One of the hardest things to figure out looking at this chart is whether or not the search late in the day of the British pound was based solely upon people willing to step in and pick this market up, or if it’s simply a matter of US longs closing out in the stock market. It was very thin trading it is difficult to imagine a scenario where everybody wants to own the Pound in this environment. After all, the United Kingdom is most certainly going to struggle going forward. Granted, the Federal Reserve has decided to flood the market with liquidity and then should weigh upon the US dollar but to move 1000 pips in a week is beyond ridiculous.

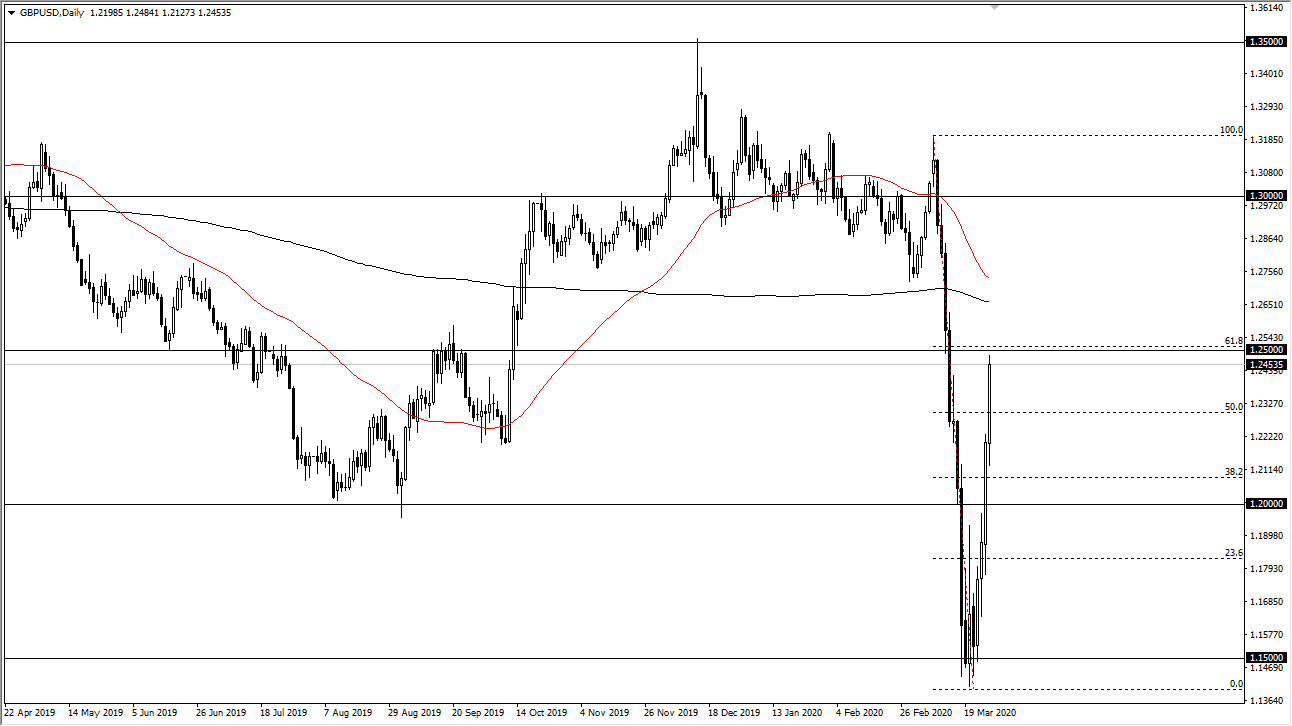

As I watch this, we are closing out the week in a couple of minutes. I’m watching the Pound jump 10 to 12 pips at a time, in thin trading. I think this is setting up for some type of trouble, and even if you are bullish of Sterling, you don’t necessarily want to see this market takeoff above the 1.25 level at the open. The weekly candlestick is obviously a very bullish and has wiped out the previous week’s negativity. More than likely, the best thing that we are going to see for buyers would be some type of pullback, perhaps down to the 1.20 level and then a bounce again. That would be the beginning of building up some type of base.

The candlestick does look very bullish for the Friday session, but again you have to keep in mind that a huge portion of the gains were in thin New York trading, while the rest of the world wasn’t involved. It is because of this that I fully anticipate that Monday will open up with a gap lower, although how negative is anybody’s guess. Again, if we do gap above and go higher immediately, at that point I would be very skittish about getting overly bullish. We may continue to see a lot of back and forth in wild swings like we have seen in the USD/JPY pair, meaning that you could get a gap higher, a run towards the 1.28 level, and then sellers coming right back into the market. It’s also worth noting that the 1.25 level is the 61.8% Fibonacci retracement level, but at this point we are trading on pure panic and emotion more than technical or fundamental analysis.