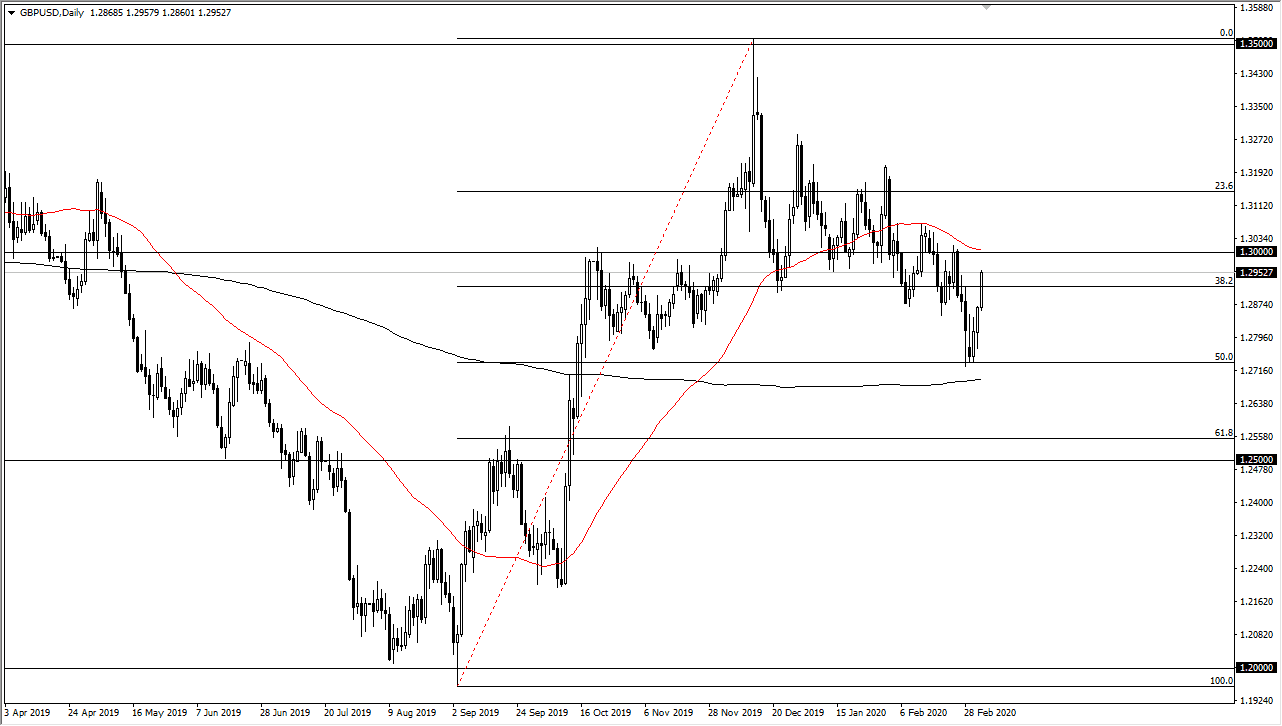

Looking at the British pound, you can see that we are plainly rallied significantly during the trading session on Thursday. We have broken above the 1.29 handle and have even tested the 1.2950 region. At this point, the British pound is probably moving more on the fact that the Federal Reserve is cutting rates than it is on signs of strength in and of itself. Granted, the Bank of England is likely to see a reason to cut interest rates sooner or later, but it has been a bit of mixed signals from London.

Looking at the chart, the 1.30 level above will more than likely cause a lot of resistance, not only due to the fact that it is a large, round, psychologically significant figure, but it is also the scene of a 50 day EMA. At this point, I anticipate that the market may make a move towards that area, but the fact that the jobs number is coming out during the trading session on Friday, just about anything will be possible in the short term. With this, we have to remain vigilant as we go into that massive volatile statement.

British pound overextended on short-term charts

The British pound rallied significantly during the trading session on Thursday, reaching towards the 1.2950 level. At this point in time, the market is looking very likely that it is going towards the 1.30 level above, which is an area that attracts a lot of attention. The 200 EMA has been broken through rather easily, and now it looks very likely that we will continue to try to go to the upside. That being said, I anticipate that you will probably see a bit of noise as we get closer to the jobs figure. I anticipate that a pullback towards the 1.2925 level could offer a little bit of support, but ultimately, it’s likely that we will see even more support closer to the 1.2875 handle near the 200 EMA. If we do rally in the short term, it’s very likely that the market will find it so far too overextended to break through the 1.30 level on the first attempt, unless of course the US job numbers are horrific. They have been pretty good as of late, so one has to assume that pattern continues as the coronavirus has not hit the United States the way it has many other places in the world.