious that if we get close to the 1.25 handle it will attract a lot of attention. The psychological importance of that figure will continue to offer resistance, so I think it makes sense that we rollover at that point. If we did manage break above the 1.25 level that could change some things but at this juncture it seems to be very unlikely.

I don’t know necessarily that we are going to break below the 1.20 level in the short term, but I think that it is possible if we get more negative headlines. I think overall this is likely to be a scenario where we look at the market is been oversold in offering an excellent buying opportunity, but we aren’t there yet so in the meantime we will continue to react to the latest doomsday headline. I anticipate that short-term trading will probably continue to be the way going forward, so I’m looking for signs of exhaustion to take advantage of. If we break down below the 1.20 level, then one would have to look at the 1.18 level next which is an area that has been important previously. One thing is for sure, we are getting a bit oversold so we could get a nasty bounce in the short term. I still look at that with suspicion and would take advantage of “cheap dollars.” The market will continue to be on pins and needles.