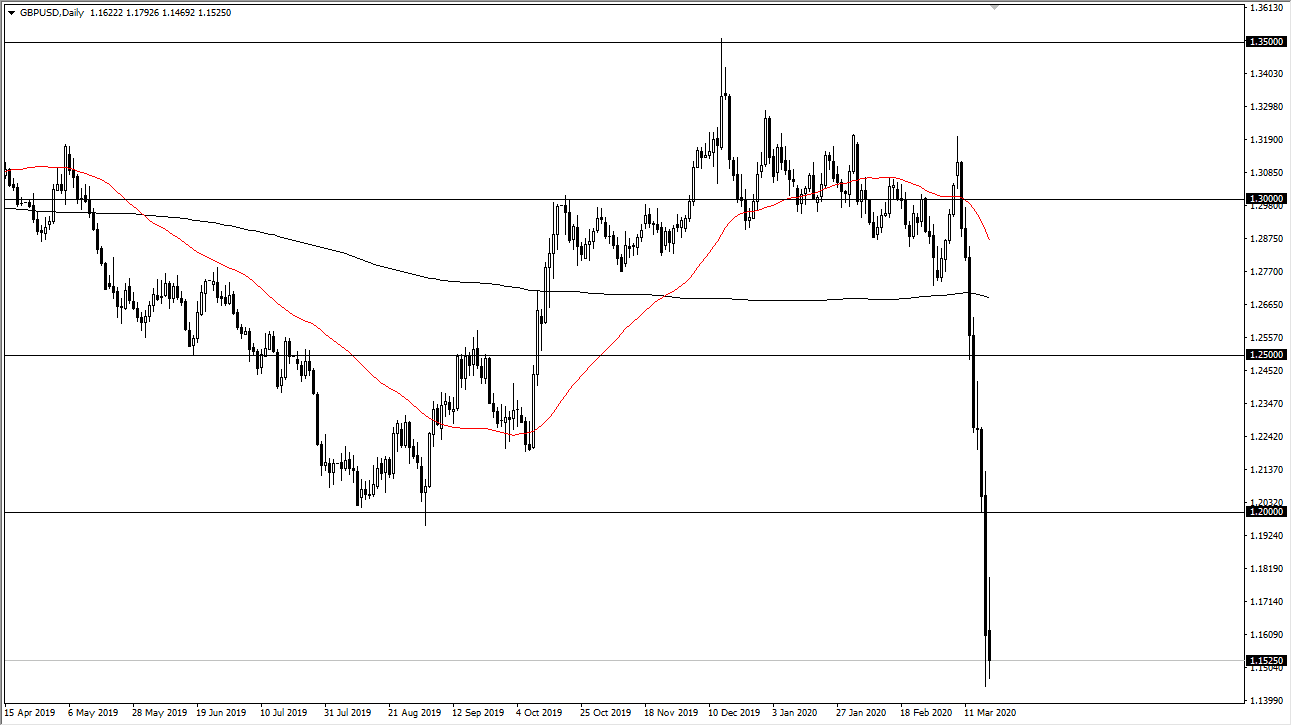

The British pound initially rally during the trading session on Thursday but ran all the way to the 1.18 level before losing a bit of strength. At this point, the market then rolled over towards the 1.15 handle, which is obviously a very large, round, psychologically significant figure. The British pound can’t seem to get out of its own way, and with the Bank of England cutting interest rates down to the 0.10% level suggests that we will continue to see weakness in Sterling.

The initial move was for the market to rally after that interest rate cut due to the fact that it was a sign that the Bank of England and the British authorities were finally doing something to support the economy after the coronavirus infection. Ultimately though, it seems as if the British economy could slow down rather drastically, and the currency of course is paying the price as the market is likely to see the GDP fall off of a cliff. That being said, it is going to be a temporary thing, so sooner or later this will be the buying opportunity of a lifetime.

If we break down below the lows of the trading session on Wednesday, this market could go down to the 1.1250 level, perhaps even down to the 1.10 level. Historically speaking, this is a very cheap level, and one would have to think that eventually the longer-term investor comes into play in order to take advantage of what is a completely oversold condition and value in the British pound. Ultimately, this is a market that has fallen too far in too short of amount of time, so I do think that a relief rally makes quite a bit of sense.

To the upside, the 1.20 level will offer significant resistance, as it has been an area of interest more than once. If we break above there, then it’s likely that the market could go to the 1.2250 level. That being said, the move would probably coincide with the US dollar falling against several other currencies around the world simultaneously. Because of this, the market is likely to see a coordinated move against the greenback if this does rally considering that the British pound has been so sold off. If the British pound were to turn back around, it’s going to need help in the form of a softening move in the greenback, something that we are probably going to see sooner rather than later as things have gotten out of control.